Brokers Issue Forecasts for Baytex Energy Corp.’s Q3 2024 Earnings (TSE:BTE)

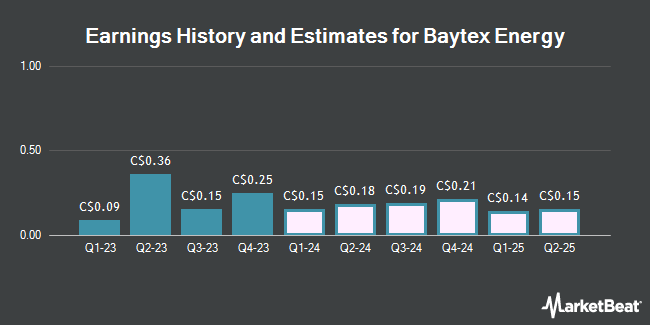

Baytex Energy Corp. (TSE:BTE – Free Report) (NYSE:BTE) – Analysts at Atb Cap Markets upped their Q3 2024 earnings estimates for Baytex Energy in a report issued on Monday, April 1st. Atb Cap Markets analyst A. Arif now forecasts that the company will post earnings per share of $0.20 for the quarter, up from their prior estimate of $0.19. The consensus estimate for Baytex Energy’s current full-year earnings is $0.64 per share. Atb Cap Markets also issued estimates for Baytex Energy’s FY2025 earnings at $0.61 EPS and FY2027 earnings at $0.15 EPS.

Baytex Energy (TSE:BTE – Get Free Report) (NYSE:BTE) last released its earnings results on Wednesday, February 28th. The company reported C$0.25 earnings per share for the quarter, beating analysts’ consensus estimates of C$0.13 by C$0.12. Baytex Energy had a negative net margin of 8.60% and a negative return on equity of 6.81%. The firm had revenue of C$1.07 billion during the quarter.

Several other brokerages have also issued reports on BTE. National Bankshares lowered their target price on Baytex Energy from C$8.25 to C$7.25 and set an “outperform” rating on the stock in a research note on Wednesday, January 10th. Royal Bank of Canada dropped their price objective on shares of Baytex Energy from C$8.00 to C$7.00 and set an “outperform” rating on the stock in a report on Thursday, February 29th. Raymond James reduced their target price on shares of Baytex Energy from C$6.75 to C$5.00 and set a “market perform” rating for the company in a research note on Friday, January 19th. Stifel Nicolaus upped their price target on shares of Baytex Energy from C$6.00 to C$6.25 and gave the company a “buy” rating in a research note on Thursday, February 29th. Finally, Canaccord Genuity Group cut their price objective on shares of Baytex Energy from C$8.00 to C$7.75 and set a “buy” rating for the company in a report on Thursday, December 7th. Three research analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of “Moderate Buy” and an average price target of C$6.65.

Check Out Our Latest Analysis on BTE

Baytex Energy Price Performance

Baytex Energy stock opened at C$5.46 on Thursday. The business’s 50 day simple moving average is C$4.51 and its 200 day simple moving average is C$4.90. Baytex Energy has a 12 month low of C$3.83 and a 12 month high of C$6.37. The company has a market cap of C$4.49 billion, a price-to-earnings ratio of -16.55, a PEG ratio of 0.12 and a beta of 2.80. The company has a current ratio of 0.79, a quick ratio of 0.77 and a debt-to-equity ratio of 63.80.

Baytex Energy Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, April 1st. Investors of record on Friday, March 15th were paid a dividend of $0.023 per share. The ex-dividend date of this dividend was Thursday, March 14th. This represents a $0.09 annualized dividend and a yield of 1.68%. Baytex Energy’s dividend payout ratio is currently -27.27%.

Insider Buying and Selling

In other news, Director Tiffany Thom Cepak sold 40,000 shares of the company’s stock in a transaction on Monday, March 25th. The shares were sold at an average price of C$3.55, for a total value of C$142,000.00. In other news, Director Tiffany Thom Cepak sold 40,000 shares of the business’s stock in a transaction dated Monday, March 25th. The stock was sold at an average price of C$3.55, for a total transaction of C$142,000.00. Also, Senior Officer Eric Thomas Greager acquired 20,000 shares of the firm’s stock in a transaction that occurred on Wednesday, March 6th. The stock was bought at an average price of C$4.25 per share, for a total transaction of C$85,000.00. 0.84% of the stock is currently owned by insiders.

Baytex Energy Company Profile

Baytex Energy Corp., an energy company, engages in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford, the United States. The company offers light oil and condensate, heavy oil, natural gas liquids, and natural gas.

Recommended Stories

Receive News & Ratings for Baytex Energy Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Baytex Energy and related companies with MarketBeat.com’s FREE daily email newsletter.