Brokers Issue Forecasts for Calian Group Ltd.’s FY2027 Earnings (TSE:CGY)

Calian Group Ltd. (TSE:CGY – Free Report) – Echelon Wealth Partners issued their FY2027 earnings per share (EPS) estimates for Calian Group in a research note issued to investors on Thursday, March 21st. Echelon Wealth Partners analyst R. Goff expects that the company will earn $8.37 per share for the year. Echelon Wealth Partners has a “Buy” rating on the stock. The consensus estimate for Calian Group’s current full-year earnings is $4.39 per share.

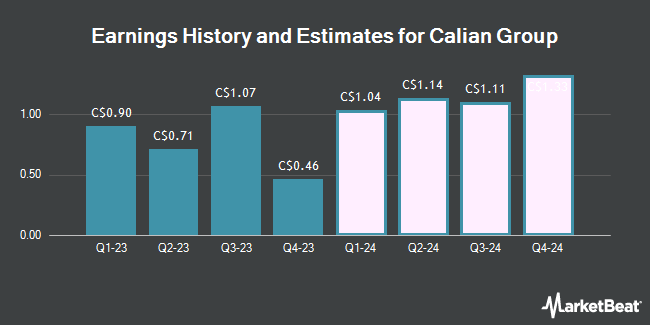

Calian Group (TSE:CGY – Get Free Report) last posted its earnings results on Wednesday, February 14th. The company reported C$0.46 earnings per share for the quarter, missing analysts’ consensus estimates of C$1.07 by C($0.61). Calian Group had a net margin of 2.87% and a return on equity of 6.20%. The firm had revenue of C$179.18 million during the quarter, compared to the consensus estimate of C$167.90 million.

A number of other research analysts also recently weighed in on the company. Cormark increased their target price on Calian Group from C$66.00 to C$73.00 in a report on Tuesday, February 20th. Royal Bank of Canada raised their price objective on Calian Group from C$65.00 to C$72.00 and gave the stock an “outperform” rating in a research note on Friday, February 16th. Desjardins raised their price objective on Calian Group from C$86.00 to C$87.00 and gave the stock a “buy” rating in a research note on Wednesday, March 6th. Finally, CIBC raised their price objective on Calian Group from C$67.00 to C$75.00 and gave the stock an “outperform” rating in a research note on Friday, February 16th. Five research analysts have rated the stock with a buy rating, According to MarketBeat.com, Calian Group has a consensus rating of “Buy” and a consensus target price of C$76.17.

Read Our Latest Stock Report on CGY

Calian Group Stock Up 0.2 %

CGY stock opened at C$57.00 on Monday. Calian Group has a fifty-two week low of C$46.27 and a fifty-two week high of C$66.13. The business’s 50-day moving average is C$57.73 and its two-hundred day moving average is C$54.53. The company has a debt-to-equity ratio of 40.20, a quick ratio of 1.20 and a current ratio of 1.01. The company has a market cap of C$674.31 million, a price-to-earnings ratio of 33.93, a P/E/G ratio of 2.50 and a beta of 0.95.

Calian Group Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Wednesday, March 13th. Investors of record on Wednesday, February 28th were given a dividend of $0.28 per share. This represents a $1.12 annualized dividend and a dividend yield of 1.96%. The ex-dividend date was Tuesday, February 27th. Calian Group’s dividend payout ratio is currently 66.67%.

About Calian Group

Calian Group Ltd. provides business services and solutions in Canada and internationally. It operates through four segment: Advanced Technologies, Health, Learning, and IT and Cyber Solutions (ITCS). The company offers systems engineering, software development, integration design, embedded design, operational management and lifecycle support, modelling and simulation-enabled design, and research & development solutions and services; environmental and radiation protection, decommissioning and waste management, regulatory affairs and licensing, and emergency preparedness and training services; and sophisticated communication systems for the satellite industry, such as antennas, RF systems, decimator RF spectrum analyzers, in-orbit test systems, software defined solutions, operations and teleport services, transmitters, receivers, and modems.

See Also

Receive News & Ratings for Calian Group Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Calian Group and related companies with MarketBeat.com’s FREE daily email newsletter.