Will Future Made in Australia push the Reserve Bank of Australia off the narrow path?

The key here is patience. The Reserve Bank has chosen to take a patient, gradualist approach with the stated intention of maintaining as close to full employment as possible, while still bringing inflation gradually back to target.

However, this approach relies on fiscal policymakers being patient too. Indeed, when the bank has described the economy as being in a “narrow pathway”, one of the factors that could push it off that narrow track is action by fiscal policymakers.

Any choices to increase public spending more in one area ought to be offset by a reduction in spending in another.

Fiscal policymakers may prove to be less patient than the central bank, in part because they deal not just with the economic cycle, but also with the electoral cycle. At a federal level, an election has to be held sometime before mid-2025.

For fiscal policymakers, full employment also creates different challenges to those faced when the economy has spare capacity.

In particular, any choices to increase public spending more in one area ought to be offset by a reduction in spending in another. If not, the economy would then end up operating further beyond its sustainable capacity and inflation would remain too high.

As the RBA’s mandate does not allow this, it would then lift interest rates further, or hold them higher for longer. The result would be that the higher interest rates further suppress private sector activity.

In short, public spending would “crowd out” private sector activity.

Lifting productivity

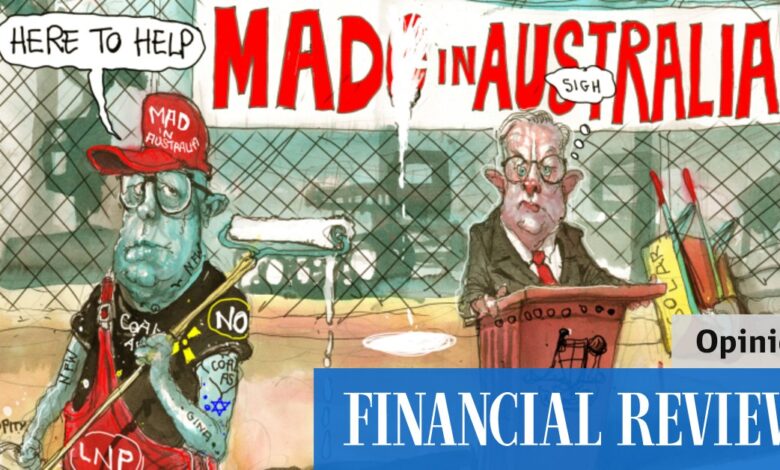

In this context, the recent announcement of expanded industry policy, the Future Made in Australia initiative, deserves closer examination than at other times in the cycle.

While these policies will support increased business investment, they will also add more to demand, in this case, with subsidies for manufacturing of solar panels, batteries and for critical minerals processing.

While this policy approach could create jobs, in a fully employed economy it may also draw workers and capital from other areas.

For example, to make more solar panels, workers that might otherwise be employed in construction could be drawn away from building houses. Importantly, this comes at a time when Australia has an acute shortage of houses, but the world has a glut of solar panels.

In an underemployed economy this trade-off may not be as critical. In that environment, it may be possible to have both more residential construction and more government-funded manufacturing.

The fully employed economy makes the current policy challenges different from those that policymakers and political leaders face most of the time.

Of course, if the policy choices themselves lift productivity, and thereby improve the supply side of the economy, rather than just boosting demand, this can help to contain inflation.

Policy choices that lift productivity ought to be in focus as part of the upcoming federal budget in May. These should include tax reform, reducing regulation, increasing competition, and making the jobs market more flexible through industrial relations changes.

A more efficient tax system and reduced regulation could help to encourage more business investment and labour market participation. Increased competition encourages businesses to innovate and improve their practices in order to compete. A more flexible jobs market allows firms to better use their scarce labour resources.

But again, patience is needed here too, as these policies tend to deliver their benefits over a longer period of time.

There will be focus on the reconciliation tables in the budget and whether the budget is expansionary or not. However, much will depend on how the personal income tax cuts and recent changes to them are treated in these tables, given the tax cuts are likely to boost demand and inflation.

If the budget does deliver policy changes that add to demand, as we expect it will, it is likely that inflation will continue to fall only slowly and remain too high for the RBA’s inflation target.

With these risks in mind, we have held the view, since late last year, that the RBA is unlikely to cut its cash rate in 2024.

Staying in the narrow pathway requires patience from both the central bank and fiscal policymakers. Indeed, without significant policymaker patience, the narrow pathway may not actually exist.