Zacks Research Brokers Raise Earnings Estimates for Host Hotels & Resorts, Inc. (NASDAQ:HST)

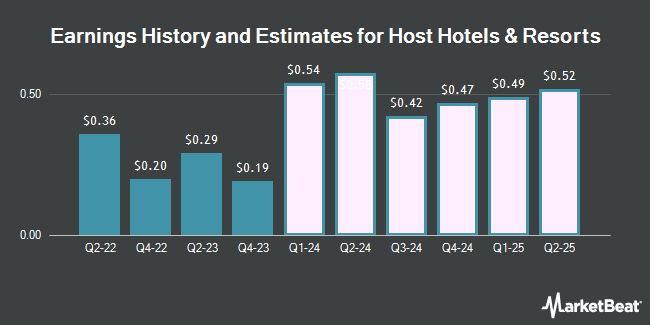

Host Hotels & Resorts, Inc. (NASDAQ:HST – Free Report) – Research analysts at Zacks Research raised their Q1 2024 earnings estimates for shares of Host Hotels & Resorts in a research note issued to investors on Wednesday, March 13th. Zacks Research analyst R. Department now forecasts that the company will earn $0.52 per share for the quarter, up from their previous estimate of $0.49. The consensus estimate for Host Hotels & Resorts’ current full-year earnings is $1.99 per share. Zacks Research also issued estimates for Host Hotels & Resorts’ Q2 2024 earnings at $0.54 EPS, Q3 2024 earnings at $0.39 EPS, Q4 2024 earnings at $0.48 EPS, Q1 2025 earnings at $0.49 EPS, Q2 2025 earnings at $0.52 EPS, Q3 2025 earnings at $0.39 EPS, Q4 2025 earnings at $0.42 EPS, FY2025 earnings at $1.82 EPS and FY2026 earnings at $1.87 EPS.

Host Hotels & Resorts (NASDAQ:HST – Get Free Report) last announced its earnings results on Wednesday, February 21st. The company reported $0.19 EPS for the quarter, missing analysts’ consensus estimates of $0.44 by ($0.25). The firm had revenue of $1.32 billion for the quarter, compared to analysts’ expectations of $1.29 billion. Host Hotels & Resorts had a net margin of 13.93% and a return on equity of 10.82%. The business’s revenue was up 4.8% compared to the same quarter last year. During the same quarter last year, the business earned $0.44 earnings per share.

Other equities analysts have also recently issued research reports about the company. Stifel Nicolaus lifted their price objective on Host Hotels & Resorts from $20.00 to $21.00 and gave the company a “buy” rating in a research note on Wednesday, January 24th. Bank of America upgraded Host Hotels & Resorts from an “underperform” rating to a “buy” rating and boosted their target price for the stock from $18.00 to $23.00 in a research note on Monday, January 8th. UBS Group decreased their target price on Host Hotels & Resorts from $20.00 to $18.00 and set a “neutral” rating for the company in a research note on Thursday, November 16th. Wells Fargo & Company boosted their target price on Host Hotels & Resorts from $20.00 to $22.00 and gave the stock an “overweight” rating in a research note on Friday, December 22nd. Finally, JPMorgan Chase & Co. raised Host Hotels & Resorts from an “underweight” rating to a “neutral” rating and set a $15.00 price target on the stock in a research report on Thursday, December 14th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and eleven have assigned a buy rating to the company’s stock. According to data from MarketBeat, the stock presently has an average rating of “Moderate Buy” and an average price target of $20.40.

Read Our Latest Stock Report on HST

Host Hotels & Resorts Stock Performance

Shares of HST opened at $20.67 on Friday. The stock has a 50-day simple moving average of $20.00 and a 200-day simple moving average of $18.04. The company has a debt-to-equity ratio of 0.63, a quick ratio of 3.29 and a current ratio of 3.29. The stock has a market capitalization of $14.54 billion, a PE ratio of 19.88, a PEG ratio of 1.84 and a beta of 1.31. Host Hotels & Resorts has a 1 year low of $14.51 and a 1 year high of $21.31.

Institutional Trading of Host Hotels & Resorts

A number of institutional investors have recently bought and sold shares of the company. Vanguard Group Inc. lifted its position in shares of Host Hotels & Resorts by 1.2% in the first quarter. Vanguard Group Inc. now owns 116,329,451 shares of the company’s stock valued at $2,260,281,000 after acquiring an additional 1,379,330 shares in the last quarter. Wellington Management Group LLP increased its stake in Host Hotels & Resorts by 15.4% in the third quarter. Wellington Management Group LLP now owns 50,275,252 shares of the company’s stock valued at $807,923,000 after purchasing an additional 6,719,578 shares during the last quarter. State Street Corp increased its stake in Host Hotels & Resorts by 7.1% in the first quarter. State Street Corp now owns 49,154,706 shares of the company’s stock valued at $956,516,000 after purchasing an additional 3,240,590 shares during the last quarter. Norges Bank acquired a new position in Host Hotels & Resorts in the fourth quarter valued at $615,558,000. Finally, JPMorgan Chase & Co. increased its stake in Host Hotels & Resorts by 1.4% in the third quarter. JPMorgan Chase & Co. now owns 22,313,389 shares of the company’s stock valued at $358,576,000 after purchasing an additional 310,079 shares during the last quarter. 98.52% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at Host Hotels & Resorts

In related news, CFO Sourav Ghosh sold 12,000 shares of Host Hotels & Resorts stock in a transaction that occurred on Friday, December 22nd. The stock was sold at an average price of $19.82, for a total value of $237,840.00. Following the sale, the chief financial officer now directly owns 171,801 shares in the company, valued at $3,405,095.82. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link. In other Host Hotels & Resorts news, CFO Sourav Ghosh sold 12,000 shares of the business’s stock in a transaction on Friday, December 22nd. The stock was sold at an average price of $19.82, for a total transaction of $237,840.00. Following the sale, the chief financial officer now directly owns 171,801 shares in the company, valued at $3,405,095.82. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, VP Nathan S. Tyrrell sold 14,193 shares of the business’s stock in a transaction on Friday, December 22nd. The stock was sold at an average price of $19.78, for a total value of $280,737.54. Following the sale, the vice president now owns 441,440 shares in the company, valued at $8,731,683.20. The disclosure for this sale can be found here. Insiders have sold a total of 37,861 shares of company stock worth $750,071 over the last three months. 1.20% of the stock is currently owned by corporate insiders.

Host Hotels & Resorts Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, April 15th. Investors of record on Thursday, March 28th will be paid a $0.20 dividend. The ex-dividend date of this dividend is Wednesday, March 27th. This is an increase from Host Hotels & Resorts’s previous quarterly dividend of $0.18. This represents a $0.80 dividend on an annualized basis and a dividend yield of 3.87%. Host Hotels & Resorts’s payout ratio is 76.92%.

About Host Hotels & Resorts

Host Hotels & Resorts, Inc is an S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels. The Company currently owns 72 properties in the United States and five properties internationally totaling approximately 42,000 rooms.

Further Reading

Receive News & Ratings for Host Hotels & Resorts Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Host Hotels & Resorts and related companies with MarketBeat.com’s FREE daily email newsletter.