2023-24 Australian Federal Budget: Economic implications

This is similar to the forecasts from the Reserve Bank of Australia (RBA), who are expecting growth and inflation to slow to 1.5% p.a. and 3.5% p.a. respectively by 2023/24. Our view is more cautious on the outlook, and we are expecting a mild recession in the near term, driven by the high level of household indebtedness and the rapid and significant rise in mortgage rates to date likely to impact consumption in the quarters ahead.

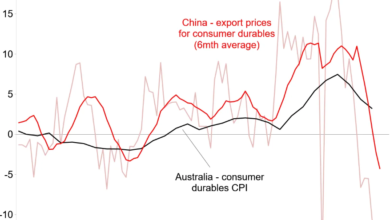

On inflation, whilst there are a number of welcomed measures in the Budget, it is unclear how much impact these measures will have and how quickly such impacts will be felt. For example, the government’s increase in rental assistance and the build-to-rent depreciation allowances increase do not appear to be significant, at least at a macroeconomic level. Further, the latter tax depreciation increase will not kick in until the next financial year, and given the lags to build new homes, it is unclear how quickly such relief will come through for the approximately 30% of household who are renting. Whilst further measures are being discussed, it appears that it may be some time before rental relief eventuates. We are also expecting a moderation in the pace of inflation in the coming years, albeit with risks tilted towards a slower than faster decline in its pace.

We acknowledge a lot of factors such as low unemployment rates, high inflation and rising interest rates are global issues and that Australia has come out relatively well compared to other developed economies. The Budget would have been a good opportunity to additionally strengthen opportunities for productivity and innovation for the Australian economy in the long term but seems to focus more on easing short term cost of living pressures.