Brokers Issue Forecasts for Omnicom Group Inc.’s Q2 2024 Earnings (NYSE:OMC)

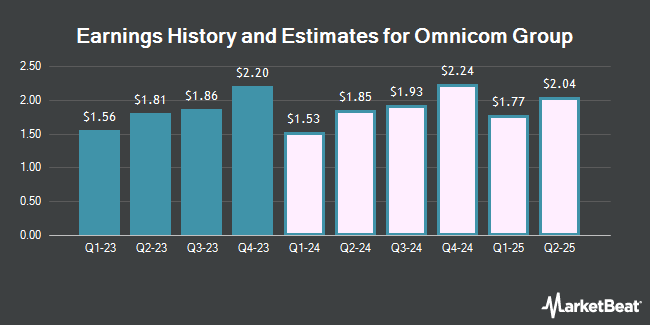

Omnicom Group Inc. (NYSE:OMC – Free Report) – Equities researchers at Zacks Research increased their Q2 2024 EPS estimates for Omnicom Group in a report issued on Tuesday, May 7th. Zacks Research analyst S. Dey now forecasts that the business services provider will earn $1.86 per share for the quarter, up from their prior estimate of $1.85. The consensus estimate for Omnicom Group’s current full-year earnings is $7.81 per share. Zacks Research also issued estimates for Omnicom Group’s Q3 2024 earnings at $1.94 EPS, Q4 2024 earnings at $2.25 EPS, FY2024 earnings at $7.71 EPS, Q1 2025 earnings at $1.78 EPS, Q3 2025 earnings at $2.06 EPS, Q4 2025 earnings at $2.32 EPS, FY2025 earnings at $8.20 EPS, Q1 2026 earnings at $2.03 EPS and FY2026 earnings at $8.83 EPS.

Omnicom Group (NYSE:OMC – Get Free Report) last issued its quarterly earnings results on Monday, February 5th. The business services provider reported $2.20 EPS for the quarter, beating the consensus estimate of $2.16 by $0.04. Omnicom Group had a net margin of 9.96% and a return on equity of 38.23%. The business had revenue of $4.06 billion during the quarter, compared to the consensus estimate of $4 billion. During the same quarter in the prior year, the firm earned $2.09 EPS. The firm’s quarterly revenue was up 5.0% on a year-over-year basis.

OMC has been the topic of several other research reports. Moffett Nathanson lifted their target price on Omnicom Group from $89.00 to $93.00 and gave the company a “neutral” rating in a research note on Wednesday, April 17th. StockNews.com upgraded shares of Omnicom Group from a “hold” rating to a “buy” rating in a research note on Thursday, April 18th. BNP Paribas raised shares of Omnicom Group from a “neutral” rating to an “outperform” rating and set a $115.00 price target on the stock in a research note on Thursday, March 28th. Wells Fargo & Company upgraded Omnicom Group from an “equal weight” rating to an “overweight” rating and boosted their target price for the company from $91.00 to $106.00 in a research note on Wednesday, April 17th. Finally, UBS Group initiated coverage on Omnicom Group in a research note on Thursday, January 11th. They set a “buy” rating and a $117.00 price target for the company. One investment analyst has rated the stock with a sell rating, one has issued a hold rating and nine have given a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of “Moderate Buy” and an average price target of $104.40.

Get Our Latest Stock Report on Omnicom Group

Omnicom Group Price Performance

OMC opened at $95.08 on Thursday. The firm has a market capitalization of $18.62 billion, a P/E ratio of 12.85, a PEG ratio of 2.18 and a beta of 0.96. Omnicom Group has a 12-month low of $72.20 and a 12-month high of $99.23. The company has a quick ratio of 0.81, a current ratio of 0.93 and a debt-to-equity ratio of 1.33. The stock has a fifty day moving average of $93.12 and a 200-day moving average of $87.14.

Omnicom Group Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 9th. Stockholders of record on Monday, June 10th will be issued a dividend of $0.70 per share. This represents a $2.80 annualized dividend and a dividend yield of 2.94%. The ex-dividend date is Monday, June 10th. Omnicom Group’s payout ratio is presently 37.84%.

Insider Buying and Selling

In other news, Director Linda Johnson Rice sold 507 shares of the stock in a transaction on Friday, February 9th. The shares were sold at an average price of $86.66, for a total value of $43,936.62. Following the completion of the transaction, the director now owns 9,753 shares in the company, valued at approximately $845,194.98. The sale was disclosed in a filing with the SEC, which is available at this link. 1.30% of the stock is owned by company insiders.

Hedge Funds Weigh In On Omnicom Group

A number of hedge funds have recently modified their holdings of OMC. HHM Wealth Advisors LLC bought a new stake in Omnicom Group in the fourth quarter valued at $26,000. Frazier Financial Advisors LLC acquired a new stake in Omnicom Group during the 4th quarter valued at $26,000. Pinnacle Bancorp Inc. raised its position in Omnicom Group by 61.6% in the 4th quarter. Pinnacle Bancorp Inc. now owns 328 shares of the business services provider’s stock valued at $28,000 after purchasing an additional 125 shares during the last quarter. Richardson Financial Services Inc. acquired a new position in Omnicom Group in the fourth quarter worth $29,000. Finally, OFI Invest Asset Management bought a new stake in shares of Omnicom Group during the third quarter worth $25,000. 91.97% of the stock is owned by institutional investors and hedge funds.

About Omnicom Group

Omnicom Group Inc, together with its subsidiaries, offers advertising, marketing, and corporate communications services. It provides a range of services in the areas of advertising and media, precision marketing, commerce and branding, experiential, execution and support, public relations, and healthcare.

Featured Stories

Receive News & Ratings for Omnicom Group Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Omnicom Group and related companies with MarketBeat.com’s FREE daily email newsletter.