Brokers Issue Forecasts for Granite Ridge Resources, Inc.’s Q1 2024 Earnings (NYSE:GRNT)

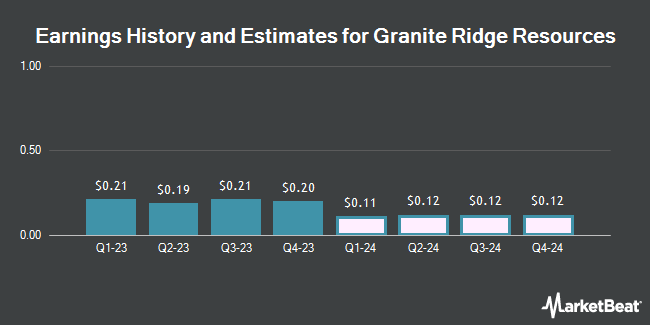

Granite Ridge Resources, Inc. (NYSE:GRNT – Free Report) – Analysts at Capital One Financial decreased their Q1 2024 earnings per share estimates for shares of Granite Ridge Resources in a research report issued on Monday, March 25th. Capital One Financial analyst P. Johnston now expects that the company will earn $0.11 per share for the quarter, down from their previous forecast of $0.15. The consensus estimate for Granite Ridge Resources’ current full-year earnings is $0.61 per share. Capital One Financial also issued estimates for Granite Ridge Resources’ Q2 2024 earnings at $0.12 EPS, Q3 2024 earnings at $0.12 EPS, Q4 2024 earnings at $0.12 EPS, FY2024 earnings at $0.48 EPS and FY2025 earnings at $0.63 EPS.

Granite Ridge Resources Trading Down 2.7 %

NYSE:GRNT opened at $6.20 on Tuesday. The company has a debt-to-equity ratio of 0.16, a quick ratio of 2.44 and a current ratio of 2.44. The stock has a market cap of $808.79 million, a price-to-earnings ratio of 10.16 and a beta of 0.20. Granite Ridge Resources has a one year low of $5.00 and a one year high of $8.14. The business’s 50-day simple moving average is $5.89 and its 200 day simple moving average is $5.98.

Granite Ridge Resources (NYSE:GRNT – Get Free Report) last released its quarterly earnings results on Thursday, March 7th. The company reported $0.20 earnings per share for the quarter, topping the consensus estimate of $0.19 by $0.01. The company had revenue of $106.80 million during the quarter. Granite Ridge Resources had a return on equity of 16.35% and a net margin of 20.58%. During the same period in the previous year, the business posted $0.38 EPS.

Granite Ridge Resources Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, March 15th. Shareholders of record on Friday, March 1st were paid a dividend of $0.11 per share. This represents a $0.44 annualized dividend and a yield of 7.10%. The ex-dividend date of this dividend was Thursday, February 29th. Granite Ridge Resources’s dividend payout ratio (DPR) is currently 72.13%.

Insider Buying and Selling at Granite Ridge Resources

In other news, CFO Tyler Farquharson purchased 5,000 shares of the firm’s stock in a transaction on Friday, March 15th. The stock was bought at an average cost of $6.20 per share, for a total transaction of $31,000.00. Following the completion of the acquisition, the chief financial officer now directly owns 68,037 shares of the company’s stock, valued at $421,829.40. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Insiders have bought a total of 9,250 shares of company stock valued at $57,190 in the last three months. 1.40% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Granite Ridge Resources

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Vanguard Group Inc. raised its holdings in Granite Ridge Resources by 1.8% in the 4th quarter. Vanguard Group Inc. now owns 1,636,341 shares of the company’s stock valued at $9,851,000 after acquiring an additional 29,172 shares during the period. Goldman Sachs Group Inc. boosted its position in shares of Granite Ridge Resources by 430.5% during the 4th quarter. Goldman Sachs Group Inc. now owns 184,137 shares of the company’s stock worth $1,109,000 after acquiring an additional 149,425 shares in the last quarter. American International Group Inc. boosted its position in shares of Granite Ridge Resources by 30.7% during the 4th quarter. American International Group Inc. now owns 16,948 shares of the company’s stock worth $102,000 after acquiring an additional 3,980 shares in the last quarter. Virtus Fund Advisers LLC acquired a new stake in shares of Granite Ridge Resources during the 4th quarter worth approximately $40,000. Finally, Virtus Investment Advisers Inc. acquired a new stake in shares of Granite Ridge Resources during the 4th quarter worth approximately $603,000. 31.56% of the stock is owned by institutional investors and hedge funds.

About Granite Ridge Resources

Granite Ridge Resources, Inc operates as a non-operated oil and gas exploration and production company. It owns a portfolio of wells and acreage across the Permian and other unconventional basins in the United States. Granite Ridge Resources, Inc is based in Dallas, Texas.

Featured Stories

Receive News & Ratings for Granite Ridge Resources Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Granite Ridge Resources and related companies with MarketBeat.com’s FREE daily email newsletter.