Zacks Research Brokers Cut Earnings Estimates for Jones Lang LaSalle Incorporated (NYSE:JLL)

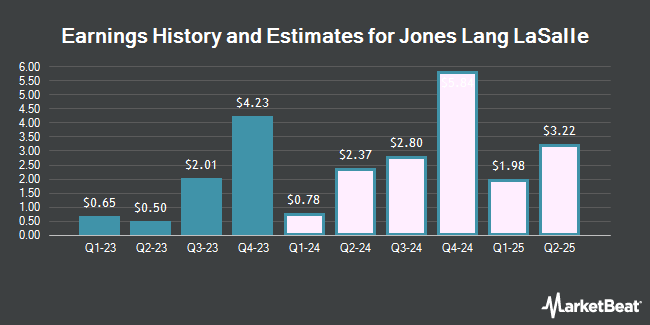

Jones Lang LaSalle Incorporated (NYSE:JLL – Free Report) – Zacks Research reduced their Q3 2024 earnings per share estimates for Jones Lang LaSalle in a research note issued on Monday, April 1st. Zacks Research analyst R. Fatarpekar now expects that the financial services provider will post earnings per share of $2.77 for the quarter, down from their prior forecast of $2.78. The consensus estimate for Jones Lang LaSalle’s current full-year earnings is $11.98 per share. Zacks Research also issued estimates for Jones Lang LaSalle’s Q1 2025 earnings at $2.81 EPS.

Several other equities analysts also recently weighed in on the company. TheStreet upgraded Jones Lang LaSalle from a “c+” rating to a “b-” rating in a report on Wednesday, February 14th. Raymond James upgraded Jones Lang LaSalle from an “outperform” rating to a “strong-buy” rating and lifted their price objective for the stock from $218.00 to $246.00 in a report on Wednesday. Finally, StockNews.com upgraded Jones Lang LaSalle from a “hold” rating to a “buy” rating in a report on Wednesday, February 28th. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating, two have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, Jones Lang LaSalle currently has a consensus rating of “Moderate Buy” and a consensus price target of $183.40.

View Our Latest Analysis on JLL

Jones Lang LaSalle Stock Performance

Shares of Jones Lang LaSalle stock opened at $194.39 on Wednesday. Jones Lang LaSalle has a 12 month low of $119.46 and a 12 month high of $196.61. The company has a current ratio of 1.94, a quick ratio of 1.94 and a debt-to-equity ratio of 0.22. The business has a fifty day simple moving average of $184.64 and a two-hundred day simple moving average of $166.02. The firm has a market capitalization of $9.22 billion, a P/E ratio of 41.71 and a beta of 1.42.

Jones Lang LaSalle (NYSE:JLL – Get Free Report) last announced its quarterly earnings results on Tuesday, February 27th. The financial services provider reported $4.23 EPS for the quarter, topping analysts’ consensus estimates of $3.70 by $0.53. The company had revenue of $5.88 billion during the quarter, compared to analyst estimates of $5.86 billion. Jones Lang LaSalle had a return on equity of 5.74% and a net margin of 1.09%. The firm’s revenue was up 4.9% on a year-over-year basis. During the same quarter last year, the firm posted $4.36 earnings per share.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in the stock. Covestor Ltd lifted its position in shares of Jones Lang LaSalle by 61.3% during the 1st quarter. Covestor Ltd now owns 150 shares of the financial services provider’s stock valued at $36,000 after buying an additional 57 shares in the last quarter. Cerity Partners LLC lifted its holdings in Jones Lang LaSalle by 2.0% in the 2nd quarter. Cerity Partners LLC now owns 3,042 shares of the financial services provider’s stock worth $474,000 after purchasing an additional 61 shares in the last quarter. Tributary Capital Management LLC raised its holdings in shares of Jones Lang LaSalle by 1.9% during the 4th quarter. Tributary Capital Management LLC now owns 4,351 shares of the financial services provider’s stock worth $822,000 after acquiring an additional 83 shares in the last quarter. HighTower Advisors LLC raised its holdings in shares of Jones Lang LaSalle by 2.5% during the 1st quarter. HighTower Advisors LLC now owns 3,413 shares of the financial services provider’s stock worth $818,000 after acquiring an additional 84 shares in the last quarter. Finally, Exchange Traded Concepts LLC raised its holdings in shares of Jones Lang LaSalle by 78.7% during the 3rd quarter. Exchange Traded Concepts LLC now owns 218 shares of the financial services provider’s stock worth $31,000 after acquiring an additional 96 shares in the last quarter. 94.80% of the stock is owned by hedge funds and other institutional investors.

Jones Lang LaSalle Company Profile

Jones Lang LaSalle Incorporated operates as a commercial real estate and investment management company. It engages in the buying, building, occupying, managing, and investing in a commercial, industrial, hotel, residential, and retail properties in Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Further Reading

Receive News & Ratings for Jones Lang LaSalle Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Jones Lang LaSalle and related companies with MarketBeat.com’s FREE daily email newsletter.