Telsey Advisory Group Brokers Cut Earnings Estimates for Dollar Tree, Inc. (NASDAQ:DLTR)

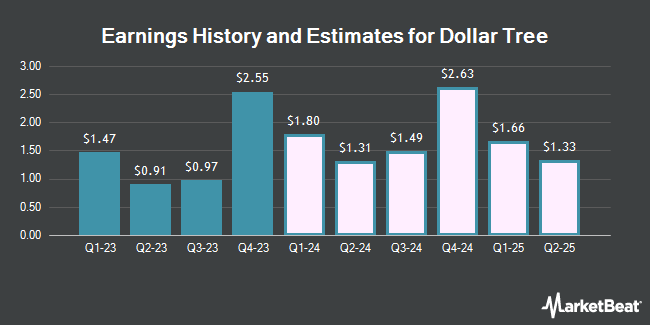

Dollar Tree, Inc. (NASDAQ:DLTR – Free Report) – Analysts at Telsey Advisory Group cut their Q1 2025 earnings per share (EPS) estimates for shares of Dollar Tree in a research note issued on Wednesday, March 13th. Telsey Advisory Group analyst J. Feldman now expects that the company will post earnings per share of $1.46 for the quarter, down from their previous forecast of $1.78. Telsey Advisory Group currently has a “Outperform” rating and a $160.00 target price on the stock. The consensus estimate for Dollar Tree’s current full-year earnings is $7.05 per share.

Dollar Tree (NASDAQ:DLTR – Get Free Report) last posted its quarterly earnings data on Wednesday, March 13th. The company reported $2.55 EPS for the quarter, missing the consensus estimate of $2.67 by ($0.12). The firm had revenue of $8.63 billion for the quarter, compared to analysts’ expectations of $8.66 billion. Dollar Tree had a positive return on equity of 15.11% and a negative net margin of 3.26%. The firm’s quarterly revenue was up 11.9% compared to the same quarter last year. During the same period in the previous year, the firm earned $2.04 earnings per share.

Several other research firms have also commented on DLTR. JPMorgan Chase & Co. reduced their price target on Dollar Tree from $165.00 to $144.00 in a research report on Thursday. Truist Financial boosted their target price on shares of Dollar Tree from $135.00 to $149.00 and gave the stock a “buy” rating in a report on Thursday, December 21st. TheStreet cut shares of Dollar Tree from a “b-” rating to a “c” rating in a report on Wednesday. Wells Fargo & Company boosted their price objective on shares of Dollar Tree from $160.00 to $180.00 and gave the stock an “overweight” rating in a research note on Monday, March 4th. Finally, Morgan Stanley lowered their target price on shares of Dollar Tree from $140.00 to $135.00 and set an “equal weight” rating for the company in a research note on Thursday, November 30th. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and eleven have assigned a buy rating to the company’s stock. Based on data from MarketBeat, the company presently has an average rating of “Moderate Buy” and a consensus target price of $150.95.

Check Out Our Latest Stock Report on DLTR

Dollar Tree Price Performance

Shares of DLTR stock opened at $127.42 on Monday. The company has a market capitalization of $27.76 billion, a P/E ratio of -27.58, a P/E/G ratio of 4.44 and a beta of 0.92. The company’s 50-day simple moving average is $139.38 and its two-hundred day simple moving average is $125.65. Dollar Tree has a one year low of $102.77 and a one year high of $161.10. The company has a debt-to-equity ratio of 0.47, a current ratio of 1.31 and a quick ratio of 0.17.

Institutional Inflows and Outflows

Several large investors have recently made changes to their positions in DLTR. Capital World Investors raised its position in Dollar Tree by 2.8% during the fourth quarter. Capital World Investors now owns 17,608,690 shares of the company’s stock worth $2,501,314,000 after acquiring an additional 487,180 shares during the period. BlackRock Inc. lifted its stake in Dollar Tree by 0.3% in the 1st quarter. BlackRock Inc. now owns 16,041,782 shares of the company’s stock valued at $2,302,798,000 after buying an additional 50,496 shares in the last quarter. Mantle Ridge LP boosted its holdings in Dollar Tree by 11,365,431.0% in the 1st quarter. Mantle Ridge LP now owns 11,365,531 shares of the company’s stock worth $1,820,190,000 after buying an additional 11,365,431 shares during the last quarter. Capital International Investors increased its stake in Dollar Tree by 30.1% during the 4th quarter. Capital International Investors now owns 10,581,632 shares of the company’s stock worth $1,503,123,000 after buying an additional 2,445,827 shares in the last quarter. Finally, State Street Corp raised its holdings in shares of Dollar Tree by 1.5% during the second quarter. State Street Corp now owns 9,065,379 shares of the company’s stock valued at $1,300,882,000 after acquiring an additional 132,041 shares during the last quarter. 97.40% of the stock is owned by institutional investors and hedge funds.

Insider Activity at Dollar Tree

In other news, Director Ridge Lp Mantle purchased 738,862 shares of the company’s stock in a transaction that occurred on Wednesday, December 20th. The shares were bought at an average price of $134.37 per share, for a total transaction of $99,280,886.94. Following the completion of the transaction, the director now owns 12,104,493 shares in the company, valued at $1,626,480,724.41. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 6.00% of the company’s stock.

About Dollar Tree

Dollar Tree, Inc operates discount variety retail stores. The company operates in two segments, Dollar Tree and Family Dollar. The Dollar Tree segment offers merchandise at the fixed price of $ 1.25. It provides consumable merchandise, which includes everyday consumables, such as household paper and chemicals, food, candy, health, personal care products, and frozen and refrigerated food; variety merchandise comprising toys, durable housewares, gifts, stationery, party goods, greeting cards, softlines, arts and crafts supplies, and other items; and seasonal goods that include Christmas, Easter, Halloween, and Valentine’s Day merchandise.

Featured Articles

Receive News & Ratings for Dollar Tree Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Dollar Tree and related companies with MarketBeat.com’s FREE daily email newsletter.