AUD/USD Forecast: Australian GDP, US Labor Market, and Fed’s Powell – Key Influences

US Economic Calendar: Labor Market and Fed Chair Powell in Focus

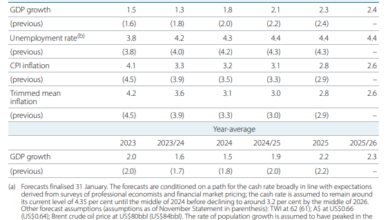

ADP employment change and JOLTs Job Openings will warrant investor attention on Wednesday. The ISM Services PMI for February signaled a decline in service sector jobs. Weaker-than-expected numbers could fuel bets on a June Fed rate cut and fear of a hard landing.

A softer labor market may impact wage growth and disposable income. Downward trends in disposable income and labor market uncertainty could curb consumer spending.

Economists forecast the ADP to report a 150k increase in employment in February, up from 107k in December. However, economists expect JOLTs Job Openings to fall from 9.026 million to 8.900 million in January. Investors must also consider quit rates. Workers are less likely to leave their jobs in a deteriorating labor market environment.

While the numbers will influence the buyer appetite for the AUD/USD, Fed Chair Powell will have the final say. The Fed Chair will give testimony on Capitol Hill. Inflation, the economic outlook, and timelines for interest rate cuts will garner investor interest.

Short-Term Forecast

Near-term AUD/USD trends will hinge on Australian GDP numbers, US labor market data, and Fed Chair Powell. A tighter US labor market, a hawkish Fed Chair, and weaker Australian economic growth would impact the AUD/USD. However, updates from the NPC also need consideration.

AUD/USD Price Action

Daily Chart

The AUD/USD hovered below the 50-day and 200-day EMAs, affirming bearish price signals.

An Aussie dollar move to the $0.65500 handle and the 50-day would give the bulls a run at the 200-day EMA. A breakout from the 200-day EMA would bring the $0.66162 resistance level into play.

NPC-related news, Q4 GDP numbers from Australia, US labor market data, and Fed Chair Powell need consideration.

However, a break below the $0.64900 support level could signal a drop to the trend line and the $0.63853 support level.

A 14-period Daily RSI reading of 42.39 suggests an AUD/USD fall to the trend line before entering oversold territory.