CT’s investment performance improves, but weighed down by the past

Connecticut State Treasurer Erick Russell touted the state’s strong pension investment returns for fiscal year 2023 during an informational forum before the Finance, Revenue and Bonding Committee, following a 2023 report from the Yale School of Management that showed historically Connecticut has had some of the worst investment performance in the country.

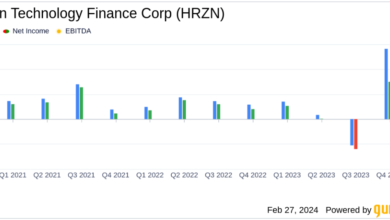

With $55 billion in assets under management, Connecticut had a strong year with its pension investments, beating the state’s benchmarks by more than 2 percent, a stark turnaround from prior years when the state’s investments underperformed.

That historical underperformance, stretching back to the 1990s and encompassing the tenure of two state treasurers, cost the people of Connecticut severely. According to Yale’s estimates, had Connecticut at least matched the median investment performance of other states, taxpayers could have saved $27 billion.

Last year, Russell and lawmakers worked together on a series of reforms to help change the way Connecticut invests its billions in pension money: lawmakers approved increased compensation for state investment officers so pay would be more competitive with the private sector; loosened restrictions on who could serve on the Investment Advisory Council (IAC), and the IAC changed their asset management strategy.

All that, in conjunction with the transfer of $8 billion in surplus revenue to pay down the state’s long-term pension debt under Connecticut’s fiscal guardrails, has worked well for the past year and driven up the investment rate of return, saving taxpayers money and freeing up revenue that can be used elsewhere.

Prior to the forum, the Treasurer’s Office issued a press release touting Connecticut as among the top 27 percent of pension funds in the country based on 2023’s returns.

“The positive performance of our investments matches the state’s overall financial resurgence,” Russell said. “Strong returns not only protect the retirement security of our public servants, including retired teachers and state workers, but it frees up critical budgetary resources to meet the needs of Connecticut residents and make long-term investments.”

During questions from lawmakers, Russell stopped short of identifying what went wrong with Connecticut’s past pension investments over the last twenty years, focusing instead on his tenure, and saying that it is difficult to draw comparisons between investment performance on a state-by-state basis, something the team from Yale contends they managed to do.

“If you look historically, we went about 70 years without properly funding our pensions,” Russell said during the hearing. “And to look at a public pension fund and their strategy when they’re 30 percent funded compared to a public pension fund that is 100 percent funded, it is really hard to look at that as an apples-to-apples comparison.”

“Our biggest reform here has been asset allocation, which is the biggest driver of our risk-adjusted performance,” Russell said. According to a presentation created by the Treasurer’s Office, Connecticut has begun to reduce its allocation in global equity and global fixed income and increased alternative investments and private assets.

Russell also indicated that they are now reviewing private outside management firms used by the state for investments to ensure they meet certain benchmarks and that the state is not doubling down on asset managers who are underperforming – a criticism that emerged following the Yale study, which found Connecticut was repeatedly investing with management companies with poor performance and high fees.

Sen. John Fonfara, D-Hartford, co-chair of the Finance Committee, said he took partial responsibility for not paying more attention to Connecticut’s pension performance in the past and questioned the role of the IAC in past asset allocation decisions.

“I personally take responsibility as the chair of this committee for some time never having asked the questions of the treasurer’s performance,” Fonfara said. “We’ve got some catching up to do. It does not mean that we are attempting to manage your office. We have a responsibility as fiscal stewards to know how are we managing the responsibilities of all those funds that we have under our guidance.”

“I can’t help but wonder, where was the investment advisory council during that time? These folks who were supposed to be the watchdogs and sound the alarm,” Fonfara asked, but Russell indicated he could not opine on past decisions.

Also presenting at the forum was Prof. Jeffery Sonnenfeld, professor of Leadership Practice at the Yale School of Management, and Steven Tian, director of research and chief executive of the Leadership Institute — the team who, together with Yale students, authored the report that put Connecticut’s investment performance in the spotlight.

Sonnenfeld praised Russell’s leadership in making much-needed changes to the way Connecticut invests and how much oversight it gives to private managers charged with investing Connecticut’s billions but defended their work comparing Connecticut to other states.

Sonnenfeld and Tian presented an updated version of their 2023 study, which covered Connecticut’s pension performance up until 2022. According to their most recent analysis, Connecticut went from having the second-worst performing investment record, to having the eighth-worst, which is a solid swing for only one year.

“I think Treasurer Russell… has done a superb job, spectacular, as a first-year public official parachuting in,” Sonnenfeld said. “I wouldn’t say mission accomplished yet, but I wouldn’t have anticipated that we would be where we are.”

Sonnenfeld indicated that the poor pension returns under previous state treasurers he admired could have saved Connecticut from many of the budget fights and fiscal problems experienced over the past decade or more.

“A lot of the political food fights that took place over decisions on taxation and spending, that mattered, but it’s incidental compared to the magnitude of what happened here,” Sonnenfeld said. “The way we have spent an inordinate amount of time taking a look at fiscal issues and not taking a look at the pension fund issues.”

However, Sonnenfeld and Tian did level some criticism over the press release indicating Connecticut’s pension fund performance was in the top 27 percent in the nation.

Sen. Ryan Fazio, R-Greenwich, who is supportive of the changes made by the Treasurer’s Office, had questioned Russell’s numbers, saying that it compared Connecticut to an index that included a majority municipal pension funds, rather than state pension funds. Russell responded that “there were no comparisons to municipalities,” that they were all pension funds with more than $1 billion in AUM, and that “those are large state plans.”

Sonnenfeld and Tian, however, showed that the Makeeta database used by the Treasurer’s Office actually consists of 70 percent municipal pension funds.

“You can literally see… that most of these funds that are benchmarked against Connecticut are local municipal funds,” Tian said. “It’s not exactly apples-to-apples comparison. Most local, municipal funds do not have the resources, do not have the scale, and do not have the support of state pension funds. It’s really a different ball game.”

Despite the differing numbers on benchmarks, the overall takeaway was that Connecticut’s pension investment performance has shown a strong turnaround under new guidelines, oversight, management, and legislation.

Sonnenfeld and Tian’s latest report offered further reforms moving forward, including getting rid of underperforming external managers, limiting exposure to any single external manager, more transparency for investment reporting, proper comparative benchmarking, making the IAC the fiduciary rather than the treasurer – something only done by one other state, North Carolina, that has performed worse than Connecticut – reducing “unnecessary fees,” and relying more on passive index funds.

Interestingly, some of these same recommendations were made by the now-defunct Legislative Program Review and Investigations (PRI) Committee in 1989 – something Sonnenfeld and Tian said they just recently discovered – as did Fonfara, who held up a copy of the report during the meeting.

At the time, Connecticut’s pension investments were performing well, according to the report, however, the PRI Committee recommended more transparent reporting for the public, instituting formal operating policies, expanding the role of the IAC, and setting competitive compensation for professional investment staff. More than thirty years later, some of these steps have finally been taken, although not all.

Connecticut’s major pension funds for state employees, teachers, and municipal employees are currently 52 percent, 59.8 percent, and 74.2 percent funded, respectively. The investment rate of return for fiscal year 2023 was 8.5 percent, roughly 2.5 points over the state’s benchmark rate of return of 5.9 percent. Pension payments by the state account for $3.3 billion per year at a time when state agencies and nonprofit organizations are clamoring for more state funding.

Connecticut’s improved performance, combined with paying down nearly $8 billion in pension debt, has freed up hundreds of millions in discretionary spending.

“There is a lot of credit to be shared for Connecticut’s steady rise among our peers and continued positive performance,” Russell said in the March 20 press release. “The unified commitment of policymakers to correct the errors of the past and meet our funding obligations has us well-positioned to build on this momentum and achieve sustained success.”