Allspring Global Investments Holdings LLC Has $7.41 Million Stock Holdings in Interactive Brokers Group, Inc. (NASDAQ:IBKR)

Allspring Global Investments Holdings LLC decreased its holdings in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 80.1% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 89,369 shares of the financial services provider’s stock after selling 360,147 shares during the quarter. Allspring Global Investments Holdings LLC’s holdings in Interactive Brokers Group were worth $7,409,000 as of its most recent SEC filing.

Allspring Global Investments Holdings LLC decreased its holdings in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 80.1% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 89,369 shares of the financial services provider’s stock after selling 360,147 shares during the quarter. Allspring Global Investments Holdings LLC’s holdings in Interactive Brokers Group were worth $7,409,000 as of its most recent SEC filing.

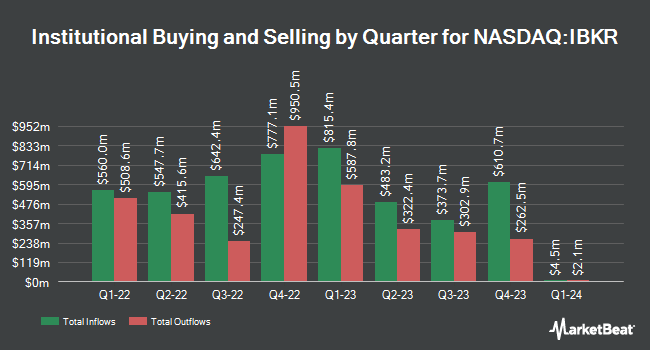

Other hedge funds and other institutional investors have also modified their holdings of the company. International Assets Investment Management LLC acquired a new position in Interactive Brokers Group during the fourth quarter worth $7,841,000. Meeder Asset Management Inc. acquired a new position in shares of Interactive Brokers Group during the 4th quarter valued at about $210,000. CENTRAL TRUST Co increased its holdings in shares of Interactive Brokers Group by 6.1% during the 4th quarter. CENTRAL TRUST Co now owns 4,344 shares of the financial services provider’s stock valued at $360,000 after acquiring an additional 249 shares during the last quarter. Allworth Financial LP raised its stake in shares of Interactive Brokers Group by 54.9% in the 4th quarter. Allworth Financial LP now owns 1,410 shares of the financial services provider’s stock valued at $117,000 after acquiring an additional 500 shares in the last quarter. Finally, Asset Management One Co. Ltd. lifted its holdings in Interactive Brokers Group by 22.2% in the 4th quarter. Asset Management One Co. Ltd. now owns 744 shares of the financial services provider’s stock worth $62,000 after purchasing an additional 135 shares during the last quarter. Institutional investors own 23.80% of the company’s stock.

Analyst Ratings Changes

Several equities analysts have commented on IBKR shares. The Goldman Sachs Group upgraded Interactive Brokers Group from a “neutral” rating to a “buy” rating and increased their price target for the company from $88.00 to $102.00 in a report on Tuesday, January 9th. Bank of America lifted their target price on shares of Interactive Brokers Group from $147.00 to $152.00 and gave the stock a “buy” rating in a report on Wednesday. Barclays upped their price target on shares of Interactive Brokers Group from $132.00 to $136.00 and gave the company an “overweight” rating in a report on Wednesday. Citigroup lifted their price objective on Interactive Brokers Group from $105.00 to $135.00 and gave the stock a “buy” rating in a research note on Thursday, April 11th. Finally, UBS Group cut their price objective on Interactive Brokers Group from $108.00 to $104.00 and set a “buy” rating for the company in a research report on Tuesday, January 9th. One analyst has rated the stock with a hold rating and seven have assigned a buy rating to the company. According to MarketBeat.com, Interactive Brokers Group has an average rating of “Moderate Buy” and an average price target of $120.00.

Read Our Latest Research Report on Interactive Brokers Group

Interactive Brokers Group Price Performance

NASDAQ IBKR opened at $109.23 on Thursday. The company’s fifty day moving average is $108.19 and its two-hundred day moving average is $92.55. The firm has a market capitalization of $45.99 billion, a price-to-earnings ratio of 19.30, a P/E/G ratio of 1.24 and a beta of 0.83. Interactive Brokers Group, Inc. has a 52-week low of $70.83 and a 52-week high of $116.92.

Interactive Brokers Group (NASDAQ:IBKR – Get Free Report) last released its earnings results on Tuesday, January 16th. The financial services provider reported $1.52 earnings per share for the quarter, missing analysts’ consensus estimates of $1.53 by ($0.01). The firm had revenue of $1.14 billion for the quarter, compared to analyst estimates of $1.14 billion. Interactive Brokers Group had a return on equity of 4.66% and a net margin of 7.72%. The firm’s quarterly revenue was up 16.7% compared to the same quarter last year. During the same period last year, the business earned $1.30 earnings per share. As a group, sell-side analysts expect that Interactive Brokers Group, Inc. will post 6.36 earnings per share for the current fiscal year.

Insiders Place Their Bets

In other news, Vice Chairman Earl H. Nemser sold 5,000 shares of the business’s stock in a transaction that occurred on Wednesday, February 21st. The stock was sold at an average price of $104.86, for a total transaction of $524,300.00. Following the sale, the insider now directly owns 113,770 shares in the company, valued at $11,929,922.20. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. In other news, Vice Chairman Earl H. Nemser sold 10,000 shares of the firm’s stock in a transaction dated Thursday, February 15th. The shares were sold at an average price of $103.53, for a total transaction of $1,035,300.00. Following the completion of the transaction, the insider now directly owns 123,770 shares of the company’s stock, valued at approximately $12,813,908.10. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Vice Chairman Earl H. Nemser sold 5,000 shares of Interactive Brokers Group stock in a transaction dated Wednesday, February 21st. The shares were sold at an average price of $104.86, for a total transaction of $524,300.00. Following the sale, the insider now owns 113,770 shares in the company, valued at $11,929,922.20. The disclosure for this sale can be found here. In the last quarter, insiders sold 428,883 shares of company stock worth $40,395,135. 3.21% of the stock is currently owned by company insiders.

Interactive Brokers Group Company Profile

Interactive Brokers Group, Inc operates as an automated electronic broker worldwide. The company engages in the execution, clearance, and settlement of trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, exchange traded funds (ETFs), precious metals, and cryptocurrencies.

Read More

Want to see what other hedge funds are holding IBKR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report).

Receive News & Ratings for Interactive Brokers Group Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Interactive Brokers Group and related companies with MarketBeat.com’s FREE daily email newsletter.