Brokers Issue Forecasts for Definity Financial Co.’s Q1 2024 Earnings (TSE:DFY)

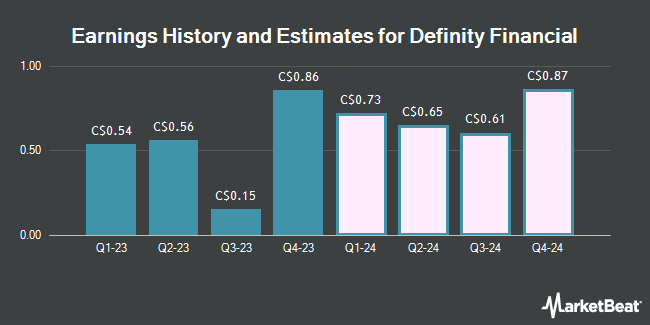

Definity Financial Co. (TSE:DFY – Free Report) – Stock analysts at Cormark issued their Q1 2024 earnings estimates for shares of Definity Financial in a research note issued to investors on Wednesday, May 1st. Cormark analyst L. Persaud expects that the company will post earnings per share of $0.74 for the quarter. The consensus estimate for Definity Financial’s current full-year earnings is $2.79 per share. Cormark also issued estimates for Definity Financial’s FY2024 earnings at $2.77 EPS and FY2025 earnings at $3.00 EPS.

Definity Financial (TSE:DFY – Get Free Report) last posted its earnings results on Thursday, February 15th. The company reported C$0.86 EPS for the quarter, beating analysts’ consensus estimates of C$0.74 by C$0.12. The business had revenue of C$1 billion for the quarter. Definity Financial had a net margin of 9.06% and a return on equity of 12.52%.

A number of other research firms have also recently weighed in on DFY. Raymond James raised their price target on shares of Definity Financial from C$42.00 to C$46.00 and gave the company a “market perform” rating in a report on Friday, February 16th. Scotiabank raised their price target on shares of Definity Financial from C$49.00 to C$51.00 and gave the company an “outperform” rating in a report on Friday, April 26th. Royal Bank of Canada raised their price target on shares of Definity Financial from C$49.00 to C$50.00 and gave the company an “outperform” rating in a report on Monday, April 29th. National Bankshares raised their price target on shares of Definity Financial from C$59.00 to C$60.00 and gave the company an “outperform” rating in a report on Tuesday. Finally, Desjardins raised their price target on shares of Definity Financial from C$44.00 to C$45.00 and gave the company a “hold” rating in a report on Tuesday, April 16th. Three research analysts have rated the stock with a hold rating and five have given a buy rating to the company’s stock. Based on data from MarketBeat.com, the company has an average rating of “Moderate Buy” and an average price target of C$47.70.

Check Out Our Latest Stock Report on Definity Financial

Definity Financial Trading Up 0.1 %

TSE DFY opened at C$46.05 on Friday. The company has a debt-to-equity ratio of 4.99, a quick ratio of 0.31 and a current ratio of 4.68. The company has a market capitalization of C$5.34 billion, a price-to-earnings ratio of 15.25, a price-to-earnings-growth ratio of 2.63 and a beta of 0.08. The company’s 50-day simple moving average is C$44.87 and its two-hundred day simple moving average is C$40.39. Definity Financial has a one year low of C$32.09 and a one year high of C$47.50.

Definity Financial Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, March 28th. Shareholders of record on Friday, March 15th were given a dividend of $0.16 per share. The ex-dividend date was Thursday, March 14th. This is a positive change from Definity Financial’s previous quarterly dividend of $0.14. This represents a $0.64 dividend on an annualized basis and a yield of 1.39%. Definity Financial’s dividend payout ratio (DPR) is currently 21.33%.

About Definity Financial

Definity Financial Corporation, together with its subsidiaries, offers property and casualty insurance products in Canada. It provides personal insurance products, including auto, property, general and umbrella liability, and pet insurance products to individuals under the Economical, Sonnet, Family, Petsecure, and Peppermint brands; and commercial insurance products, which include fleet, commercial auto, property, liability, and specialty insurance products to businesses under the Definity Insurance and Economical brand name.

Read More

Receive News & Ratings for Definity Financial Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Definity Financial and related companies with MarketBeat.com’s FREE daily email newsletter.