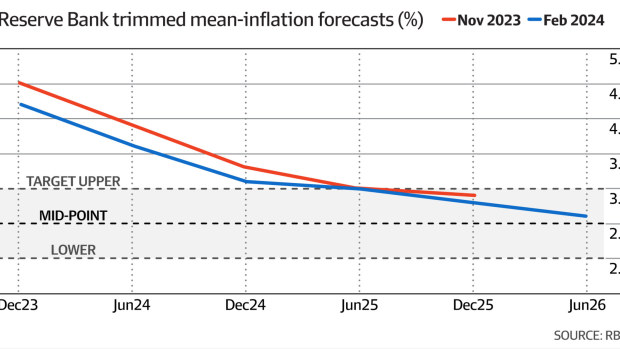

Inflation will not return to the mid-point of the central bank’s target band until the middle of 2026, it says in its latest quarterly outlook for the economy

The bank noted services inflation remained high despite having passed its peak, while goods inflation had recorded substantial declines. Offsetting the good news in goods prices, however, the statement noted a marked uptick in global shipping prices since Iran-backed Houthi rebels started attacking commercial shipping in the Red Sea in January.

The central bank’s February statement on monetary policy assumed almost two cuts in the official overnight cash rate to 3.9 per cent by December this year, which is based on market and economist pricing for rates.

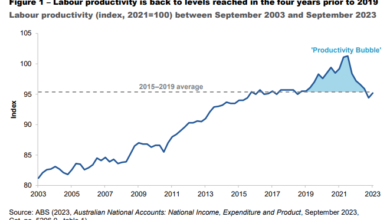

But the outlook for inflation and interest rates assumed a large rebound in labour productivity of 3 per cent over 2023-24, without which nominal unit labour cost growth of 7 per cent will not be consistent with target inflation.

Productivity growth

”The forecasts for nominal wages growth remain consistent with the inflation target, provided labour productivity growth returns to around long-run averages,” the statement said.

“While productivity growth is difficult to forecast and there are risks that productivity will be weaker than anticipated, much of the recent weakness in productivity has been a by-product of the pandemic and the economic cycle and will likely unwind over the next few years.”

Economic growth is forecast to be slightly lower than three months ago as inflation and high interest rates weigh on household consumption. Gross domestic product is expected to grow by 1.3 per cent in 2023-24 and 2.1 per cent in 2024-25.

From late 2024, growth is expected to pick up gradually as inflation declines and the pressures on household incomes ease.

Two key risks

“The risks to the domestic outlook are broadly balanced, though the costs associated with these risks differ,” the RBA said, identifying two key risks.

The first, demand could be softer than expected, leading to costs to the bank’s full-employment objective, though inflation would decline faster than expected in this case.

And second, inflation could take longer to return to target than anticipated, which the bank said, “would be costly (in terms of both the employment and inflation objectives) if this led to inflation expectations drifting upwards”.

Labour market tightness is expected to continue easing with unemployment growing from 3.9 per cent in January to 4.2 per cent by June and 4.3 per cent by the end of the year. Meanwhile, employment growth is expected to continue though at a slower pace than over the past two years.