Brokers Issue Forecasts for Domino’s Pizza, Inc.’s Q1 2024 Earnings (NYSE:DPZ)

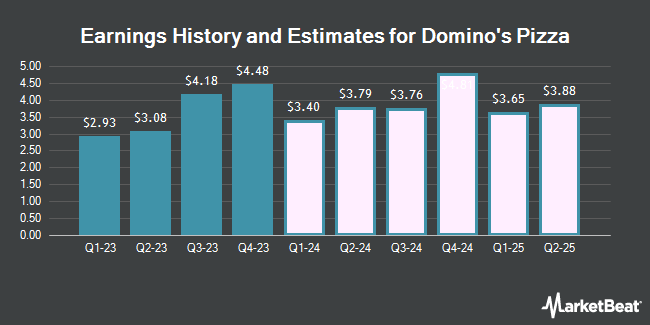

Domino’s Pizza, Inc. (NYSE:DPZ – Free Report) – Research analysts at Wedbush lowered their Q1 2024 EPS estimates for shares of Domino’s Pizza in a report released on Monday, February 26th. Wedbush analyst N. Setyan now expects that the restaurant operator will post earnings of $3.36 per share for the quarter, down from their prior forecast of $3.38. Wedbush has a “Outperform” rating and a $520.00 price objective on the stock. The consensus estimate for Domino’s Pizza’s current full-year earnings is $14.52 per share. Wedbush also issued estimates for Domino’s Pizza’s Q2 2024 earnings at $3.75 EPS, Q4 2024 earnings at $5.12 EPS, FY2024 earnings at $15.97 EPS, Q1 2025 earnings at $3.83 EPS, Q2 2025 earnings at $4.24 EPS, Q3 2025 earnings at $4.27 EPS, Q4 2025 earnings at $5.75 EPS and FY2025 earnings at $18.06 EPS.

Domino’s Pizza (NYSE:DPZ – Get Free Report) last issued its quarterly earnings results on Monday, February 26th. The restaurant operator reported $4.48 earnings per share for the quarter, topping analysts’ consensus estimates of $4.38 by $0.10. The company had revenue of $1.40 billion for the quarter, compared to the consensus estimate of $1.42 billion. Domino’s Pizza had a net margin of 11.64% and a negative return on equity of 12.50%. The firm’s quarterly revenue was up .8% on a year-over-year basis. During the same period in the previous year, the firm earned $4.43 EPS.

Several other equities research analysts also recently commented on the stock. Argus raised shares of Domino’s Pizza from a “hold” rating to a “buy” rating and set a $530.00 price objective on the stock in a report on Tuesday. Piper Sandler upped their price target on Domino’s Pizza from $400.00 to $435.00 and gave the company a “neutral” rating in a research report on Tuesday. JPMorgan Chase & Co. restated a “neutral” rating and issued a $430.00 price objective (up from $420.00) on shares of Domino’s Pizza in a research report on Tuesday. BMO Capital Markets upped their price objective on shares of Domino’s Pizza from $475.00 to $535.00 and gave the stock an “outperform” rating in a research report on Tuesday. Finally, Stephens upped their price objective on shares of Domino’s Pizza from $365.00 to $400.00 and gave the stock an “equal weight” rating in a research report on Friday, December 8th. One equities research analyst has rated the stock with a sell rating, eight have assigned a hold rating and seventeen have assigned a buy rating to the company. According to MarketBeat, Domino’s Pizza currently has an average rating of “Moderate Buy” and an average price target of $441.79.

Check Out Our Latest Analysis on DPZ

Domino’s Pizza Stock Down 2.8 %

NYSE DPZ opened at $446.27 on Tuesday. The company has a market cap of $15.57 billion, a PE ratio of 30.52, a price-to-earnings-growth ratio of 2.24 and a beta of 0.84. Domino’s Pizza has a 52 week low of $285.84 and a 52 week high of $476.18. The firm’s 50-day simple moving average is $419.83 and its two-hundred day simple moving average is $391.82.

Hedge Funds Weigh In On Domino’s Pizza

Large investors have recently bought and sold shares of the business. Capital Investment Advisors LLC lifted its holdings in shares of Domino’s Pizza by 1.1% in the 4th quarter. Capital Investment Advisors LLC now owns 2,225 shares of the restaurant operator’s stock worth $917,000 after buying an additional 25 shares during the period. Wealthsource Partners LLC grew its holdings in Domino’s Pizza by 2.0% during the fourth quarter. Wealthsource Partners LLC now owns 1,284 shares of the restaurant operator’s stock worth $529,000 after acquiring an additional 25 shares during the period. Tokio Marine Asset Management Co. Ltd. grew its holdings in Domino’s Pizza by 2.9% during the fourth quarter. Tokio Marine Asset Management Co. Ltd. now owns 934 shares of the restaurant operator’s stock worth $385,000 after acquiring an additional 26 shares during the period. B. Metzler seel. Sohn & Co. AG grew its holdings in Domino’s Pizza by 2.2% during the second quarter. B. Metzler seel. Sohn & Co. AG now owns 1,412 shares of the restaurant operator’s stock worth $476,000 after acquiring an additional 30 shares during the period. Finally, Studio Investment Management LLC grew its holdings in Domino’s Pizza by 4.9% during the fourth quarter. Studio Investment Management LLC now owns 665 shares of the restaurant operator’s stock worth $230,000 after acquiring an additional 31 shares during the period. Hedge funds and other institutional investors own 92.27% of the company’s stock.

Domino’s Pizza Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, March 29th. Investors of record on Friday, March 15th will be issued a dividend of $1.51 per share. The ex-dividend date of this dividend is Thursday, March 14th. This represents a $6.04 dividend on an annualized basis and a yield of 1.35%. This is a boost from Domino’s Pizza’s previous quarterly dividend of $1.21. Domino’s Pizza’s payout ratio is presently 33.11%.

Domino’s Pizza Company Profile

Domino’s Pizza, Inc, through its subsidiaries, operates as a pizza company in the United States and internationally. The company operates through three segments: U.S. Stores, International Franchise, and Supply Chain. It offers pizzas under the Domino’s brand name through company-owned and franchised stores.

Recommended Stories

Receive News & Ratings for Domino’s Pizza Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Domino’s Pizza and related companies with MarketBeat.com’s FREE daily email newsletter.