Brokers Set Expectations for BRP Inc.’s FY2025 Earnings (TSE:DOO)

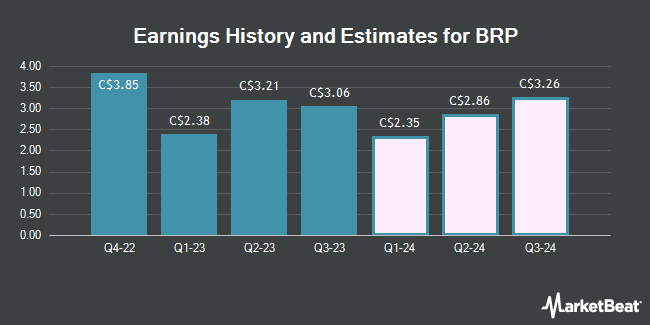

BRP Inc. (TSE:DOO – Free Report) – Investment analysts at National Bank Financial dropped their FY2025 earnings per share estimates for shares of BRP in a research report issued to clients and investors on Monday, March 18th. National Bank Financial analyst C. Doerksen now forecasts that the company will post earnings of $8.74 per share for the year, down from their prior forecast of $8.84. The consensus estimate for BRP’s current full-year earnings is $9.78 per share.

DOO has been the topic of a number of other research reports. UBS Group cut shares of BRP from a “buy” rating to a “neutral” rating and lowered their target price for the company from C$190.00 to C$89.00 in a report on Monday, December 4th. CIBC decreased their price target on shares of BRP from C$138.00 to C$106.00 and set an “outperform” rating on the stock in a report on Friday, December 1st. Desjardins decreased their price target on shares of BRP from C$168.00 to C$117.00 and set a “buy” rating on the stock in a report on Friday, December 1st. BMO Capital Markets decreased their price target on shares of BRP from C$150.00 to C$115.00 and set an “outperform” rating on the stock in a report on Friday, December 1st. Finally, National Bankshares cut their target price on shares of BRP from C$107.00 to C$105.00 and set an “outperform” rating for the company in a research report on Tuesday. Three research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company’s stock. According to MarketBeat.com, the company currently has a consensus rating of “Moderate Buy” and an average target price of C$105.31.

Get Our Latest Stock Analysis on DOO

BRP Stock Performance

BRP stock traded up C$1.10 during trading on Wednesday, hitting C$84.40. The stock had a trading volume of 59,556 shares, compared to its average volume of 194,253. BRP has a 1 year low of C$77.42 and a 1 year high of C$122.41. The company has a quick ratio of 0.20, a current ratio of 1.40 and a debt-to-equity ratio of 438.99. The stock’s 50 day moving average is C$88.81 and its two-hundred day moving average is C$93.85. The stock has a market cap of C$2.96 billion, a price-to-earnings ratio of 7.22, a price-to-earnings-growth ratio of 1.94 and a beta of 2.41.

BRP Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, January 12th. Stockholders of record on Friday, January 12th were paid a $0.18 dividend. This represents a $0.72 annualized dividend and a dividend yield of 0.85%. The ex-dividend date was Thursday, December 28th. BRP’s dividend payout ratio is currently 6.24%.

About BRP

BRP Inc, together with its subsidiaries, designs, develops, manufactures, distributes, and markets powersports vehicles and marine products in North America, Europe, Australia, New Zealand, and Latin America. The company operates through two segments, Powersports and Marine. The Powersports segment offers year-round products, such as Can-Am ATVs, SSVs, and 3WVs; seasonal products, including Ski-Doo and Lynx snowmobiles, Sea-Doo PWCs and pontoons, and Rotax engines for karts and recreational aircraft.

See Also

Before you consider BRP, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and BRP wasn’t on the list.

While BRP currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Click the link below and we’ll send you MarketBeat’s guide to investing in 5G and which 5G stocks show the most promise.