Brokers Offer Predictions for Antero Resources Co.’s Q2 2024 Earnings (NYSE:AR)

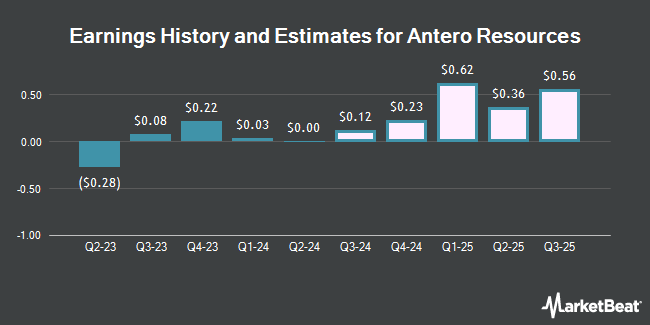

Antero Resources Co. (NYSE:AR – Free Report) – Zacks Research increased their Q2 2024 earnings estimates for shares of Antero Resources in a note issued to investors on Monday, May 20th. Zacks Research analyst A. Kanoria now anticipates that the oil and natural gas company will post earnings per share of ($0.13) for the quarter, up from their previous estimate of ($0.16). The consensus estimate for Antero Resources’ current full-year earnings is $0.33 per share. Zacks Research also issued estimates for Antero Resources’ Q4 2024 earnings at $0.24 EPS, FY2024 earnings at $0.20 EPS, Q1 2025 earnings at $0.66 EPS, Q2 2025 earnings at $0.41 EPS, Q3 2025 earnings at $0.62 EPS, FY2025 earnings at $2.57 EPS and FY2026 earnings at $2.69 EPS.

Other equities analysts have also recently issued reports about the stock. JPMorgan Chase & Co. raised their price target on shares of Antero Resources from $30.00 to $32.00 and gave the stock an “overweight” rating in a research note on Wednesday, March 27th. Mizuho raised their price target on shares of Antero Resources from $29.00 to $37.00 and gave the stock a “neutral” rating in a research note on Monday, May 13th. Scotiabank raised their price target on shares of Antero Resources from $36.00 to $40.00 and gave the stock a “sector perform” rating in a research note on Tuesday, April 30th. Barclays assumed coverage on shares of Antero Resources in a research note on Wednesday, April 10th. They set an “equal weight” rating and a $32.00 price target for the company. Finally, Wells Fargo & Company raised their price target on shares of Antero Resources from $35.00 to $43.00 and gave the stock an “overweight” rating in a research note on Tuesday, April 30th. One analyst has rated the stock with a sell rating, seven have issued a hold rating, five have issued a buy rating and one has issued a strong buy rating to the company’s stock. According to data from MarketBeat.com, the company presently has an average rating of “Hold” and a consensus price target of $32.69.

View Our Latest Stock Report on AR

Antero Resources Stock Performance

Shares of AR stock opened at $34.11 on Wednesday. The company has a debt-to-equity ratio of 0.21, a quick ratio of 0.29 and a current ratio of 0.29. The company has a market capitalization of $10.60 billion, a P/E ratio of 170.55 and a beta of 3.27. The company’s 50 day moving average price is $30.81 and its two-hundred day moving average price is $26.15. Antero Resources has a 52 week low of $19.91 and a 52 week high of $35.83.

Antero Resources (NYSE:AR – Get Free Report) last announced its earnings results on Wednesday, April 24th. The oil and natural gas company reported $0.03 EPS for the quarter. The firm had revenue of $1.12 billion for the quarter, compared to the consensus estimate of $1.08 billion. Antero Resources had a net margin of 1.50% and a return on equity of 0.18%.

Insider Activity

In other news, insider Sheri Pearce sold 28,009 shares of the business’s stock in a transaction dated Wednesday, March 13th. The shares were sold at an average price of $26.29, for a total value of $736,356.61. Following the completion of the sale, the insider now owns 106,698 shares of the company’s stock, valued at $2,805,090.42. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. In related news, Director W Howard Keenan, Jr. sold 232,293 shares of the company’s stock in a transaction dated Thursday, March 14th. The shares were sold at an average price of $25.85, for a total transaction of $6,004,774.05. Following the completion of the sale, the director now owns 3,000,000 shares of the company’s stock, valued at $77,550,000. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Sheri Pearce sold 28,009 shares of the company’s stock in a transaction dated Wednesday, March 13th. The stock was sold at an average price of $26.29, for a total transaction of $736,356.61. Following the sale, the insider now directly owns 106,698 shares of the company’s stock, valued at approximately $2,805,090.42. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 943,657 shares of company stock valued at $28,479,689. 5.95% of the stock is owned by company insiders.

Institutional Investors Weigh In On Antero Resources

Several institutional investors and hedge funds have recently bought and sold shares of AR. Allspring Global Investments Holdings LLC lifted its holdings in shares of Antero Resources by 1,311.8% in the first quarter. Allspring Global Investments Holdings LLC now owns 960 shares of the oil and natural gas company’s stock worth $28,000 after acquiring an additional 892 shares during the last quarter. Mather Group LLC. bought a new position in shares of Antero Resources in the first quarter worth about $37,000. Lindbrook Capital LLC lifted its holdings in shares of Antero Resources by 81.5% in the fourth quarter. Lindbrook Capital LLC now owns 1,479 shares of the oil and natural gas company’s stock worth $34,000 after acquiring an additional 664 shares during the last quarter. Itau Unibanco Holding S.A. bought a new position in shares of Antero Resources in the third quarter worth about $47,000. Finally, Planned Solutions Inc. acquired a new position in shares of Antero Resources in the fourth quarter valued at approximately $45,000. Institutional investors own 83.04% of the company’s stock.

About Antero Resources

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Development; Marketing; and Equity Method Investment in Antero Midstream.

Recommended Stories

Receive News & Ratings for Antero Resources Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Antero Resources and related companies with MarketBeat.com’s FREE daily email newsletter.