Brokers Issue Forecasts for uniQure’s FY2027 Earnings (NASDAQ:QURE)

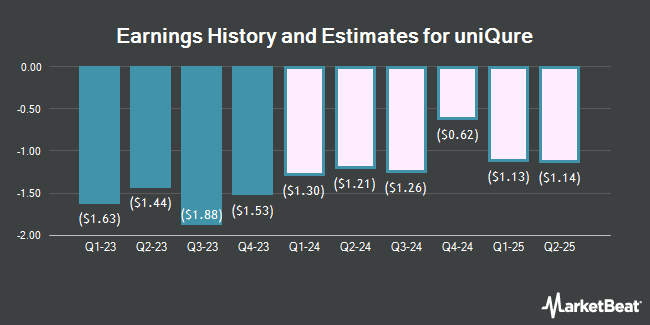

uniQure (NASDAQ:QURE – Free Report) – Research analysts at HC Wainwright cut their FY2027 earnings estimates for shares of uniQure in a note issued to investors on Wednesday, May 8th. HC Wainwright analyst P. Trucchio now anticipates that the biotechnology company will earn $0.67 per share for the year, down from their prior estimate of $0.68. HC Wainwright currently has a “Buy” rating and a $25.00 target price on the stock. The consensus estimate for uniQure’s current full-year earnings is ($4.45) per share. HC Wainwright also issued estimates for uniQure’s FY2028 earnings at $2.74 EPS.

uniQure (NASDAQ:QURE – Get Free Report) last issued its quarterly earnings results on Wednesday, February 28th. The biotechnology company reported ($1.53) earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of ($1.54) by $0.01. uniQure had a negative return on equity of 121.60% and a negative net margin of 1,562.22%. The firm had revenue of $6.69 million during the quarter, compared to analyst estimates of $3.20 million.

A number of other equities research analysts also recently weighed in on QURE. StockNews.com raised shares of uniQure to a “sell” rating in a report on Friday, March 1st. Royal Bank of Canada restated an “outperform” rating and issued a $28.00 price target on shares of uniQure in a research report on Tuesday, January 16th. Mizuho cut their price objective on uniQure from $7.00 to $6.00 and set a “neutral” rating for the company in a research report on Wednesday. Finally, The Goldman Sachs Group cut uniQure from a “buy” rating to a “neutral” rating and decreased their target price for the stock from $63.00 to $8.00 in a report on Thursday, February 29th. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating and five have given a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of “Moderate Buy” and an average target price of $26.67.

Check Out Our Latest Report on uniQure

uniQure Trading Down 3.0 %

Shares of QURE stock opened at $4.92 on Friday. The stock has a 50-day simple moving average of $4.97 and a 200 day simple moving average of $5.87. The stock has a market capitalization of $238.87 million, a P/E ratio of -0.79 and a beta of 0.98. uniQure has a fifty-two week low of $4.25 and a fifty-two week high of $22.48. The company has a quick ratio of 8.68, a current ratio of 9.39 and a debt-to-equity ratio of 0.70.

Insider Buying and Selling at uniQure

In other news, COO Pierre Caloz sold 9,455 shares of the firm’s stock in a transaction on Monday, February 26th. The stock was sold at an average price of $6.47, for a total value of $61,173.85. Following the completion of the sale, the chief operating officer now owns 85,643 shares of the company’s stock, valued at $554,110.21. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. In other news, COO Pierre Caloz sold 9,455 shares of the stock in a transaction that occurred on Monday, February 26th. The shares were sold at an average price of $6.47, for a total value of $61,173.85. Following the completion of the sale, the chief operating officer now directly owns 85,643 shares of the company’s stock, valued at $554,110.21. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Matthew C. Kapusta sold 27,904 shares of the business’s stock in a transaction that occurred on Monday, February 26th. The shares were sold at an average price of $6.35, for a total transaction of $177,190.40. Following the transaction, the chief executive officer now directly owns 440,839 shares in the company, valued at $2,799,327.65. The disclosure for this sale can be found here. Insiders have sold a total of 53,265 shares of company stock valued at $339,845 in the last three months. 4.74% of the stock is currently owned by company insiders.

Institutional Trading of uniQure

Several hedge funds and other institutional investors have recently modified their holdings of QURE. Headlands Technologies LLC purchased a new position in uniQure in the third quarter valued at about $31,000. China Universal Asset Management Co. Ltd. raised its position in uniQure by 222.1% during the fourth quarter. China Universal Asset Management Co. Ltd. now owns 6,258 shares of the biotechnology company’s stock valued at $42,000 after acquiring an additional 4,315 shares in the last quarter. Nomura Holdings Inc. acquired a new stake in uniQure in the third quarter valued at approximately $67,000. Laurion Capital Management LP bought a new stake in uniQure in the third quarter worth approximately $73,000. Finally, Vanguard Personalized Indexing Management LLC acquired a new position in shares of uniQure during the 4th quarter worth $86,000. 78.83% of the stock is currently owned by hedge funds and other institutional investors.

uniQure Company Profile

uniQure N.V. develops treatments for patients suffering from rare and other devastating diseases. It offers HEMGENIX that has completed Phase III HOPE-B pivotal trial for the treatment of hemophilia B. The company also develops AMT-130, a gene therapy that is in Phase I/II clinical study for the treatment of Huntington’s disease.

Featured Articles

Receive News & Ratings for uniQure Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for uniQure and related companies with MarketBeat.com’s FREE daily email newsletter.