Currencies: Euro ends weak despite good German IFO data – 2024-03-22

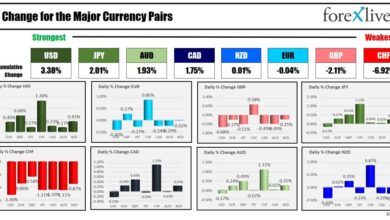

The Dollar is proving its robustness in this post-FOMC period: the FED’s announcements caused a small air pocket of -0.6% at the time, which was quickly filled on Thursday, and the greenback continues to climb, ending the week at a high of 104.4E on the ‘$-Index’ (i.e. +0.85%).

Nor is the dollar suffering from the easing of the T-Bond 2034 by -5pts to 4.22%.

The ’30-yr’ was still above its March 15 levels on Thursday evening before easing by -4.5pts to 4.400%.

And this improvement is taking place in the absence of any significant figures (an agenda devoid of ‘stats’ or speeches by central bankers).

The euro is down a further -0.5% on Friday (towards $1.0805) despite the publication of a good “figure” from Germany: the Ifo business climate index in Germany continues to recover, at 87.8 compared with an upwardly revised 85.7 in February.

A score well above expectations (consensus 86.0; CE 85.5) and the highest since last June.

The Swiss franc, which had fallen -0.9% with the SNB’s surprise rate cut announcement the previous day, stabilized at around $0.8990 and recovered 0.35% against the euro.

The yen was the strongest at +0.2% against the dollar, but lost 1% on the week, despite the BoJ’s rate hike on Tuesday

Copyright (c) 2024 CercleFinance.com. All rights reserved.