National Australia Bank optimistic on economy outlook, posts drop in earnings

(Reuters) -National Australia Bank said on Wednesday it remains optimistic on the outlook for the Australian economy, even as it posted a 3% drop in first-quarter cash profit compared with the quarterly average of the second half of fiscal 2023.

The country’s second-biggest lender by market valuation reported a hit to cash earnings due to higher cost pressures, deposit costs and competitive lending, which in turn impacted margins.

NAB posted cash earnings of A$1.80 billion ($1.18 billion) for the quarter ended Dec. 31. It had earned A$2.15 billion in the prior corresponding period.

First-quarter revenue excluding the bank’s markets and treasury income was broadly flat against the quarterly average in the second half of the previous fiscal year.

This led to a marginal decrease in its net interest margin – a key measure of profitability for banks.

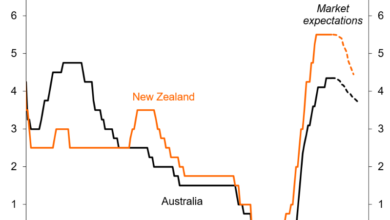

Persistently elevated interest rates boosted the profits of major Australian lenders over the last year. However, runaway inflation and high interest rates have started to dent borrowing capacity and pressure credit growth.

The bank’s common equity tier 1 ratio, a closely watched measure of its spare cash, stood at 12.0% as of December-end, compared with 12.22% at the end of September.

($1 = 1.5265 Australian dollars)

(Reporting by Archishma Iyer and Echha Jain in BengaluruEditing by Pooja Desai and Matthew Lewis)