Brokers Issue Forecasts for Hancock Whitney Co.’s Q1 2024 Earnings (NASDAQ:HWC)

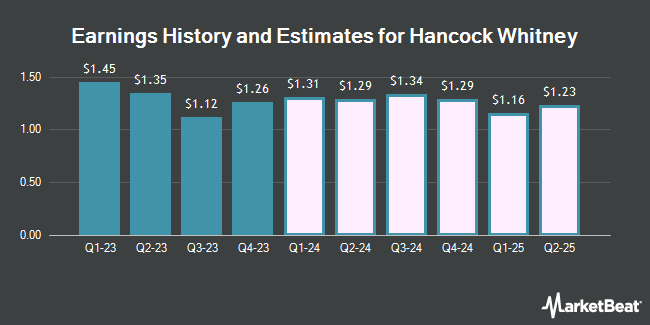

Hancock Whitney Co. (NASDAQ:HWC – Free Report) – Stock analysts at Zacks Research upped their Q1 2024 earnings per share estimates for shares of Hancock Whitney in a note issued to investors on Tuesday, March 26th. Zacks Research analyst R. Department now expects that the company will post earnings per share of $1.14 for the quarter, up from their prior estimate of $1.12. The consensus estimate for Hancock Whitney’s current full-year earnings is $4.78 per share. Zacks Research also issued estimates for Hancock Whitney’s Q2 2024 earnings at $1.12 EPS, Q3 2024 earnings at $1.18 EPS, Q2 2025 earnings at $1.23 EPS, Q4 2025 earnings at $1.30 EPS and FY2025 earnings at $5.01 EPS.

Hancock Whitney (NASDAQ:HWC – Get Free Report) last announced its quarterly earnings data on Tuesday, January 16th. The company reported $1.26 earnings per share for the quarter, beating analysts’ consensus estimates of $1.19 by $0.07. The company had revenue of $308.41 million for the quarter, compared to analysts’ expectations of $355.51 million. Hancock Whitney had a return on equity of 12.54% and a net margin of 20.57%. During the same period last year, the firm posted $1.65 EPS.

A number of other brokerages have also recently commented on HWC. DA Davidson reaffirmed a “buy” rating and issued a $55.00 price target on shares of Hancock Whitney in a research note on Tuesday, February 13th. Raymond James lifted their price target on Hancock Whitney from $45.00 to $55.00 and gave the stock an “outperform” rating in a research note on Friday, January 5th. Stephens decreased their price target on Hancock Whitney from $55.00 to $50.00 and set an “equal weight” rating on the stock in a research note on Wednesday, January 17th. Citigroup began coverage on Hancock Whitney in a research note on Friday, December 1st. They issued a “neutral” rating and a $45.00 price target on the stock. Finally, Piper Sandler lifted their price target on Hancock Whitney from $51.00 to $55.00 and gave the stock an “overweight” rating in a research note on Wednesday, January 17th. Six equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to MarketBeat, the stock has a consensus rating of “Hold” and a consensus price target of $48.88.

Check Out Our Latest Stock Analysis on HWC

Hancock Whitney Stock Performance

Shares of NASDAQ HWC opened at $43.47 on Wednesday. The stock has a market cap of $3.76 billion, a price-to-earnings ratio of 9.66 and a beta of 1.32. The company has a current ratio of 0.81, a quick ratio of 0.81 and a debt-to-equity ratio of 0.06. Hancock Whitney has a 1-year low of $31.02 and a 1-year high of $49.65. The stock’s 50-day moving average is $43.94 and its 200 day moving average is $41.71.

Hancock Whitney Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, March 15th. Stockholders of record on Tuesday, March 5th were paid a dividend of $0.30 per share. The ex-dividend date was Monday, March 4th. This represents a $1.20 annualized dividend and a dividend yield of 2.76%. Hancock Whitney’s dividend payout ratio (DPR) is presently 26.67%.

Insider Activity

In related news, insider Joseph S. Exnicios sold 9,857 shares of Hancock Whitney stock in a transaction that occurred on Monday, January 22nd. The stock was sold at an average price of $47.15, for a total transaction of $464,757.55. Following the sale, the insider now directly owns 30,159 shares in the company, valued at $1,421,996.85. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. In related news, insider Christopher S. Ziluca sold 3,636 shares of Hancock Whitney stock in a transaction that occurred on Thursday, February 22nd. The stock was sold at an average price of $43.50, for a total transaction of $158,166.00. Following the sale, the insider now directly owns 35,285 shares in the company, valued at $1,534,897.50. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Joseph S. Exnicios sold 9,857 shares of Hancock Whitney stock in a transaction that occurred on Monday, January 22nd. The shares were sold at an average price of $47.15, for a total value of $464,757.55. Following the sale, the insider now owns 30,159 shares in the company, valued at $1,421,996.85. The disclosure for this sale can be found here. Over the last three months, insiders have sold 35,225 shares of company stock valued at $1,634,014. Company insiders own 1.10% of the company’s stock.

Institutional Investors Weigh In On Hancock Whitney

Several hedge funds have recently added to or reduced their stakes in the stock. Pathstone Family Office LLC boosted its holdings in Hancock Whitney by 1.9% in the third quarter. Pathstone Family Office LLC now owns 13,613 shares of the company’s stock worth $624,000 after acquiring an additional 256 shares in the last quarter. Cutler Capital Management LLC raised its stake in shares of Hancock Whitney by 2.7% in the second quarter. Cutler Capital Management LLC now owns 10,572 shares of the company’s stock worth $406,000 after purchasing an additional 275 shares during the last quarter. Captrust Financial Advisors raised its stake in shares of Hancock Whitney by 4.4% in the fourth quarter. Captrust Financial Advisors now owns 7,719 shares of the company’s stock worth $374,000 after purchasing an additional 322 shares during the last quarter. Quadrant Capital Group LLC raised its stake in shares of Hancock Whitney by 35.2% in the fourth quarter. Quadrant Capital Group LLC now owns 1,260 shares of the company’s stock worth $61,000 after purchasing an additional 328 shares during the last quarter. Finally, PNC Financial Services Group Inc. increased its position in Hancock Whitney by 12.4% during the first quarter. PNC Financial Services Group Inc. now owns 2,980 shares of the company’s stock valued at $154,000 after acquiring an additional 329 shares during the last quarter. 81.22% of the stock is owned by institutional investors.

Hancock Whitney Company Profile

Hancock Whitney Corporation operates as the financial holding company for Hancock Whitney Bank that provides traditional and online banking services to commercial, small business, and retail customers. It offers various transaction and savings deposit products consisting of brokered deposits, time deposits, and money market accounts; treasury management services, secured and unsecured loan products including revolving credit facilities, and letters of credit and similar financial guarantees; and trust and investment management services to retirement plans, corporations, and individuals, and investment advisory and brokerage products.

Featured Articles

Receive News & Ratings for Hancock Whitney Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Hancock Whitney and related companies with MarketBeat.com’s FREE daily email newsletter.