Check Call: Mo’ money, mo’ problems for brokers

Check Call the Show. News and Analysis for 3PLs and Freight Brokers.

More money, more problems: something the Federal Motor Carrier Safety Administration has taken literally. The agency has announced a 25% increase in fees collected by states from motor carriers, brokers and leasing companies. These fees are used to pay for state highway safety programs. The fee increase in the Unified Carrier Registration (UCR) Plan is for the 2025 registration year.

The increase for carriers can be anywhere from $9 to $9,000 depending on fleet size, but for brokers and leasing companies it’s expected to be $46. This is only the second time ever this rate has increased.

The FMCSA said: “This upward adjustment … follows two years of reductions in fees affecting the 2023 and 2024 registration years, averaging a 37.3 percent decrease in fees, as well as steady, unmodified collections from 2010 to 2017. The agency believes this recalibration of fees is reasonable and in accordance with the structure of, and obligations created by, the statute.”

According to John Gallager’s article for FreightWaves, “The total state funding entitlement under the UCR program has been set at approximately $108 million for 2025. The program collects this amount in the form of UCR fees from transportation businesses and then distributes the respective entitlement to each participating state. Those entitlements range from $7.5 million for Michigan to $372,007 for North Carolina, according to UCR Plan documents.”

Carriers, leasing companies and freight brokers have to register with the FMCSA every year to maintain active authority. For most freight brokers, a nominal increase will be easily absorbed.

However larger carriers stand to take the brunt of the hit as carriers with over 1,001 power units will see a $9,000 increase for a grand total of $44,836 to register with the FMCSA in 2025. Ideally a carrier that large should be able to absorb the hit, but given that the freight market has been struggling, it certainly isn’t helping profit margins, even if it’s unlikely to be a death knell for anyone.

Here’s hoping that we see some impressive road improvements over the next few years as a result of the rate hike.

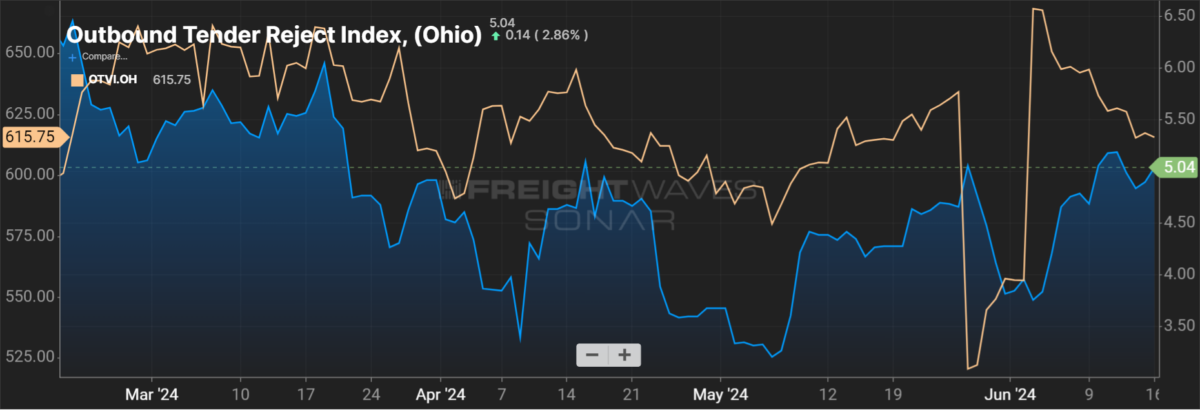

Market Check. It’s a big summer for Ohio as there are four “super loads” moving through the state. These loads are large equipment moving across the state. Unfortunately, this will shut down major highways over the next week until June 25. One load in particular is expected to take over a week to move. There will be a few more loads that come throughout the summer as the state is hoping to have everything completed by back-to-school season.

The highway closures are expected to occur mainly at night and during off hours, with the route published before each move. That said, as summer carries on, there will be some interruptions from southern Ohio up to Columbus. It’s unlikely but possible that rejections could jump as carriers don’t want to deal with navigating around these super loads. However, realistically it’s going to become crucial to pay attention as shippers should expect delays in freight moving through the state. Outbound tender lead times may need to be adjusted depending on the urgency of the goods, or alternative routes will need to be found.

Who’s with whom? What a partnership has emerged between Triumph Financial and C.H. Robinson. C.H. Robinson has joined Triumph’s freight payment platform. This opens C.H. Robinson’s 450,000 contract carriers to the solutions that Triumph offers on its platform. The agreement will provide C.H. Robinson’s customers payment tools to improve processing times, automate back-office functions and reduce fraud.

Todd Maiden’s article quotes Aaron Graft, vice chairman and CEO at Triumph Financial: “By joining the TriumphPay Network, C.H. Robinson will continue to deliver best-in-class carrier offerings and further underscore their position as a leader in the transportation industry.”

The organizations hope to improve efficiency.

The more you know

Wiliot aims to help secure food supply chain using ambient IoT

Forward Air cuts workforce as it navigates post-merger landscape

Averitt prepares for Mexico nearshoring boom with expansion in Texas

US logistics inflation remains high despite 11% drop in costs