Centre for Independent Studies’ Robert Carling says government debt on track to hit $1.4trn this year

The update in December revealed a $64.4 billion surge in tax revenue since the May budget had helped propel the 2024 forecast of a $13.9 billion deficit towards a tiny deficit, or balance, of $1.1 billion – and potentially a surplus if commodity prices stay at elevated levels.

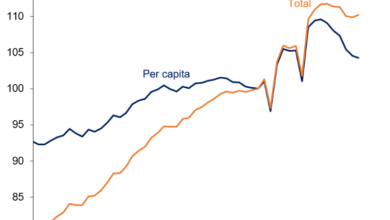

Mr Carling said at the federal level the budget had benefited from tax receipts in three years being $427 billion more than was expected in 2020. “Almost half this windfall has gone into higher government spending and the rest to limiting the growth of debt,” he said.

But sustained government spending on big ticket infrastructure projects, particularly in NSW and Victoria, at a time when the cost of health, defence and social services programs are soaring, has prompted the economist to pour cold water on the likelihood of sustained surpluses.

Victoria’s interest bill on gross debt is set to be as high as 8 per cent of its total revenues in fiscal 2027, he said. In NSW, the interest bill as a percentage of revenues will be 5 per cent.

State governments in Western Australia and Queensland had been able to capitalise on strong commodities and export prices to produce surpluses, but more work is needed to stop debt levels – and the interest burden – from dragging on national accounts, he said.