CoinSwitch parent forays into equity trading with Lemonn

NEW DELHI :New Delhi: CoinSwitch parent PeepalCo on Tuesday announced its first foray beyond cryptocurrencies, with the launch of its brokerage arm to offer equity trading.

With the launch of the brokerage platform, Lemonn, CoinSwitch aims to revive its business, following the cryptocurrency industry’s prolonged downturn spanning over two years. However, PeepalCo also claimed that the expansion was always on the cards.

Lemonn will target “an under-represented asset class of retail equity investors in India”, said Ashish Singhal, co-founder and chief executive of CoinSwitch, a cryptocurrency unicorn with 20 million registered users.

“We’re looking to find our market fit by offering what competitors do not have. This will include a curated view of every stock based on sell-side analyst outtakes, and industry-based curation of companies that will help investors discover lesser-known stocks across sectors, and to make more informed investment decisions.”

However, the Lemonn brand, registered with the Securities and Exchange Board of India (Sebi) under Nu Investors Technologies, will not need to acquire a market advisory license to offer its services, Singhal said.

“This is a field that we may pursue in the months to come, and the idea remains open. For now, we’re not into management and advisory, since we’re only showcasing ratings that analysts have already published, and not offering our own advisory.”

While Singhal refrained from providing a target for the first year of operations, the equity trading platform is expected to revive the company’s fortunes.

In FY23, PeepalCo reported around 82% decline in its net revenue from ₹248.6 crore a year ago to ₹45.6 crore. In comparison, India’s largest brokerage firm in terms of active client volumes, Zerodha’s operating revenue in FY23 was at ₹6,875 crore, while net profit stood at ₹2,909 crore. Zerodha had over 6.5 million daily active users at the end of 2023.

“The drop in revenue was largely due to prioritizing compliance, because of which retail deposits and withdrawals in crypto trading were suspended until December last year.”

“With the new trading platform becoming operational, we will see some boost coming through to our revenue, although right now the priority will be on finding the right market fit and acquiring users,” he added.

Devam Sardana, business head, Lemonn, said the equity and crypto platforms will operate independently, with no cross-sharing of user data or operational overlap. “We also have a 100-member team just for the equity platform, which we plan to scale up by the end of this year.”

Lemonn, signifying “a fresh approach to equity investments”, will also compete with the likes of Upstox, Groww, Angel One, and ICICI Direct, besides Zerodha.

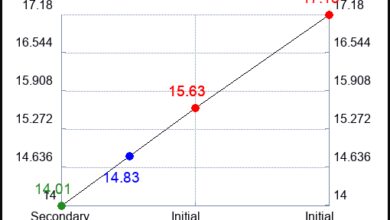

According to BSE data, as of Tuesday, India has 167.6 million registered equity investors, representing just over 11.5% of the population. CoinSwitch aims to capitalize on the opportunities offered by this under-penetrated sector.

Since the introduction of a 30% long-term capital gains tax (LTCG) on all profits from crypto withdrawals, and 1% tax deducted at source for all crypto trades on exchanges in the Union Budget for FY22, domestic cryptocurrency exchanges have witnessed a significant decline in daily average trading volumes.

According to data from market tracker Crebaco Global, daily average trading volumes across three leading domestic exchanges—WazirX, CoinDCX, and Zebpay— declined by 90% from $68.5 million in March 2022 just $6.7 million on 29 February. However, Bitcoin, the leading cryptocurrency, hit a new all-time high in March.

Besides, the suspension of bank deposits to crypto exchanges for retail users, and the bearish stance of the Reserve Bank, has severely impacted the crypto industry. However, CoinSwitch asserted that it maintains sufficient cash reserves.

“We have been careful with our expenses in the past two years, and have a runway of over five years at the moment to innovate for the future,” Singhal said. In October 2021, the company secured a $260 million Series-C funding led by US-based VC firm Andreessen Horowitz (a16z), marking the largest venture capital investment in India’s crypto industry.

A senior industry executive, requesting anonymity, said the launch of the trading platform by CoinSwitch was along expected lines, and the company could diversify its product offerings further.

“It would not be entirely surprising if Singhal decides to exit the crypto market in another five years. The biggest detrimental factor in India is not just the lack of regulations, but taxation. The Centre has no real reason to relax this avenue, since Bitcoin or any other token has not done much to cement investor confidence, despite the one-off exchange-traded fund (ETF) introduction in the US. On overall terms, it seems to be a wise move from a company that is well-funded, and has a sizeable user base,” the executive added.

Singhal said Lemonn will be promoted on CoinSwitch’s crypto platforms to attract users.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!