Ret-tape warning despite booming deals

Japan fell to third place in 2022 as the largest foreign investor in the country, behind the United States and the United Kingdom, according to the Japan-Australia Investment Report 2023.

It said Japanese companies were concerned about the interaction of federal and state laws in the project approval process, government policies, legal actions by environmental activists and courts introducing social policies.

Energy concerns

Industry sources in Tokyo backed this up, telling the Financial Review that this had been a problem with states, in some cases, slow to follow up on potential investment in hydrogen and other industries where there was support at a federal level.

A liquefied hydrogen carrier berthed in northern Japan. The country relies on imports for most of its energy needs. AP

Energy policy uncertainty surrounding LNG projects, prices caps, supply and a “safeguard mechanism” to help reduce emissions has also drawn complaints from Japanese investors and the government.

Experts said Australia must be careful not to miss out on opportunities, as Japan’s economy shifts, and years of efforts to improve corporate governance for listed companies and free up capital take effect. New rules forcing listed Japanese companies trading below their liquidation value to improve their financial health are spurring many to look overseas to invest large capital reserves.

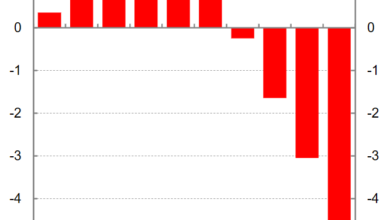

The report noted Australia has become a net capital exporter in recent years after consistently being a net importer of capital because domestic savings were insufficient to fund growth.

Growing deals

Despite this, interest in Australia from corporate Japan, at a time when the Asian country’s economy is emerging from decades of deflation and negative interest rates, is on the rise.

Desperate for new energy sources, including traditional fossil fuels and green energy sources, companies continued to invest in Australian projects. Some of the biggest deals were also in the consumer sector as companies in Japan look for new high-growth markets to offset an ageing population in their home markets.

In 2023, there were 53 merger and acquisition deals. While many of the big deals were energy-related, many focused on the Australian consumer market and technology and biotech companies, which showed Japan’s interest in Australia goes well beyond energy security.

Kirin’s $1.9 billion takeover of vitamins group Blackmores was a major one, along with Seven & i Holdings’ $1.71 billion acquisition of convenience store group 7-Eleven Australia, and Kao’s $450 million deal to buy skincare producer Bondi Sands.

Two-way trade between Australia and Japan last year was $143.3 billion, a 24 per cent increase compared to 2022.

However, exports to Japan fell in value in 2023 from a record the previous year as the price of coal and LNG fell.

The report confirmed the dominant role Australia plays in supplying Japan’s energy needs. Last year, 41 per cent of Japan’s LNG imports came from Australia, 64 per cent of its thermal coal and 33 per cent of its uranium.

Australia’s competitors are Saudi Arabia, the United Arab Emirates and Russia, which still accounts for about 9 per cent of Japan’s coal, oil and LNG needs despite sanctions imposed by other Western nations over the war in Ukraine.

Coal and LNG make up 74 per cent of Australia’s exports to Japan.

The report also found Japanese banks are now major financiers of Australian economic, and social infrastructure.

The report comes as Japan ramps up efforts to secure new sources of energy from friendly countries like Australia as the Kishida government becomes increasingly worried about the impact of war in the Middle East and Ukraine on energy supplies.