Wheaton Precious Metals Corp. (NYSE:WPM) Stock Holdings Lifted by Marketfield Asset Management LLC

Marketfield Asset Management LLC lifted its holdings in Wheaton Precious Metals Corp. (NYSE:WPM – Free Report) by 61.0% during the fourth quarter, according to the company in its most recent filing with the SEC. The fund owned 88,025 shares of the company’s stock after buying an additional 33,337 shares during the quarter. Wheaton Precious Metals makes up 3.5% of Marketfield Asset Management LLC’s portfolio, making the stock its 11th biggest position. Marketfield Asset Management LLC’s holdings in Wheaton Precious Metals were worth $4,343,000 as of its most recent SEC filing.

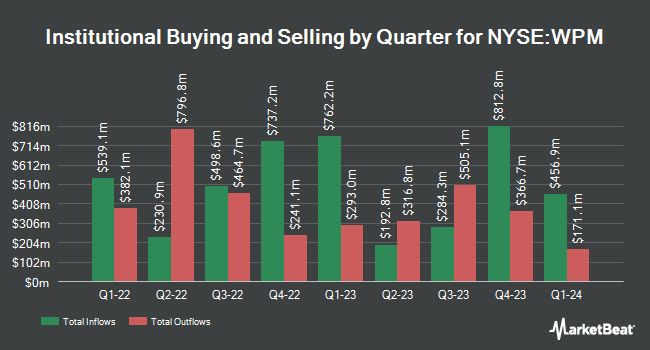

A number of other large investors also recently modified their holdings of WPM. First Eagle Investment Management LLC increased its holdings in shares of Wheaton Precious Metals by 0.5% in the 4th quarter. First Eagle Investment Management LLC now owns 21,110,441 shares of the company’s stock worth $1,041,589,000 after acquiring an additional 112,178 shares during the period. Van ECK Associates Corp increased its holdings in shares of Wheaton Precious Metals by 9.9% in the 4th quarter. Van ECK Associates Corp now owns 20,521,065 shares of the company’s stock worth $1,012,517,000 after acquiring an additional 1,856,031 shares during the period. Vanguard Group Inc. increased its holdings in shares of Wheaton Precious Metals by 1.6% in the 3rd quarter. Vanguard Group Inc. now owns 16,203,069 shares of the company’s stock worth $657,034,000 after acquiring an additional 248,541 shares during the period. Norges Bank acquired a new stake in shares of Wheaton Precious Metals in the 4th quarter worth about $387,481,000. Finally, Massachusetts Financial Services Co. MA increased its holdings in shares of Wheaton Precious Metals by 0.7% in the 4th quarter. Massachusetts Financial Services Co. MA now owns 7,641,208 shares of the company’s stock worth $377,017,000 after acquiring an additional 55,942 shares during the period. 70.34% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several research firms have commented on WPM. BMO Capital Markets raised their target price on shares of Wheaton Precious Metals from $59.00 to $61.00 and gave the company an “outperform” rating in a research note on Tuesday, May 21st. CIBC raised their target price on shares of Wheaton Precious Metals from $70.00 to $75.00 and gave the company an “outperform” rating in a research note on Wednesday, May 22nd. Scotiabank raised their target price on shares of Wheaton Precious Metals from $59.00 to $66.50 and gave the company an “outperform” rating in a research note on Thursday, May 23rd. TD Securities raised shares of Wheaton Precious Metals from a “hold” rating to a “buy” rating and raised their target price for the company from $51.00 to $53.00 in a research note on Monday, March 18th. Finally, Jefferies Financial Group raised their target price on shares of Wheaton Precious Metals from $52.00 to $61.00 and gave the company a “buy” rating in a research note on Monday, April 22nd. Three analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. Based on data from MarketBeat, Wheaton Precious Metals currently has a consensus rating of “Moderate Buy” and an average price target of $61.33.

Check Out Our Latest Stock Analysis on WPM

Wheaton Precious Metals Price Performance

Shares of WPM traded up $0.19 during mid-day trading on Wednesday, hitting $53.52. The company’s stock had a trading volume of 1,042,225 shares, compared to its average volume of 1,996,199. The firm has a 50-day moving average price of $53.83 and a 200 day moving average price of $48.97. The stock has a market capitalization of $24.26 billion, a price-to-earnings ratio of 41.17, a PEG ratio of 1.94 and a beta of 0.78. Wheaton Precious Metals Corp. has a fifty-two week low of $38.37 and a fifty-two week high of $57.87.

Wheaton Precious Metals (NYSE:WPM – Get Free Report) last announced its earnings results on Thursday, May 9th. The company reported $0.36 EPS for the quarter, topping the consensus estimate of $0.29 by $0.07. Wheaton Precious Metals had a net margin of 53.74% and a return on equity of 8.53%. The company had revenue of $296.80 million during the quarter, compared to analysts’ expectations of $278.95 million. During the same period last year, the company posted $0.23 earnings per share. The business’s revenue for the quarter was up 38.7% on a year-over-year basis. As a group, equities analysts anticipate that Wheaton Precious Metals Corp. will post 1.29 EPS for the current fiscal year.

Wheaton Precious Metals Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, June 11th. Shareholders of record on Wednesday, May 29th were issued a $0.155 dividend. This represents a $0.62 annualized dividend and a dividend yield of 1.16%. The ex-dividend date of this dividend was Wednesday, May 29th. Wheaton Precious Metals’s payout ratio is 47.69%.

Wheaton Precious Metals Profile

Wheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 2017. Wheaton Precious Metals Corp.

See Also

Want to see what other hedge funds are holding WPM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Wheaton Precious Metals Corp. (NYSE:WPM – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Wheaton Precious Metals, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Wheaton Precious Metals wasn’t on the list.

While Wheaton Precious Metals currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Click the link below and we’ll send you MarketBeat’s list of seven best retirement stocks and why they should be in your portfolio.