Brokers Offer Predictions for Ballard Power Systems Inc.’s Q4 2023 Earnings (NASDAQ:BLDP)

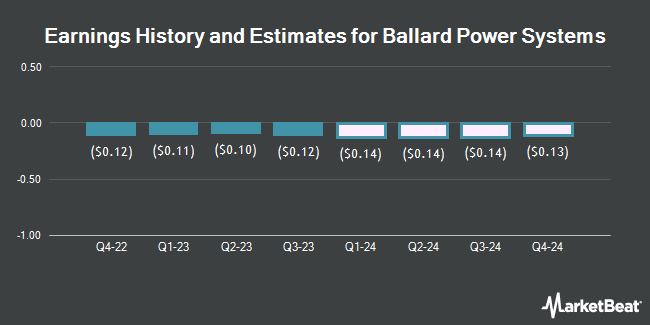

Ballard Power Systems Inc. (NASDAQ:BLDP – Free Report) (TSE:BLD) – Research analysts at B. Riley raised their Q4 2023 earnings per share (EPS) estimates for shares of Ballard Power Systems in a report released on Wednesday, February 28th. B. Riley analyst C. Souther now forecasts that the technology company will post earnings per share of ($0.11) for the quarter, up from their prior estimate of ($0.12). The consensus estimate for Ballard Power Systems’ current full-year earnings is ($0.46) per share. B. Riley also issued estimates for Ballard Power Systems’ FY2024 earnings at ($0.49) EPS.

Several other equities analysts have also recently issued reports on the company. Wells Fargo & Company decreased their price objective on Ballard Power Systems from $5.00 to $3.50 and set an “underweight” rating for the company in a report on Monday, November 13th. BMO Capital Markets reduced their price target on Ballard Power Systems from $3.65 to $3.50 and set an “underperform” rating for the company in a report on Wednesday, November 8th. Susquehanna Bancshares cut their price objective on Ballard Power Systems from $5.00 to $4.00 and set a “neutral” rating for the company in a research note on Wednesday, November 8th. TD Securities dropped their price target on Ballard Power Systems from $4.00 to $3.50 and set a “hold” rating for the company in a research report on Wednesday, November 8th. Finally, Jefferies Financial Group lowered their price objective on Ballard Power Systems from $4.00 to $3.50 and set a “hold” rating for the company in a research report on Tuesday, January 30th. Two investment analysts have rated the stock with a sell rating, eleven have given a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat.com, Ballard Power Systems presently has an average rating of “Hold” and a consensus target price of $4.20.

Check Out Our Latest Research Report on Ballard Power Systems

Ballard Power Systems Stock Up 2.5 %

Shares of BLDP stock opened at $3.22 on Friday. The stock’s fifty day moving average price is $3.32 and its 200 day moving average price is $3.58. Ballard Power Systems has a 1-year low of $2.87 and a 1-year high of $6.06. The company has a debt-to-equity ratio of 0.01, a current ratio of 12.57 and a quick ratio of 11.59. The company has a market cap of $962.59 million, a price-to-earnings ratio of -5.96 and a beta of 1.70.

Hedge Funds Weigh In On Ballard Power Systems

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in BLDP. The Manufacturers Life Insurance Company boosted its stake in shares of Ballard Power Systems by 1.5% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 184,039 shares of the technology company’s stock valued at $805,000 after buying an additional 2,746 shares during the period. Advisors Asset Management Inc. boosted its stake in shares of Ballard Power Systems by 6.3% during the 4th quarter. Advisors Asset Management Inc. now owns 49,742 shares of the technology company’s stock valued at $238,000 after buying an additional 2,940 shares during the period. Mackenzie Financial Corp boosted its stake in shares of Ballard Power Systems by 2.6% during the 3rd quarter. Mackenzie Financial Corp now owns 115,748 shares of the technology company’s stock valued at $393,000 after buying an additional 2,974 shares during the period. Vident Advisory LLC boosted its stake in shares of Ballard Power Systems by 11.2% during the 4th quarter. Vident Advisory LLC now owns 34,798 shares of the technology company’s stock valued at $129,000 after buying an additional 3,504 shares during the period. Finally, BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp boosted its stake in shares of Ballard Power Systems by 2.7% during the 2nd quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 137,595 shares of the technology company’s stock valued at $602,000 after buying an additional 3,570 shares during the period. Institutional investors and hedge funds own 23.41% of the company’s stock.

Ballard Power Systems Company Profile

Ballard Power Systems Inc engages in the design, development, manufacture, sale, and service of proton exchange membrane (PEM) fuel cell products. The company offers its products for power product markets, consisting of heavy-duty motives, such as bus, truck, rail, and marine applications; material handling; and power generation.

Read More

Receive News & Ratings for Ballard Power Systems Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Ballard Power Systems and related companies with MarketBeat.com’s FREE daily email newsletter.