10 Best Metals Trading Brokers (☑️Updated 2024*)

The 10 Best Metals Trading Brokers revealed. Commodities trading is becoming a popular alternative to stock and forex trading in modern markets.

While most forex brokers offer several precious metals, finding a suitable metals trading broker can be tedious and daunting.

In this in-depth guide, you’ll learn:

✅What is The Appeal of Trading Metals?

✅Who are the 10 Best Metals Trading Brokers?

✅What are the Best Trading Strategies for Trading Metals in Modern Markets?

✅Our Conclusion on The 10 Best Metals Trading Brokers

✅Popular FAQs about The 10 Best Metals Trading Brokers

and much, MUCH more!

10 Best Metals Trading Brokers – a Comparison

10 Best Metals Trading Brokers (2024)

- ☑️easyMarkets – Overall, The Best Metals Trading Broker

- ☑️Pepperstone – Best MetaTrader 4 Broker

- ☑️Exness – Best Educational Broker

- ☑️FXTM – Exceptional Customer Service

- ☑️AvaTrade – Low Forex Fee CFD Broker

- ☑️Tickmill – Leading Multi-Asset Broker

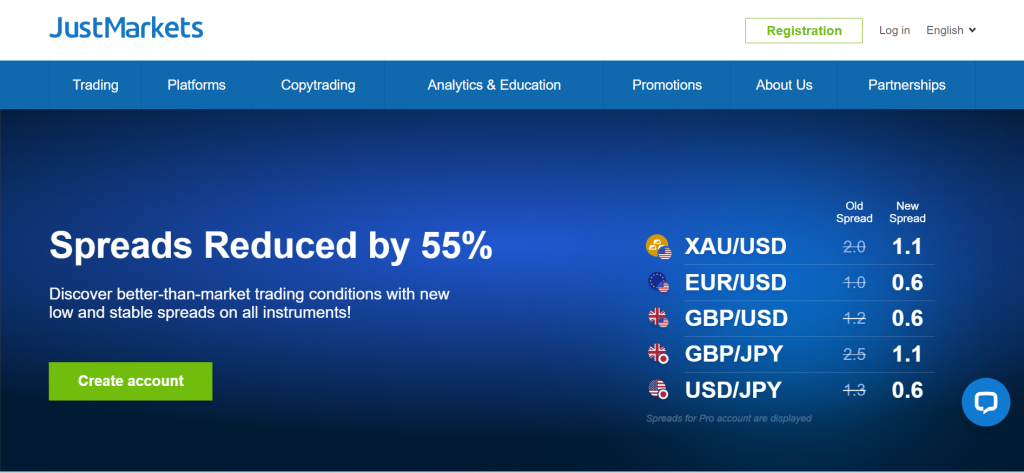

- ☑️JustMarkets – Best Broker in Africa

- ☑️HFM – Best Trading Accounts

- ☑️XM – Best CFD Provider

- ☑️FP Markets – Excellent Forex Partners Program

What is The Appeal of Trading Metals?

Metal trading has become a more popular investment option because of its inherent value, historical significance, and economic prominence.

Furthermore, when there is financial unrest, precious metals like gold and silver are often viewed as secure investments offering significant protection against inflation and currency devaluation.

In addition, these precious metals have several industrial uses that create price fluctuations and volatility, which can be attractive earning opportunities for traders.

However, despite its allure, success in metals trading involves considering the dynamics of supply and demand, geopolitical disturbances, and broader economic patterns.

Skilled traders typically navigate this intricate landscape by combining technical analysis with an acute awareness of market sentiment.

Therefore, by adopting such a balanced strategy, traders can easily detect shifts in momentum or trends, allowing them to make calculated moves that leverage these developments for greater profits.

easyMarkets

Overview

easyMarkets is a leading trading name known for innovation and exceptional customer service.

Furthermore, easyMarkets offers a user-friendly platform for traders to stay connected to markets anywhere in the world at any given time.

easyMarkets offers a wide range of metal trading options, including precious metals like gold, silver, platinum, and palladium, industrial metals like copper, energy items like oil, and agricultural goods like wheat, corn, and soybeans.

In addition, traders can participate in metal options trading, which allows them to make metal price predictions within a specific timeframe.

easyMarkets Metals Trading Features

Pros and Cons easyMarkets

Pepperstone

Overview

Pepperstone offers diverse trading options for precious metals like Gold, Silver, Platinum, and Palladium, offering them against major currencies like the US Dollar.

Furthermore, Pepperstone’s approach is based on understanding precious metals’ historical and economic significance.

Gold is often seen as a way to protect against inflation and currency devaluation. At the same time, Silver is valued for its perceived safety during economic disturbances and uncertainty, and the metal’s practical uses in industry.

Furthermore, Platinum and Palladium offer unique opportunities because of their rarity and industrial applications.

Overall, Pepperstone offers dedicated customer support across channels, access to various trading platforms, competitive spreads, and the ability to trade metals across different currencies, providing beginners and professionals with a more tailor-made trading experience.

Pepperstone Metals Trading Features

Pros and Cons Pepperstone

Exness

Overview

Exness offers traders a wide range of trading opportunities, particularly in commodities like metals and energy.

Furthermore, Exness offers some of the most innovative and robust trading technologies, such as the Exness Terminal, which integrates with TradingView and offers over 50 drawing tools and 100 indicators. In addition, Exness offers a proprietary app and supports MT4 and MT5.

The broker provides quick order execution (often within a few milliseconds), a low entry barrier into metals trading, and secure transactions.

They offer various account types for metals trading, attractive spreads and flexible leverage ratios according to the account type and account balance.

Exness Metals Trading Features

Pros and Cons Exness

FXTM

Overview

FXTM offers a user-friendly platform for traders to trade precious metals like gold and silver against major currencies like the US dollar, euro, and British pound.

Furthermore, FXTM offers competitive trading fees, with spreads as low as 0.0 pips, depending on market conditions.

FXTM ensures quick execution of transactions on precious metals, providing the best market pricing and fewer chances of slippage occurring. The broker is a trusted broker licensed by reputable institutions like the FSC and FCA, ensuring the security of traders’ money.

In addition, FXTM offers two flexible account types, including Advantage and Advantage Plus, to meet specific trading needs in competitive metals trading markets.

FXTM Metals Trading Features

Pros and Cons FXTM

AvaTrade

Overview

AvaTrade offers traders various precious metal trading options, including gold, silver, platinum, palladium, and copper.

With AvaTrade, traders can trade metal CFD, allowing them to speculate on price swings without physically owning the metals themselves.

Furthermore, AvaTrade offers short selling and high leverage, which can benefit traders who want to increase profits and reduce the chance of loss.

AvaTrade offers several powerful trading platforms for trading metals, including robust mobile apps that let traders participate in markets from anywhere in the world.

In addition, AvaTrade provides dedicated client service 24 hours a day, 5 days a week, in multiple languages, and uses SSL-secured online platforms for security.

AvaTrade Metals Trading Features

Pros and Cons AvaTrade

Tickmill

Overview

Tickmill specialises in trading precious metals like gold and silver, offering competitive conditions across its three retail account types: Classic, Pro, and VIP.

Tickmill offers leverage of up to 1:500 for gold and 1:25 for silver, letting traders boost their profit-earning potential in volatile, liquid metals markets.

Furthermore, Tickmill’s Pro and VIP accounts are commission-based, with a $4 commission per lot and narrow spreads from 0.0 pips on major instruments like EUR/USD. While the Classic account is commission-free, the spreads on this account tend to be wider.

In addition, Tickmill supports popular MetaTrader 4 and 5 platforms for metals trading, providing a reliable trading environment with comprehensive charting tools, analytical capabilities, and the ability to use Expert Advisors for automated trading methods.

Tickmill Metals Trading Features

Pros and Cons Tickmill

JustMarkets

Overview

JustMarkets is a well-known Seychelles-based forex and CFD broker that offers metal traders a unique advantage in competitive markets. This broker offers several account types, from Standard Cent to Raw Spread, ensuring that all traders receive tailor-made solutions.

Furthermore, JustMarkets spreads are competitive, and traders can use leverage of up to 1:100 on commodities like metals, allowing them to boost their earning potential. JustMarkets’ spreads on metals are variable and depend on the account type used.

While the Raw Spread Account charges spread from 1.8 pips on XAG/USD and 0.6 pips on XAU/USD, the Standard Cent (commission-free) charges 3.6 and 1.9 pips, respectively, on these instruments.

JustMarkets Metals Trading Features

Pros and Cons JustMarkets

HFM

Overview

HFM provides a robust platform for trading precious metals, catering to various trading strategies and skill levels. This broker offers metal CFDs that can be traded using varying leverage ratios, allowing for increased position sizes and potential profits.

They offer competitive trading conditions for gold, silver, platinum, and palladium, with competitive floating spreads and low commissions on zero-spread accounts.

HFM’s retail trading accounts include Cent, Zero, Pro, Premium, and Pro Plus, tailored to individual traders from beginners to professionals.

Furthermore, with HFM’s HFCopy option, beginner traders can easily learn from expert traders. The same solution allows traders to become strategy providers where they can start earning performance fees when traders copy their strategies on metals trading.

HFM Metals Trading Features

Pros and Con HFM

XM

Overview

XM offers trading opportunities for precious metals like gold, silver, palladium, and platinum on their MT4 and MT5 platforms.

This broker is well-known in the metals trading environment for its competitive spreads, starting at 1.8 pips for gold and 2 pips for silver, and offers flexible trading conditions for both long and short positions.

With access to several powerful trading platforms across devices, traders can improve their skills and expertise using several features, tools, guides, and resources.

XM focuses on providing a smooth trading experience with features like no requotes and the ability to trade long or short, regardless of the account type.

Additionally, metal traders can access research resources like daily updates, market insights, and an economic calendar. To ensure that they can keep updated on market movements that could affect their metals trading.

XM Metals Trading Features

Pros and Cons XM

FP Markets

Overview

FP Markets allows traders to trade precious metals such as gold and silver against major currencies, including the US and Australian dollar.

With leverage of up to 1:30 on metals, traders can engage in the market via the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms and the award-winning proprietary IRESS platform.

In addition, FP Markets is known for providing traders with narrow spreads across metals instruments and access to the most recent gold and silver news and charts.

Furthermore, FP Markets emphasizes the educational materials and trading tools offered to help traders improve their trading skills while managing risks in the metals markets.

FP Markets Metals Trading Features

Pros and Cons FP Markets

What are the Best Trading Strategies for Trading Metals in Modern Markets?

When traders participate in metals trading, regardless of the type of metal, unique strategies can benefit traders. Below, we will cover some of the most popular strategies often used in metals trading.

Following Trends

When you follow trends, you follow the flow of the market for a certain time. This strategy works well for metals since their prices rise and fall in cycles.

You can use tools like the 50-day or 200-day moving averages to determine where the market is headed to achieve this.

For example, when the economy is fragile, individuals frequently invest in gold or silver, which might cause prices to rise.

Relying on Price Swings

Some methods are based on the assumption that prices will return to their normal levels after going too high or too low.

This can be useful in the metal market, where prices fluctuate dramatically due to political factors or unexpected supply shifts.

Traders can use indicators such as the Relative Strength Index (RSI) to determine when a metal’s price has moved too much one way or the other.

Capitalizing on Large Price Moves

Breakout methods are beneficial when prices unexpectedly break out of their normal range, implying that they may continue in that direction.

This can occur when there is an unexpected change in supply, a new rule, or a significant shift in demand.

Traders who use this strategy typically look for patterns such as consolidations or triangles and purchase if prices break above one level or sell if they fall below another.

For example, if platinum prices climb over a critical resistance level, it could indicate that it is time to purchase, with expectations of more gains.

Protecting Yourself with Futures and Options

Traders often use hedging to minimize losses during volatile market conditions. You can use futures or options contracts to do this in metal trading.

For example, if you hold silver positions, you can buy put options or sell futures contracts to ensure you do not lose significant profits as silver prices unexpectedly plummet.

Furthermore, hedging is a strategy to keep your profits safeguarded, especially because metal prices are known to fluctuate significantly.

Taking Advantage of Interest Rates

The carry trade method is commonly utilized in forex and can apply to metals such as gold and silver. Carry trading aims to capitalize on currency interest rate variations in the futures market.

Therefore, you can purchase metals futures at high interest rates and sell them in currencies with low-interest rates, making small profits daily. However, this complex trading method requires a thorough understanding of global economic trends and interest rate movements.

In Conclusion

In our experience, traders must identify a suitable trading platform. The brokers that we discussed are known for offering advanced trading platforms, competitive spreads, and a range of metal instruments that can be traded.

However, these brokers are not a one-size-fits-all for all traders. Therefore, traders must evaluate each broker carefully regarding their regulations, account options, spreads, educational materials, and other factors.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all South African investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Frequently Asked Questions

Can I trade metals on micro and mini accounts?

Yes, several brokers provide micro or mini accounts with low minimum deposit requirements.

Do metal trading firms provide educational resources?

Yes, respectable brokers frequently offer educational resources and tools like webinars, articles, and market research.

Is it more advantageous to trade gold than other metals?

Not always. Your trading approach and market circumstances will determine whether your chosen metal instrument is profitable.

What are the inherent risks associated with trading metals?

Metals trading entails high risk because of market volatility and the possibility of unexpected price swings. Furthermore, while leverage can help traders boost their profit potential, it could lead to the loss of invested funds if the market turns against traders.

Can I trade metals from my phone?

Yes, most metals trading brokers provide mobile trading apps for iOS and Android smartphones.

Which trading platforms are most popular for metals trading?

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular because of their robust charting and automated trading features.