Brokers Offer Predictions for APA Co.’s Q1 2024 Earnings (NASDAQ:APA)

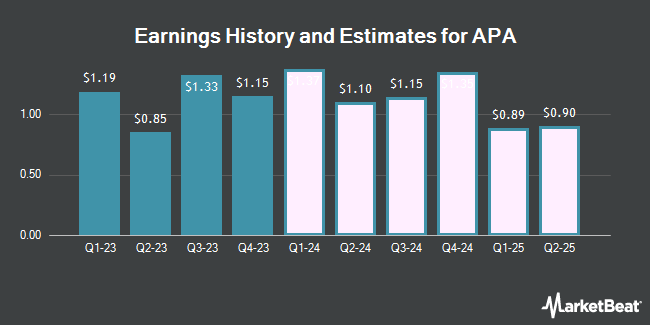

APA Co. (NASDAQ:APA – Free Report) – Analysts at Zacks Research lowered their Q1 2024 earnings estimates for shares of APA in a report released on Wednesday, March 6th. Zacks Research analyst N. Choudhury now forecasts that the company will post earnings per share of $0.73 for the quarter, down from their prior forecast of $1.33. The consensus estimate for APA’s current full-year earnings is $4.06 per share. Zacks Research also issued estimates for APA’s Q2 2024 earnings at $0.94 EPS, Q3 2024 earnings at $0.76 EPS, Q4 2024 earnings at $1.03 EPS, FY2024 earnings at $3.46 EPS, Q1 2025 earnings at $0.89 EPS, Q2 2025 earnings at $0.90 EPS, Q3 2025 earnings at $1.47 EPS, Q4 2025 earnings at $1.12 EPS and FY2025 earnings at $4.39 EPS.

APA (NASDAQ:APA – Get Free Report) last released its quarterly earnings data on Thursday, February 22nd. The company reported $1.15 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.33 by ($0.18). APA had a return on equity of 62.64% and a net margin of 34.95%. The business had revenue of $2.17 billion during the quarter, compared to analyst estimates of $2.07 billion. During the same period in the previous year, the company earned $1.48 EPS. APA’s revenue was down 12.3% on a year-over-year basis.

APA has been the subject of a number of other reports. Piper Sandler decreased their price objective on shares of APA from $36.00 to $33.00 and set a “neutral” rating for the company in a research report on Thursday. Wells Fargo & Company dropped their price objective on APA from $53.00 to $52.00 and set an “overweight” rating on the stock in a report on Wednesday, November 22nd. Raymond James reduced their target price on APA from $44.00 to $43.00 and set a “strong-buy” rating for the company in a research note on Wednesday, January 24th. Scotiabank restated a “sector perform” rating and issued a $37.00 price target (down previously from $43.00) on shares of APA in a research note on Tuesday, January 16th. Finally, Johnson Rice downgraded shares of APA from a “buy” rating to a “hold” rating and set a $40.00 price objective on the stock. in a research note on Friday, January 5th. Two research analysts have rated the stock with a sell rating, ten have given a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company’s stock. According to MarketBeat, the stock presently has a consensus rating of “Hold” and a consensus price target of $44.00.

View Our Latest Stock Report on APA

APA Stock Performance

Shares of NASDAQ:APA opened at $30.81 on Monday. The business’s 50-day simple moving average is $31.43 and its 200 day simple moving average is $36.47. The company has a market cap of $9.30 billion, a P/E ratio of 3.32 and a beta of 3.27. The company has a debt-to-equity ratio of 1.41, a quick ratio of 1.02 and a current ratio of 1.02. APA has a one year low of $29.47 and a one year high of $46.15.

Hedge Funds Weigh In On APA

Several hedge funds have recently made changes to their positions in APA. HB Wealth Management LLC purchased a new stake in shares of APA during the third quarter valued at $256,000. Charles Schwab Investment Management Inc. increased its position in shares of APA by 1.0% in the third quarter. Charles Schwab Investment Management Inc. now owns 2,531,313 shares of the company’s stock worth $104,037,000 after acquiring an additional 24,182 shares in the last quarter. Smead Capital Management Inc. raised its holdings in shares of APA by 3.8% during the third quarter. Smead Capital Management Inc. now owns 4,609,497 shares of the company’s stock valued at $189,450,000 after acquiring an additional 167,934 shares during the period. Todd Asset Management LLC lifted its position in shares of APA by 17.3% in the 3rd quarter. Todd Asset Management LLC now owns 614,481 shares of the company’s stock valued at $25,255,000 after acquiring an additional 90,555 shares in the last quarter. Finally, Atria Investments Inc acquired a new position in APA in the 3rd quarter worth approximately $1,531,000. Institutional investors and hedge funds own 80.48% of the company’s stock.

APA Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, May 22nd. Investors of record on Monday, April 22nd will be paid a dividend of $0.25 per share. The ex-dividend date is Friday, April 19th. This represents a $1.00 annualized dividend and a yield of 3.25%. APA’s dividend payout ratio is currently 10.78%.

APA Company Profile

APA Corporation, through its subsidiaries, explores for, develops, and produces natural gas, crude oil, and natural gas liquids. It has operations in the United States, Egypt, and the United Kingdom, as well as has exploration activities offshore Suriname. The company also operates gathering, compression, processing, and transmission assets in West Texas, as well as holds ownership in four Permian Basin long-haul pipeline.

See Also

Receive News & Ratings for APA Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for APA and related companies with MarketBeat.com’s FREE daily email newsletter.