Bullock hedges on next RBA interest rate move

She survived largely unscathed the 44-minute media conference, fielding questions from about 25 journalists in a makeshift press room outside the RBA’s boardroom at Martin Place in Sydney.

Humanising the under-scrutiny central bank, a beaming Bullock welcomed journalists with a casual, “Hi, thanks for coming”.

Highest priority

She offered a quick history lesson on why interest rates could never stay at emergency lows experienced during the pandemic, before delivering her key line to the punters battling cost-of-living pressures and higher mortgage payments.

“Inflation hurts all Australians,” she said, reminding borrowers why the squeeze from interest rates was necessary.

“Returning inflation to target within a reasonable timeframe remains the board’s highest priority,” the board statement said.

The RBA’s new communications team wants borrowers to know Bullock is aware of the financial pain it is inflicting on some borrowers, but that the alternative of sustained high inflation would be worse for living standards.

Bullock’s even-handed public discussion in front of the television cameras was perhaps a touch more dovish than the more hard-headed analysis in the RBA’s quarterly statement on monetary policy that market economists follow.

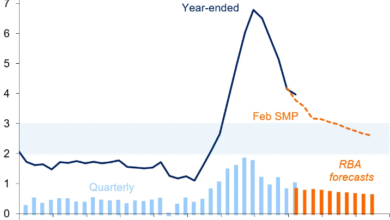

The economy is slowing and, positively, headline inflation has moderated to 4.1 per cent.

But domestic inflation pressures remain intense, fuelled by strong growth in services prices, robust wage rises, and abysmal labour productivity.

The RBA has slightly lowered its near-term inflation forecasts, but still thinks it will take until late 2025 for inflation to scrape below 3 per cent.

Tellingly, the bank noted it would take until mid-2026 for inflation to fall to its “midpoint” target of the 2-3 per cent band.

The clear-eyed assessment spelled out in its board statement and accompanying quarterly statement is a timely reminder that there is a high hurdle to meet market expectations that the first rate cut will occur around the middle of the year.

“Services inflation has passed its peak, but remains elevated due to the still-robust level of demand and strong domestic cost pressures,” the RBA said in its 55-page quarterly statement.

Slowing economy

“Market services inflation remains high and broadly based across categories.”

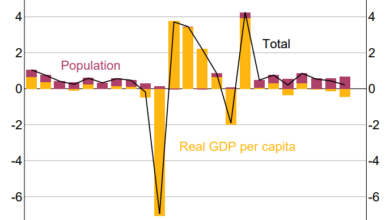

The RBA is alive to the economy slowing, as high inflation, higher borrowing costs and tax bracket creep weighs on household income and spending.

But strong growth in business investment, government spending on infrastructure projects, and the influx of international students and tourists is generating excess demand.

Rather than focusing too much on the rate of the slowdown, it is more focused on the level of demand running ahead of the economy’s capacity to produce goods and services without fuelling inflation.

“Recent high inflation is consistent with excess demand in the economy and strong domestic cost pressures,” the RBA said.

“While growth in demand has slowed, the level of demand is still robust and is assessed to be above the economy’s capacity to supply goods and services, thereby creating inflationary pressures.”

Labour market challenges

Various measures of the labour market, including the 3.9 per cent jobless rate, underemployment and job vacancies, suggest it is still too tight and beyond full employment, the RBA said.

Unit labour costs for business are running hot, as nominal wages rise and labour productivity goes backwards.

Moreover, the return to the inflation target is all predicated on the hopeful assumption that labour productivity rebounds 3 per cent in the middle of this year, after falling 2 per cent over the past year.

The assumption is based on the hope that pandemic-era interruptions unwind, productivity rebounds to its same level as two years ago, and then returns to its long-run average of about 1 per cent.

It’s a sharp turnaround from the recent experience.

“Recent weak productivity outcomes have contributed to very strong growth in unit labour costs, placing upward pressure on inflation,” the RBA said.

At a time when the Labor government is re-regulating the labour market, it is a bold bet.

The productivity recovery is a key risk called out by the RBA in its statement of risks.

The economic forecasts are also based on a “technical assumption” (not an RBA forecast) of almost two interest rate cuts priced in by the market and market economists by the end of 2024.

After Bullock’s appearance, the money market is fully pricing the first rate cut in September, pushed back from bets for June as of last week.

The RBA’s sobering outlook for inflation is a timely reminder that a tough battle still lies ahead, and imminent rate cuts are far from assured.