Did the Reserve Bank hit the brakes too hard? Why Australia’s economy is heading into reverse

The softening-up process is already underway.

After the inflation numbers dropped last week, coming in well below expectations, Treasurer Jim Chalmers could see the writing on the wall.

When the economic growth numbers are released on Wednesday, there’s little chance the news will be good.

Until Monday, most economists were predicting growth of between 0.1 per cent and 0.3 per cent for the December quarter.

That all changed when the ABS revealed Australian companies were running down their inventories at an alarming pace, indicating they have little faith that demand will pick up any time soon.

There’s now every possibility the GDP numbers could tip negative, giving the first real indication that Australia’s economy is shrinking under the weight of 13 interest rate hikes in quick succession.

If that’s the case, expect a raft of headlines screaming “RECESSION”. Technically, that won’t be true. You need the economy to contract two quarters in a row to use the R-word.

But you don’t need a weatherman to know which way the wind is blowing. Right now, there’s an icy gale coming in from the south and everyone can feel it.

Every single piece of official data since late last year has stunned the experts. At every turn, economists and analysts have been blindsided, describing every release as “surprisingly weak”.

December quarter inflation was way below the anticipated result, the jobs numbers were awful and, as for retail sales, we saw one of the biggest falls on record over Christmas.

While it bounced back a little in January, household consumption has been flat since September and the only reason it hasn’t declined is because the value of sales is being propped up by price rises driven by inflation.

The amount of goods and services changing hands has gone backwards.

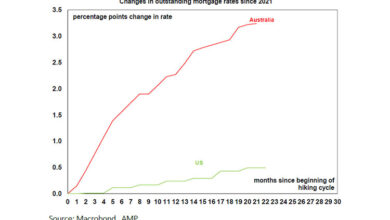

Lurking beneath all this are concerns about the wisdom of that 13th rate hike last November by the Reserve Bank of Australia (RBA) when it was clear inflation was waning and the full impact of the previous dozen rate increases had not taken effect.

Feel like you’re in a recession? Australia may not be but you are

The language shifted late last week.

At the G20 meeting in Brazil, the treasurer candidly admitted that growth was flatlining and the challenge ahead was not one of inflation-fighting but reinvigorating the economy.

“Inflation is still our major concern,” he told the ABC.

“But at some stage, the balance of risks in our economy and in the global economy is going to shift from inflation to growth.

“If and when that happens, we’ll make sure that our budget settings and our economic policies reflect the economic conditions as well.”

With a federal budget just 10 weeks away and an election next year, this was a clear message that the government was preparing to unleash some fiscal measures to boost growth.

The extent of the problem to a large degree has been masked by the rapid population increase post-pandemic when workers and students flooded back into the country.

Although the economy, overall, has expanded, that largely has been a result of the extra people who have arrived. Unfortunately, it’s a different story if you compare like for like. Within the economy, we have all gone backwards.

In the September quarter, the economy grew by an anaemic 0.2 per cent. But per capita GDP – that’s GDP divided by the number of Australians – went backwards by 0.5 per cent. That followed a 0.1 per cent decline in the June quarter.

On that measure we’re already in a per capita recession, a potent force in the world of politics.

The government may have taken heart from the result of the Dunkley by-election on the weekend, but there is no doubting the growing air of discontent within the community about the sudden evaporation in spending power and now living standards.

Prepare for leaner times in the jobs market

For almost two years, the RBA, Treasury and the government have been holding out for a “soft landing” — the idea that you can belt the economy with a punishing round of rate hikes without tipping it into recession.

There were a couple of things working in favour of such an outcome. No-one spent much through the pandemic and, with all the stimulus, most households accumulated some fat savings buffers.

Then there was the remarkable demand for labour which saw unemployment drop to its lowest level in half a century. Despite the rate hikes and the number of new arrivals, jobless numbers remained well below 4 per cent, an idea that had been abandoned decades ago.

If enough people retained their jobs and there was enough in the bank to maintain the mortgage payments and rents, the hope was that we might just be able to get through this.

That’s suddenly and rapidly changing. The buffers are running low, with many households exhausted. And unemployment is on the rise.

Job advertisements began to tank late last year, with Seek reporting a 20 per cent decline in the year to November. More recently, large firms like Optus, BHP and Westpac have begun laying off workers.

At this stage, the lay-offs are in their hundreds, not thousands. But that can quickly change.

For while we’ve all been intrigued by the strength of the labour force as inflation and interest rates have risen. Most economists have been blissfully unaware of the reality of the jobs market.

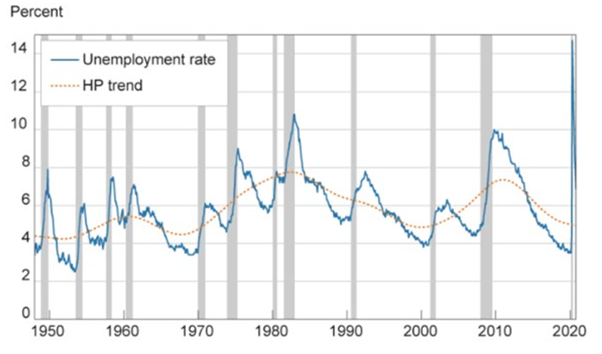

Rather than a neat and ordered trade-off between inflation and unemployment, as the textbooks would suggest, the jobs market tends to react violently and belatedly to rate hikes.

This graph, from a study conducted by the US Federal Reserve of Cleveland going back 70 years, shows the jobs market usually remains extremely strong right up until the economy tips into recession.

The moral of the story is that you don’t see a recession until you’ve arrived.

Emergency about-face?

The rapid lift in population in the past two years has meant that we’ve needed to create around 40,000 jobs a month just to contain unemployment. More than 600,000 arrived last year alone.

That was a relatively easy task as the economy bounced back from COVID lockdowns and labour was scarce.

But if new arrivals of that magnitude collide with a cooling labour market, the result will inevitably be a large blow-out in welfare payments and a return to deficits.

Loading

Increasingly, state governments have been forced to pick up the tab for infrastructure to cope with the rapid growth in our cities, according to a recent report by S&P Global, with state debt ballooning to $600 billion by the end of this year.

When it comes to stimulus, the stage 3 tax cuts — now rejigged to benefit all taxpayers — will inject around $20 billion into the economy in the first year, which just may end up as perfect timing.

Six months ago, the idea of pumping that kind of cash into a highly inflationary environment was seen as foolhardy and possibly delaying any chance of early interest rate cuts.

Not any longer. Dr Chalmers now would be eyeing other budget spending measures that could keep the economy buoyant without fuelling inflation.

Unfortunately, the November rate hike by the RBA is still working its way through the economy and acting as a handbrake. But it may just force the newly reconstituted board to backtrack with an earlier-than-expected rate cut.