RBA Hike ‘Will Hurt Christmas Trade’ – Forbes Advisor Australia

The RBA has today hiked the cash rate target by 25 basis points, taking it from 2.35% to 2.6%. It is now the sixth month in a row that the central bank has increased the cash rate in an effort to curb surging inflation.

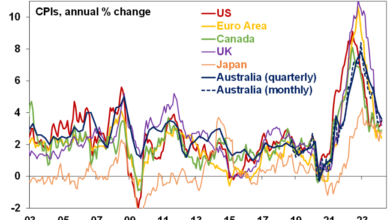

In a statement published at the conclusion of the central bank’s meeting, RBA governor Philip Lowe said that the nation’s inflation–as is the case in most countries–is “too high”.

“Global factors explain much of this high inflation, but strong domestic demand relative to the ability of the economy to meet that demand is also playing a role,” Lowe says.

Yet, Lowe remains adamant that the board’s priority is to return inflation to a 2-3% range, while “keeping the economy on an even keel”.

“The path to achieving this balance is a narrow one and it is clouded in uncertainty,” Lowe says, acknowledging that one source of uncertainty is the deteriorating outlook for the global economy

“Another Forbes is how household spending in Australia responds to the tighter financial conditions. Higher inflation and higher interest rates are putting pressure on household budgets, with the full effects of higher interest rates yet to be felt in mortgage payments.”

In terms of mortgage payments, this latest hike means people with an average $500,000, 25-year mortgage will pay an extra $76.45 a month. It will equate to more than $150 a month for those with a $1 million mortgage.

Since the RBA started lifting rates in May, that same mortgage borrower would have seen their monthly repayments jump by more than $500.

To date, the aggressive monetary tightening from the RBA has seen the highest number of Australian mortgage holders classified as ‘At Risk’ since May 2019—that being 942,000 Australians, Roy Morgan research has found.

And if the rate is hiked again in November–which it is predicted to be–that number would rise by 158,000 to 1.1 million (24.3%) – the highest since July 2013.

Looking back, the last time rates rose this quickly was in 1994 following the recession of the early ’90s.

At the time, the government and RBA officials had announced what was then considered a bold inflation target of between 2-3%. So when inflation threatened to rise again following the recession, the RBA did exactly as it is doing now: raised the cash rate over many months until it reached 7.5%.

It wasn’t until August 1996 before the cash rate began to decline down, with many Australians now concerned that our current climate is a matter of history repeating itself.

After all, when addressing a parliamentary standing committee last month, Lowe made it clear that further hikes to the cash rate would be required: albeit also noting that it would be necessary to slow both the speed and size of rate hikes.

While the RBA is not on a “pre-set path”, as Lowe explained, it was committed to doing whatever was necessary to bring Australia’s inflation rate back down to its goal of between 2-3%.

But this commitment to lowering the inflation rate has many Australians and economists concerned, voicing fears that these consecutive cash rate increases will see the economy thrown into a recession we “don’t need to have”.

Nevertheless, Lowe has not shied away from signalling further cash rate hikes are to come, stating that the RBA is closely monitoring the global economy, household spending and wage and price-setting behaviour.

It also anticipates a further increase in inflation over the months ahead, before it declines back to the central goal. In the statement, the bank’s central forecast for CPI inflation was reported to be around 7.75% over 2022, a little above 4% over 2023 and around 3% in 2024.