Q3 2025 Earnings Estimate for Wheaton Precious Metals Corp. Issued By Zacks Research (NYSE:WPM)

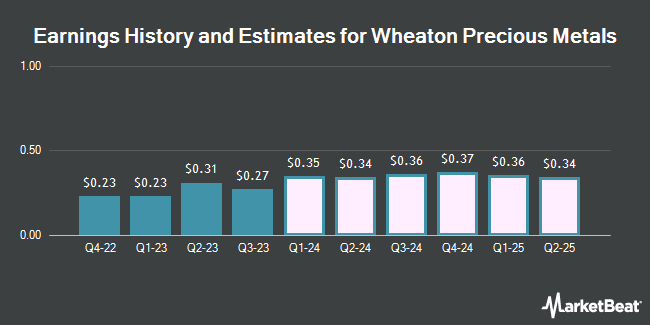

Wheaton Precious Metals Corp. (NYSE:WPM – Free Report) – Investment analysts at Zacks Research boosted their Q3 2025 earnings per share estimates for shares of Wheaton Precious Metals in a report released on Friday, March 22nd. Zacks Research analyst M. Das now expects that the company will post earnings per share of $0.34 for the quarter, up from their prior estimate of $0.32. The consensus estimate for Wheaton Precious Metals’ current full-year earnings is $1.22 per share. Zacks Research also issued estimates for Wheaton Precious Metals’ Q4 2025 earnings at $0.34 EPS, FY2025 earnings at $1.29 EPS and FY2026 earnings at $1.32 EPS.

Other equities analysts also recently issued reports about the company. Raymond James lowered their price objective on Wheaton Precious Metals from $60.00 to $58.00 and set a “market perform” rating on the stock in a research report on Thursday, February 22nd. Scotiabank dropped their price objective on Wheaton Precious Metals from $60.00 to $59.00 and set a “sector outperform” rating on the stock in a research note on Wednesday, February 28th. TD Securities upgraded Wheaton Precious Metals from a “hold” rating to a “buy” rating and upped their target price for the stock from $51.00 to $53.00 in a report on Monday, March 18th. National Bank Financial lowered Wheaton Precious Metals from an “outperform” rating to a “sector perform” rating in a report on Wednesday, February 21st. Finally, Jefferies Financial Group assumed coverage on Wheaton Precious Metals in a research note on Thursday, February 29th. They issued a “buy” rating and a $49.00 target price for the company. Six equities research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company’s stock. Based on data from MarketBeat, Wheaton Precious Metals currently has a consensus rating of “Moderate Buy” and an average price target of $60.65.

Read Our Latest Stock Report on Wheaton Precious Metals

Wheaton Precious Metals Stock Performance

NYSE:WPM opened at $44.89 on Monday. The stock has a 50-day simple moving average of $44.67 and a two-hundred day simple moving average of $44.98. Wheaton Precious Metals has a 52-week low of $38.37 and a 52-week high of $52.76. The firm has a market capitalization of $20.34 billion, a PE ratio of 37.72, a P/E/G ratio of 11.62 and a beta of 0.76.

Wheaton Precious Metals Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, April 15th. Investors of record on Wednesday, April 3rd will be issued a $0.155 dividend. This represents a $0.62 annualized dividend and a yield of 1.38%. The ex-dividend date of this dividend is Tuesday, April 2nd. This is an increase from Wheaton Precious Metals’s previous quarterly dividend of $0.15. Wheaton Precious Metals’s dividend payout ratio (DPR) is 50.42%.

Institutional Trading of Wheaton Precious Metals

Institutional investors have recently added to or reduced their stakes in the stock. Sprott Inc. boosted its stake in Wheaton Precious Metals by 4.8% in the third quarter. Sprott Inc. now owns 799,533 shares of the company’s stock valued at $32,421,000 after acquiring an additional 36,654 shares in the last quarter. Deutsche Bank AG grew its stake in Wheaton Precious Metals by 4.4% in the 3rd quarter. Deutsche Bank AG now owns 3,623,133 shares of the company’s stock worth $146,918,000 after acquiring an additional 152,826 shares during the period. Douglas Lane & Associates LLC grew its stake in Wheaton Precious Metals by 186.9% in the 3rd quarter. Douglas Lane & Associates LLC now owns 310,914 shares of the company’s stock worth $12,608,000 after acquiring an additional 202,539 shares during the period. Mackenzie Financial Corp grew its stake in Wheaton Precious Metals by 18.3% in the 3rd quarter. Mackenzie Financial Corp now owns 3,411,151 shares of the company’s stock worth $133,849,000 after acquiring an additional 527,358 shares during the period. Finally, Gabelli Funds LLC grew its stake in Wheaton Precious Metals by 1.6% in the 3rd quarter. Gabelli Funds LLC now owns 1,171,495 shares of the company’s stock worth $47,504,000 after acquiring an additional 18,100 shares during the period. Institutional investors and hedge funds own 58.51% of the company’s stock.

About Wheaton Precious Metals

Wheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 10, 2017. Wheaton Precious Metals Corp.

Featured Stories

Receive News & Ratings for Wheaton Precious Metals Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Wheaton Precious Metals and related companies with MarketBeat.com’s FREE daily email newsletter.