Brokers Issue Forecasts for Celestica Inc.’s Q1 2024 Earnings (NYSE:CLS)

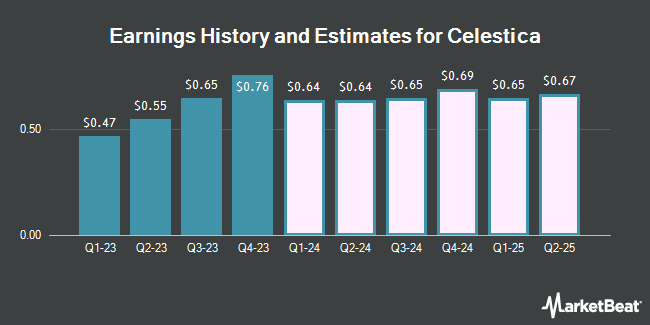

Celestica Inc. (NYSE:CLS – Free Report) (TSE:CLS) – Investment analysts at Cormark issued their Q1 2024 earnings per share estimates for shares of Celestica in a research note issued on Monday, March 11th. Cormark analyst J. Pytlak anticipates that the technology company will post earnings per share of $0.64 for the quarter. The consensus estimate for Celestica’s current full-year earnings is $2.57 per share. Cormark also issued estimates for Celestica’s Q2 2024 earnings at $0.64 EPS, Q3 2024 earnings at $0.65 EPS, Q4 2024 earnings at $0.69 EPS, FY2024 earnings at $2.61 EPS, Q1 2025 earnings at $0.65 EPS, Q2 2025 earnings at $0.67 EPS, Q3 2025 earnings at $0.74 EPS, Q4 2025 earnings at $0.77 EPS and FY2025 earnings at $2.83 EPS.

A number of other equities research analysts also recently issued reports on CLS. StockNews.com downgraded Celestica from a “buy” rating to a “hold” rating in a research report on Wednesday, February 28th. TD Securities increased their price objective on Celestica from $33.00 to $40.00 and gave the company a “buy” rating in a report on Wednesday, January 31st. Stifel Nicolaus raised their target price on Celestica from $26.00 to $30.00 and gave the stock a “hold” rating in a research note on Thursday, November 30th. CIBC raised their target price on Celestica from $33.00 to $41.00 and gave the stock an “outperform” rating in a research note on Wednesday, January 31st. Finally, BMO Capital Markets lifted their price objective on Celestica from $32.00 to $37.00 and gave the company an “outperform” rating in a research note on Wednesday, January 31st. Two equities research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. Based on data from MarketBeat.com, Celestica currently has a consensus rating of “Moderate Buy” and a consensus price target of $33.88.

Check Out Our Latest Analysis on Celestica

Celestica Price Performance

NYSE:CLS opened at $44.45 on Thursday. The company has a quick ratio of 0.75, a current ratio of 1.40 and a debt-to-equity ratio of 0.41. The business’s 50-day simple moving average is $36.93 and its two-hundred day simple moving average is $29.67. The stock has a market cap of $5.31 billion, a PE ratio of 21.90 and a beta of 2.21. Celestica has a 52 week low of $10.50 and a 52 week high of $49.35.

Celestica (NYSE:CLS – Get Free Report) (TSE:CLS) last issued its earnings results on Monday, January 29th. The technology company reported $0.76 EPS for the quarter, beating the consensus estimate of $0.68 by $0.08. The business had revenue of $2.14 billion for the quarter, compared to the consensus estimate of $2.08 billion. Celestica had a return on equity of 17.09% and a net margin of 3.07%.

Hedge Funds Weigh In On Celestica

A number of hedge funds have recently made changes to their positions in the business. Vanguard Group Inc. raised its stake in shares of Celestica by 15.2% in the 4th quarter. Vanguard Group Inc. now owns 4,266,526 shares of the technology company’s stock valued at $124,924,000 after acquiring an additional 562,157 shares during the period. Tucker Asset Management LLC purchased a new stake in Celestica during the 4th quarter worth $151,000. Price T Rowe Associates Inc. MD purchased a new stake in Celestica during the 4th quarter worth $9,822,000. Legal & General Group Plc increased its stake in Celestica by 2.9% during the 4th quarter. Legal & General Group Plc now owns 137,744 shares of the technology company’s stock worth $4,054,000 after buying an additional 3,884 shares during the period. Finally, Vident Advisory LLC increased its stake in Celestica by 10.9% during the 4th quarter. Vident Advisory LLC now owns 72,220 shares of the technology company’s stock worth $2,120,000 after buying an additional 7,111 shares during the period. Hedge funds and other institutional investors own 71.33% of the company’s stock.

Celestica Company Profile

Celestica Inc provides supply chain solutions in North America, Europe, and Asia. It operates through Advanced Technology Solutions, and Connectivity & Cloud Solutions segments. The company offers a range of product manufacturing and related supply chain services, including design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, asset management, product licensing, and after-market repair and return services.

Featured Articles

Receive News & Ratings for Celestica Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Celestica and related companies with MarketBeat.com’s FREE daily email newsletter.