Brokers Offer Predictions for Canadian National Railway’s Q4 2023 Earnings (NYSE:CNI)

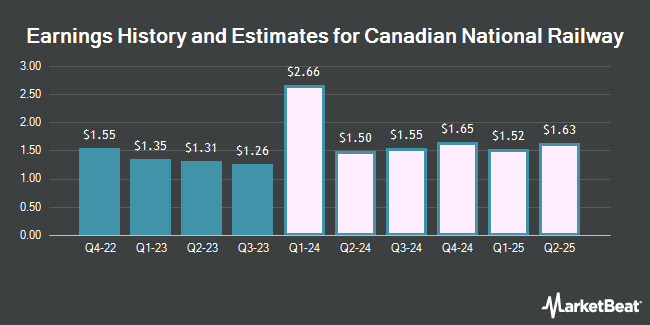

Canadian National Railway (NYSE:CNI – Free Report) TSE: CNR – Research analysts at Atb Cap Markets raised their Q4 2023 earnings per share (EPS) estimates for shares of Canadian National Railway in a research report issued on Thursday, January 18th. Atb Cap Markets analyst C. Murray now forecasts that the transportation company will post earnings of $1.44 per share for the quarter, up from their previous forecast of $1.42. The consensus estimate for Canadian National Railway’s current full-year earnings is $5.34 per share. Atb Cap Markets also issued estimates for Canadian National Railway’s Q1 2024 earnings at $1.30 EPS, FY2024 earnings at $5.90 EPS, Q1 2025 earnings at $1.49 EPS, Q2 2025 earnings at $1.75 EPS, Q3 2025 earnings at $1.72 EPS, Q4 2025 earnings at $1.83 EPS and FY2025 earnings at $6.79 EPS.

Canadian National Railway (NYSE:CNI – Get Free Report) TSE: CNR last posted its quarterly earnings results on Tuesday, October 24th. The transportation company reported $1.26 EPS for the quarter, missing analysts’ consensus estimates of $1.29 by ($0.03). Canadian National Railway had a return on equity of 23.53% and a net margin of 29.08%. The business had revenue of $2.97 billion for the quarter, compared to analyst estimates of $3.01 billion.

CNI has been the topic of a number of other research reports. Barclays boosted their price target on Canadian National Railway from $109.00 to $113.00 and gave the company an “equal weight” rating in a report on Wednesday, October 25th. Deutsche Bank Aktiengesellschaft lowered Canadian National Railway from a “buy” rating to a “hold” rating and dropped their target price for the company from $125.00 to $121.00 in a research report on Monday, November 27th. Citigroup boosted their price objective on shares of Canadian National Railway from $117.00 to $121.00 and gave the stock a “neutral” rating in a research note on Wednesday, December 13th. Susquehanna Bancshares upped their price target on Canadian National Railway from $115.00 to $143.00 and gave the stock a “neutral” rating in a research report on Monday, January 8th. Finally, Scotiabank dropped their price objective on shares of Canadian National Railway from C$172.00 to C$170.00 and set a “sector perform” rating on the stock in a report on Wednesday, September 27th. Eighteen analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. According to MarketBeat.com, the company has an average rating of “Hold” and a consensus target price of $143.85.

View Our Latest Research Report on CNI

Canadian National Railway Stock Performance

Shares of Canadian National Railway stock opened at $126.15 on Monday. The company has a quick ratio of 0.56, a current ratio of 0.72 and a debt-to-equity ratio of 0.81. The business has a 50 day moving average price of $120.49 and a 200-day moving average price of $115.17. Canadian National Railway has a 52 week low of $103.96 and a 52 week high of $127.14. The company has a market cap of $81.22 billion, a PE ratio of 23.06, a price-to-earnings-growth ratio of 2.95 and a beta of 0.90.

Canadian National Railway Cuts Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, December 28th. Investors of record on Thursday, December 7th were given a dividend of $0.5811 per share. This represents a $2.32 dividend on an annualized basis and a yield of 1.84%. The ex-dividend date of this dividend was Wednesday, December 6th. Canadian National Railway’s dividend payout ratio (DPR) is currently 42.41%.

Hedge Funds Weigh In On Canadian National Railway

Institutional investors and hedge funds have recently bought and sold shares of the stock. Knights of Columbus Asset Advisors LLC boosted its stake in shares of Canadian National Railway by 4.0% in the 2nd quarter. Knights of Columbus Asset Advisors LLC now owns 2,156 shares of the transportation company’s stock valued at $261,000 after purchasing an additional 83 shares in the last quarter. Ascent Group LLC lifted its position in Canadian National Railway by 2.2% during the 3rd quarter. Ascent Group LLC now owns 4,005 shares of the transportation company’s stock valued at $474,000 after purchasing an additional 87 shares during the period. BlackDiamond Wealth Management Inc. lifted its position in Canadian National Railway by 2.2% during the 2nd quarter. BlackDiamond Wealth Management Inc. now owns 4,086 shares of the transportation company’s stock valued at $485,000 after purchasing an additional 88 shares during the period. Baird Financial Group Inc. lifted its position in Canadian National Railway by 0.3% during the 3rd quarter. Baird Financial Group Inc. now owns 28,401 shares of the transportation company’s stock valued at $3,067,000 after purchasing an additional 88 shares during the period. Finally, SRS Capital Advisors Inc. increased its stake in shares of Canadian National Railway by 2.9% in the 2nd quarter. SRS Capital Advisors Inc. now owns 3,123 shares of the transportation company’s stock valued at $378,000 after acquiring an additional 89 shares during the last quarter. Institutional investors own 67.60% of the company’s stock.

About Canadian National Railway

Canadian National Railway Company, together with its subsidiaries, engages in rail and related transportation business. The company offers rail services, which include equipment, custom brokage services, transloading and distribution, business development and real estate, and private car storage services; and intermodal services including temperature controlled cargo, port partnership, transloading and distribution, logistic parks, customs brokerage, trucking, and moving grains in containers.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Canadian National Railway, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Canadian National Railway wasn’t on the list.

While Canadian National Railway currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.