Brokers Offer Predictions for Cambium Networks Co.’s Q2 2024 Earnings (NASDAQ:CMBM)

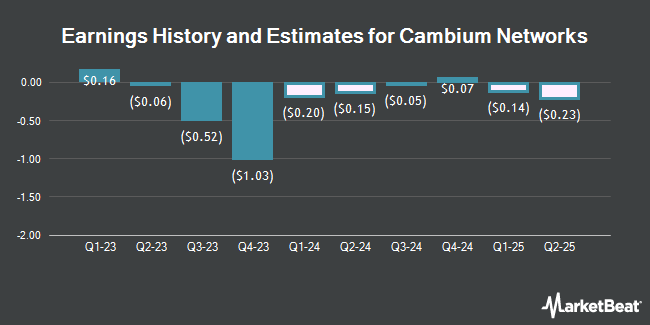

Cambium Networks Co. (NASDAQ:CMBM – Free Report) – Research analysts at Zacks Research cut their Q2 2024 earnings estimates for shares of Cambium Networks in a note issued to investors on Wednesday, March 20th. Zacks Research analyst R. Department now expects that the company will earn ($0.23) per share for the quarter, down from their prior estimate of ($0.21). The consensus estimate for Cambium Networks’ current full-year earnings is ($0.65) per share. Zacks Research also issued estimates for Cambium Networks’ Q3 2024 earnings at ($0.11) EPS, FY2024 earnings at ($0.86) EPS, Q2 2025 earnings at ($0.23) EPS, Q3 2025 earnings at ($0.07) EPS, Q4 2025 earnings at $0.21 EPS and FY2025 earnings at ($0.31) EPS.

Separately, Raymond James increased their target price on shares of Cambium Networks from $5.25 to $5.50 and gave the company an “outperform” rating in a research report on Friday, February 16th. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and three have issued a buy rating to the stock. According to MarketBeat.com, Cambium Networks currently has a consensus rating of “Hold” and a consensus target price of $11.04.

Get Our Latest Report on Cambium Networks

Cambium Networks Price Performance

CMBM opened at $4.38 on Friday. The firm has a market cap of $122.03 million, a P/E ratio of -1.90 and a beta of 0.94. The firm has a 50-day moving average of $4.38 and a 200 day moving average of $5.11. The company has a debt-to-equity ratio of 0.27, a quick ratio of 1.36 and a current ratio of 1.69. Cambium Networks has a fifty-two week low of $3.53 and a fifty-two week high of $18.09.

Cambium Networks (NASDAQ:CMBM – Get Free Report) last released its earnings results on Thursday, February 15th. The company reported ($1.03) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.44) by ($0.59). The business had revenue of $40.21 million during the quarter, compared to the consensus estimate of $41.82 million. Cambium Networks had a negative net margin of 28.87% and a negative return on equity of 30.83%.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently bought and sold shares of the business. Legato Capital Management LLC boosted its holdings in shares of Cambium Networks by 35.8% in the second quarter. Legato Capital Management LLC now owns 84,282 shares of the company’s stock worth $1,283,000 after acquiring an additional 22,240 shares during the period. Barclays PLC boosted its position in shares of Cambium Networks by 77.8% in the third quarter. Barclays PLC now owns 23,814 shares of the company’s stock valued at $175,000 after acquiring an additional 10,420 shares during the period. Portside Wealth Group LLC bought a new position in shares of Cambium Networks in the second quarter valued at approximately $856,000. Janney Montgomery Scott LLC boosted its position in shares of Cambium Networks by 885.5% in the third quarter. Janney Montgomery Scott LLC now owns 98,601 shares of the company’s stock valued at $723,000 after acquiring an additional 88,596 shares during the period. Finally, Quantbot Technologies LP bought a new position in Cambium Networks in the 3rd quarter valued at $63,000. 88.37% of the stock is owned by institutional investors.

Cambium Networks Company Profile

Cambium Networks Corporation, together with its subsidiaries, engages in the design, development, and manufacture of wireless broadband and Wi-Fi networking infrastructure solutions. The company offers point-to-point fixed wireless backhaul and point-to-multipoint fixed wireless solutions; and enterprise solutions comprising cnMatrix cloud-managed wireless-aware switching solution, Xirrus Wi-Fi solutions, and Wi-Fi 6/6E access points which support cnMaestro and Xirrus XMS management.

Read More

Receive News & Ratings for Cambium Networks Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Cambium Networks and related companies with MarketBeat.com’s FREE daily email newsletter.