Zacks Research Brokers Lower Earnings Estimates for 3D Systems Co. (NYSE:DDD)

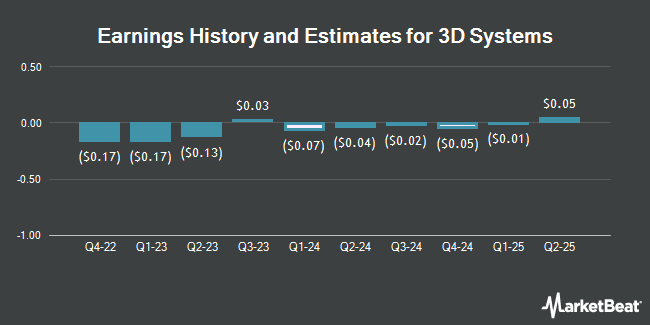

3D Systems Co. (NYSE:DDD – Free Report) – Equities research analysts at Zacks Research cut their Q3 2025 EPS estimates for shares of 3D Systems in a note issued to investors on Monday, March 11th. Zacks Research analyst A. Bhagat now forecasts that the 3D printing company will earn $0.01 per share for the quarter, down from their previous estimate of $0.05. The consensus estimate for 3D Systems’ current full-year earnings is ($0.27) per share. Zacks Research also issued estimates for 3D Systems’ FY2026 earnings at $0.08 EPS.

Other research analysts have also issued reports about the stock. Cantor Fitzgerald assumed coverage on shares of 3D Systems in a report on Tuesday, February 13th. They issued an “overweight” rating and a $8.50 price objective for the company. StockNews.com downgraded shares of 3D Systems from a “hold” rating to a “sell” rating in a research report on Sunday, March 3rd.

Read Our Latest Stock Report on 3D Systems

3D Systems Stock Down 1.1 %

Shares of NYSE DDD opened at $4.80 on Wednesday. The company has a current ratio of 4.30, a quick ratio of 3.24 and a debt-to-equity ratio of 0.76. 3D Systems has a 12 month low of $3.50 and a 12 month high of $11.09. The firm has a market capitalization of $639.80 million, a PE ratio of -1.69 and a beta of 1.73. The firm has a fifty day simple moving average of $5.02 and a two-hundred day simple moving average of $5.05.

Institutional Trading of 3D Systems

Several institutional investors have recently bought and sold shares of the company. Advisor Group Holdings Inc. raised its stake in 3D Systems by 0.6% during the 4th quarter. Advisor Group Holdings Inc. now owns 160,511 shares of the 3D printing company’s stock worth $1,188,000 after acquiring an additional 962 shares during the period. Rockefeller Capital Management L.P. raised its stake in 3D Systems by 40.4% during the 4th quarter. Rockefeller Capital Management L.P. now owns 3,474 shares of the 3D printing company’s stock worth $25,000 after acquiring an additional 1,000 shares during the period. FMR LLC raised its stake in 3D Systems by 15.9% during the 2nd quarter. FMR LLC now owns 9,246 shares of the 3D printing company’s stock worth $90,000 after acquiring an additional 1,265 shares during the period. Mercer Global Advisors Inc. ADV raised its stake in 3D Systems by 9.2% during the 3rd quarter. Mercer Global Advisors Inc. ADV now owns 16,303 shares of the 3D printing company’s stock worth $130,000 after acquiring an additional 1,380 shares during the period. Finally, GABELLI & Co INVESTMENT ADVISERS INC. grew its holdings in 3D Systems by 11.9% during the 4th quarter. GABELLI & Co INVESTMENT ADVISERS INC. now owns 13,200 shares of the 3D printing company’s stock valued at $98,000 after buying an additional 1,400 shares in the last quarter. 69.35% of the stock is owned by hedge funds and other institutional investors.

About 3D Systems

3D Systems Corporation provides 3D printing and digital manufacturing solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company offers 3D printers technologies, such as stereolithography, selective laser sintering, direct metal printing, multi jet printing, color jet printing, polymer extrusion, and extrusion and SLA based bioprinting that transform digital data input generated by 3D design software, computer aided design (CAD) software, or other 3D design tools into printed parts.

Further Reading

Receive News & Ratings for 3D Systems Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for 3D Systems and related companies with MarketBeat.com’s FREE daily email newsletter.