Jim Chalmers’ third budget defined by diabolical ‘no landing’ scenario

‘No landing’ scenario

A few months ago, that was less of an issue. Economists were forecasting growth and inflation to slow as the almost simultaneous push by central banks to raise interest rates and stymie demand appeared to be working.

Investors were pricing in at least two rate cuts in the second half of this year, and the Reserve Bank of Australia’s February statement on monetary policy assumed at least two cuts by December.

The local economy was shaping up perfectly for Labor. Slowing inflation would allow more cost-of-living relief in the budget, tax cuts would kick in from July, and interest rate relief would follow soon after. It was the perfect soft landing scenario, avoiding the long-term scarring of a hard landing.

A few months later, however, many advanced economy central bankers are pushing back expectations for interest rate cuts as their economies deliver low unemployment, average growth, and sticky inflation in what some have described as a “no landing” scenario where rates stay higher for longer.

This is particularly the case in the US, where Federal Reserve chairman Jerome Powell last week warned that persistently elevated inflation would likely delay interest rate cuts until later this year, and there would be far fewer cuts than people were previously expecting.

The “no landing” scenario doesn’t mean the economy never comes back down to earth, it just becomes more unclear how, and when.

The US economy, for example, grew at its slowest pace in nearly two years in the first quarter amid some moderation in consumer spending and a wider trade deficit, according to data released on Friday. This increases the small risk of the worst case stagflation scenario, where inflation remains high, but the government has limited options to stimulate growth.

The question locally is whether Australia will follow the US, which looks increasingly to be the case. In the IMF April World Economic Outlook, released last week, Australia was placed in the same camp as the US.

Locally, growth might not be as strong as it is in the US and Asia, but most economists think it’s not nearly as bleak as Chalmers would like to portray. At the same time, inflation is proving annoyingly stubborn.

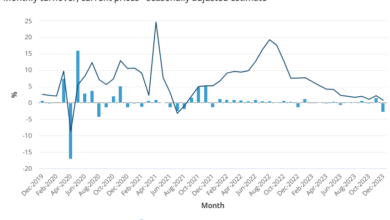

Accelerating inflation

On Wednesday, to illustrate the point, the March quarter CPI figures from the Bureau of Statistics showed inflation accelerating to a stronger-than-expected 1 per cent in the first three months of 2024, up from 0.6 per cent in the December quarter, and above market expectations of 0.8 per cent.

Treasurer Jim Chalmers in Washington.

Annual inflation was 3.6 per cent, down from 4.1 per cent in late 2023. The result was above expectations of 3.5 per cent, but benefited from the March quarter 2023 – when CPI rose 1.4 per cent – falling out of the dataset.

Notably, non-tradeables inflation – a measure of domestic price rises – was 5 per cent through the year, while tradeable inflation – a measure of imported inflation – was just 0.9 per cent, the largest gap in more than a decade.

Similar to the rest of the world, stubbornness came largely from the services sector, the main input for which is wages. The latest indicators show wages growth has settled around 4 per cent, too high for the RBA’s comfort.

Any hope Labor had of arguing there was scope for budget decisions that put more money into the economy in the next 18 months was put to bed; and for many economists, so too was the prospect of rate cuts this year.

Jarden chief economist Carlos Cacho said the stronger than expected March quarter inflation print justified the RBA’s cautious and balanced tone since the start of the year. It also undermined criticism of the bank’s decision to lift the cash rate to 4.35 per cent in November.

Cacho believes sticky inflation in new dwelling costs and rents (which make up about 15 per cent of the basket), as well as insurance and other services, will make progress back to the 2 per cent to 3 per cent target band slow.

Higher interest rates for longer

The housing component of the CPI basket rose 0.7 per cent in the March quarter. The strong increase was largely due to continued undersupply in the rental market, where prices rose 2.1 per cent in the quarter to be 7.8 per cent higher over the year, the strongest rise since March 2009.

Services inflation rose by about 1.4 per cent during the quarter, up from 1 per cent in late 2023.

“Recent wage indicators suggest wages growth is stabilising around 4 per cent which, along with weak productivity, is likely to mean unit labour costs remain elevated, putting upward pressure on inflation,” Cacho said.

With entrenched wage growth above 3.5 per cent, getting inflation back to the target band is going to be very difficult for the RBA. Wages growth of 3.5 per cent allows 2.5 per cent to be passed on to final consumer prices, with an additional 1 per cent from productivity gains, but even that low level of productivity growth has been difficult to achieve.

“We expect the RBA to keep rates on hold at 4.35 per cent in May and maintain their neutral tone and data dependence, again repeating they are ‘not ruling anything in or out,’” Cacho said.

“We continue to expect rate cuts not to occur until February 2025, with only three cuts to 3.6 per cent expected over 2025.”

Judo Bank economic adviser Warren Hogan, who last year was the nation’s most accurate economic forecaster, goes even further. He expects the RBA will be forced to raise rates a further three times this year, taking the cash rate from 0.1 per cent in May 2022 to 5.1 per cent by November.

All of which sets up a diabolical budget conundrum for Chalmers.

Budget blues

How does Labor support first home buyers without stoking house prices? How does it turbocharge the net zero energy transition while managing an infrastructure pipeline already stoking inflation? How does it pour billions of dollars into local manufacturing and the green supply chain without fuelling prices and wasting taxpayer funds on picking the wrong winners?

Politicians generally can’t resist big spending pre-election budgets, no matter the political persuasion or economic situation. Former Coalition treasurer Josh Frydenberg proved as much in the two budgets before the last election.

Of 20 leading economists surveyed by AFR Weekend, nine called for a contractionary or slightly contractionary budget that takes money out of the economy; eight called for a neutral budget; and two fell somewhere in between. Just one said there was an argument for spending on households.

Bank of Queensland chief economist and market strategist Peter Munckton – who supports a neutral budget – says there is a limit to how many spending initiatives (or expansion of initial ones) can be achieved.

“This is particularly the case given the large infrastructure programs being run in most states and the potential [and need] for a rebound in residential construction,” he says.

Andrew Ticehurst, senior economist and rate strategist at Nomura, says with the Australian dollar low, monetary policy tight, unemployment low, and inflation sticky, fiscal policy should be no more than “neutral”.

That means, when people review the federal budget’s reconciliation table on the evening of May 14, the line item labelled “total policy decisions’ impact on underlying cash balance” should be zero or positive. With what’s been flagged to date, that seems an unlikely outcome.

“Current fiscal policy settings are already modestly expansionary, and are not helping the RBA tame inflation, although it appears unwilling to say so,” Ticehurst says.

Cost-of-living help not impossible

Stephen Walters, chief economist at the Business Council of Australia, says a “slightly contractionary” budget is called for.

“In the short term, government should exercise spending restraint to avoid fuelling demand in a fully employed economy, while providing targeted and temporary cost-of-living relief where necessary,” he says.

For his part, Chalmers says the centrepiece of the government’s cost-of-living package will be the already announced stage three tax cuts, and other help will be focused on supporting the push to lower inflation. For example, last year’s energy bill rebates mechanically lowered headline inflation.

Electricity prices have rose 3.9 per cent since the June 2023 quarter, according to the Australian Bureau of Statistics. Excluding the rebates, prices would have increased by 17 per cent.

On the government’s plan to pour billions of dollars into the net zero transition and boost green manufacturing, Chalmers says it would be wrong to assume the money will be front-loaded in the next few years.

On Monday, he said decisions about cost-of-living support would be “taken in the next week or two”.

If nothing else, Wednesday’s inflation data will make for some difficult conversations around the cabinet table.