Seaport Res Ptn Brokers Raise Earnings Estimates for The AES Co. (NYSE:AES)

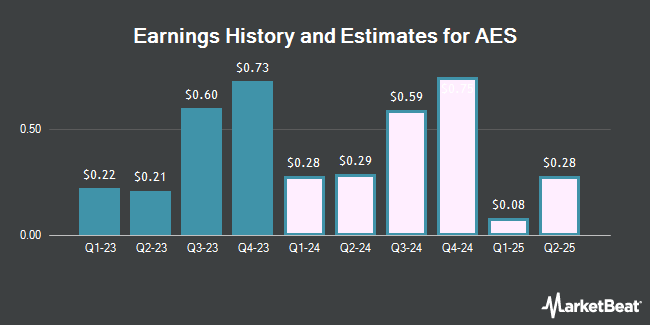

The AES Co. (NYSE:AES – Free Report) – Investment analysts at Seaport Res Ptn upped their FY2024 earnings per share (EPS) estimates for shares of AES in a research note issued on Monday, March 18th. Seaport Res Ptn analyst A. Storozynski now forecasts that the utilities provider will post earnings per share of $1.92 for the year, up from their previous forecast of $1.91. The consensus estimate for AES’s current full-year earnings is $1.90 per share. Seaport Res Ptn also issued estimates for AES’s FY2026 earnings at $2.10 EPS.

AES (NYSE:AES – Get Free Report) last announced its earnings results on Tuesday, February 27th. The utilities provider reported $0.73 EPS for the quarter, topping analysts’ consensus estimates of $0.67 by $0.06. The firm had revenue of $2.97 billion during the quarter, compared to analysts’ expectations of $3.36 billion. AES had a return on equity of 38.76% and a net margin of 2.12%. The company’s quarterly revenue was down 3.0% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.49 EPS.

AES has been the subject of a number of other reports. Morgan Stanley raised their price target on AES from $24.00 to $25.00 and gave the stock an “overweight” rating in a research note on Wednesday, February 28th. Barclays decreased their price target on AES from $21.00 to $20.00 and set an “overweight” rating for the company in a research note on Thursday, March 14th. One research analyst has rated the stock with a sell rating, three have given a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of “Hold” and an average target price of $21.00.

Get Our Latest Analysis on AES

AES Price Performance

Shares of AES stock opened at $15.52 on Wednesday. AES has a 52-week low of $11.43 and a 52-week high of $25.74. The company has a debt-to-equity ratio of 4.42, a quick ratio of 0.61 and a current ratio of 0.68. The firm has a market capitalization of $11.03 billion, a P/E ratio of 47.03, a P/E/G ratio of 0.89 and a beta of 1.07. The stock has a 50 day moving average price of $16.43 and a 200 day moving average price of $16.56.

Institutional Inflows and Outflows

Several large investors have recently made changes to their positions in AES. Cambridge Investment Research Advisors Inc. grew its stake in AES by 12.2% during the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 51,262 shares of the utilities provider’s stock worth $1,319,000 after buying an additional 5,594 shares during the last quarter. Commonwealth of Pennsylvania Public School Empls Retrmt SYS grew its stake in AES by 9.5% during the 1st quarter. Commonwealth of Pennsylvania Public School Empls Retrmt SYS now owns 91,659 shares of the utilities provider’s stock worth $2,358,000 after buying an additional 7,975 shares during the last quarter. Great West Life Assurance Co. Can grew its stake in AES by 1.2% during the 1st quarter. Great West Life Assurance Co. Can now owns 309,233 shares of the utilities provider’s stock worth $8,291,000 after buying an additional 3,755 shares during the last quarter. Yousif Capital Management LLC grew its stake in AES by 2.1% during the 1st quarter. Yousif Capital Management LLC now owns 110,543 shares of the utilities provider’s stock worth $2,844,000 after buying an additional 2,285 shares during the last quarter. Finally, Cibc World Market Inc. grew its stake in AES by 24.2% during the 1st quarter. Cibc World Market Inc. now owns 22,300 shares of the utilities provider’s stock worth $574,000 after buying an additional 4,351 shares during the last quarter. 94.49% of the stock is owned by institutional investors.

AES Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, May 15th. Stockholders of record on Wednesday, May 1st will be given a $0.1725 dividend. This represents a $0.69 annualized dividend and a dividend yield of 4.45%. The ex-dividend date is Tuesday, April 30th. AES’s payout ratio is 209.10%.

AES Company Profile

The AES Corporation, together with its subsidiaries, operates as a diversified power generation and utility company in the United States and internationally. The company owns and/or operates power plants to generate and sell power to customers, such as utilities, industrial users, and other intermediaries; owns and/or operates utilities to generate or purchase, distribute, transmit, and sell electricity to end-user customers in the residential, commercial, industrial, and governmental sectors; and generates and sells electricity on the wholesale market.

Read More

Receive News & Ratings for AES Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for AES and related companies with MarketBeat.com’s FREE daily email newsletter.