The major risk to interest rate cuts in 2024

On New Year’s Day, I was interviewed by Sky News’ James Macpherson on the outlook for Australia’s economy and interest rates in 2024.

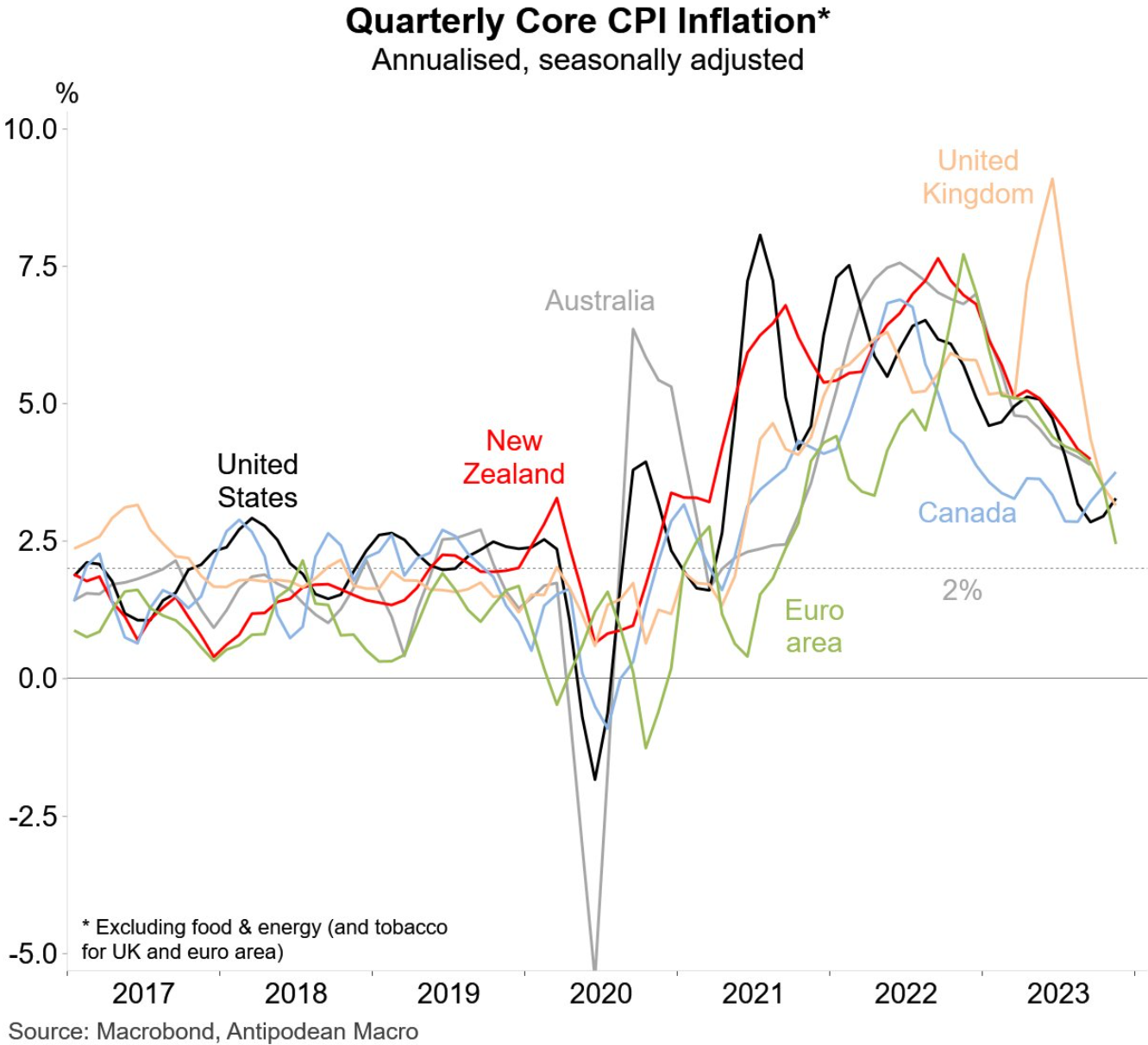

In the interview, I explained how falling goods prices have lowered inflation globally, which should mean that central banks (including the RBA) are done raising interest rates and could in fact cut later this year.

However, the key risk to this outlook is the attacks on shipping routes by Islamic militants, which risks disrupting global goods supply and driving up prices and inflation, keeping rates higher for longer.

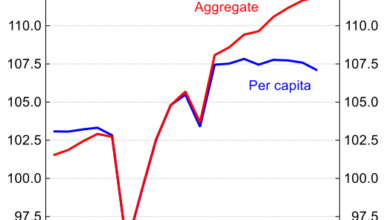

The interview also discusses how the Albanese government’s record immigration has papered over the economy’s cracks and falling living standards, and why the per capita recession should continue into 2024.

Advertisement

Below are extracts from the interview, alongside key charts.

Edited Transcript:

James Macpherson:

Looking internationally things are pretty gloomy. Overnight we had the US Navy destroy three boats carrying Houthi militants after they attacked a container ship in the Red Sea.

Those attacks are now putting real pressure on the global shipping industry. It’s a long way away from Australia but do you see a situation where that starts to have an effect on the cost of goods here in Australia?

Advertisement

Leith van Onselen:

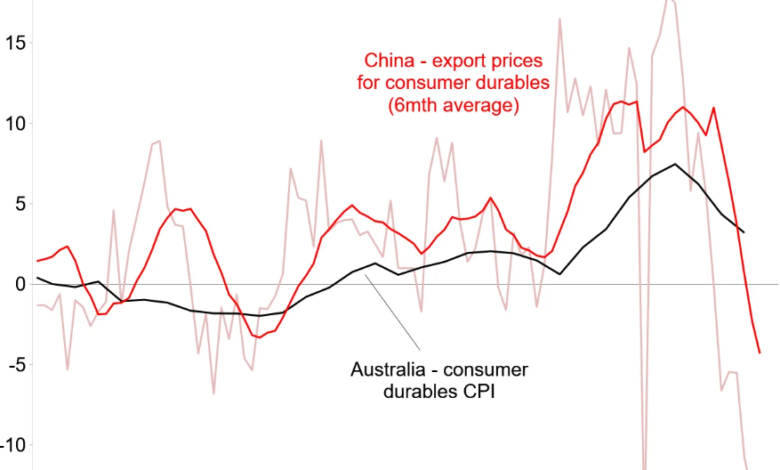

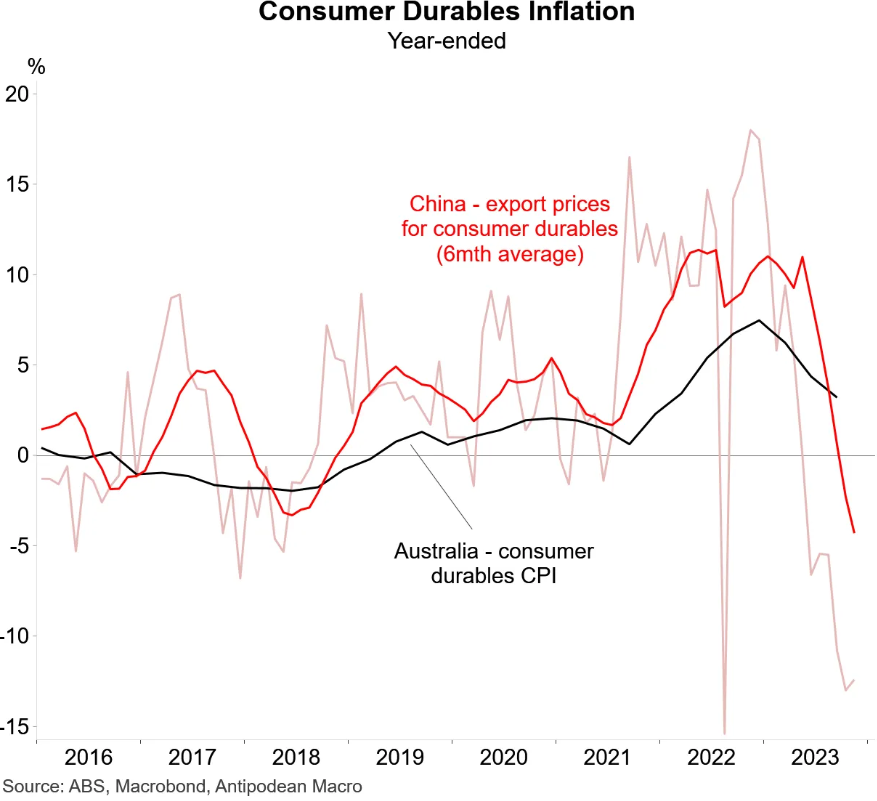

I sincerely hope not. One of the good news stories that had arisen over the past few months was that we’ve actually had global goods deflation.

So, what that means is anything that arrives into countries by boat – all your imported goods that type of thing – has been falling in price. And that basically was a reversal of what happened over the pandemic. We had obviously supply bottlenecks everywhere and that drove up prices viciously.

Advertisement

Because economies have been slowing at the same time as we had all the supply come back online, we’ve actually been getting downward pressure on inflation.

Now, the risk of these attacks is that obviously that process reverses and we start getting these supply shortages and bottlenecks again because we can’t get goods from country A to Country B.

Advertisement

If that escalates and becomes a much more pervasive problem, that will be a problem not just for the globe but will also filter down to Australia given that pretty much all our goods are imported.

That could see interest rates remain high for longer, which is not what we want.

James Macpherson:

Advertisement

Give us some good news. What’s your best case economic scenario for Australia in 2024? Encourage us a little bit?

Leith van Onselen:

The best the best case scenario is that these attacks in the Middle East don’t disrupt global supply chains and we actually have falling inflation globally, brought down by goods primarily.

What that would mean is that the central banks are likely done raising interest rates, including in Australia. And we could actually start seeing interest rate cuts towards the second half of this year.

That’s the best case scenario and it would mean that basically this 18 months of pain that Australian households have suffered would start to alleviate.

Advertisement

We could also potentially see lower migration than than what the federal government’s forecast. That’s more hopium and wishful thinking, but if we get that, it would also ease the rental crisis.

So, those are the two things I’m hoping happen this year.