Brokers Offer Predictions for Cytosorbents Co.’s Q1 2024 Earnings (NASDAQ:CTSO)

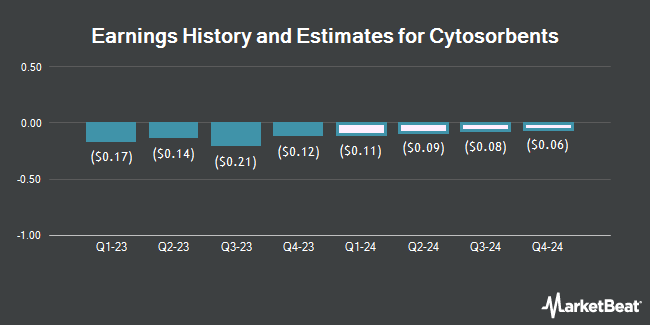

Cytosorbents Co. (NASDAQ:CTSO – Free Report) – Investment analysts at Zacks Small Cap issued their Q1 2024 earnings per share (EPS) estimates for shares of Cytosorbents in a research note issued on Thursday, April 4th. Zacks Small Cap analyst T. Kerr forecasts that the medical research company will post earnings per share of ($0.11) for the quarter. The consensus estimate for Cytosorbents’ current full-year earnings is ($0.46) per share. Zacks Small Cap also issued estimates for Cytosorbents’ Q2 2024 earnings at ($0.10) EPS, Q3 2024 earnings at ($0.08) EPS and Q4 2024 earnings at ($0.06) EPS.

Cytosorbents (NASDAQ:CTSO – Get Free Report) last released its quarterly earnings results on Thursday, March 14th. The medical research company reported ($0.12) earnings per share for the quarter, beating the consensus estimate of ($0.14) by $0.02. The business had revenue of $8.67 million during the quarter, compared to analysts’ expectations of $9.29 million. Cytosorbents had a negative return on equity of 120.24% and a negative net margin of 78.43%.

Separately, HC Wainwright restated a “neutral” rating and set a $1.00 price target on shares of Cytosorbents in a report on Friday, March 15th.

View Our Latest Stock Report on CTSO

Cytosorbents Stock Performance

NASDAQ CTSO opened at $1.01 on Monday. The stock has a market capitalization of $54.83 million, a PE ratio of -1.58 and a beta of 0.58. The business has a 50 day simple moving average of $0.97 and a two-hundred day simple moving average of $1.25. The company has a debt-to-equity ratio of 0.11, a current ratio of 1.77 and a quick ratio of 1.51. Cytosorbents has a 1-year low of $0.84 and a 1-year high of $4.29.

Institutional Investors Weigh In On Cytosorbents

Several institutional investors have recently modified their holdings of the stock. Geode Capital Management LLC lifted its stake in shares of Cytosorbents by 0.9% in the 4th quarter. Geode Capital Management LLC now owns 371,708 shares of the medical research company’s stock valued at $576,000 after purchasing an additional 3,189 shares during the last quarter. Occudo Quantitative Strategies LP lifted its stake in shares of Cytosorbents by 33.3% in the 2nd quarter. Occudo Quantitative Strategies LP now owns 24,367 shares of the medical research company’s stock valued at $53,000 after purchasing an additional 6,092 shares during the last quarter. JPMorgan Chase & Co. lifted its stake in shares of Cytosorbents by 36.0% in the 2nd quarter. JPMorgan Chase & Co. now owns 26,813 shares of the medical research company’s stock valued at $59,000 after purchasing an additional 7,102 shares during the last quarter. Morgan Stanley lifted its stake in shares of Cytosorbents by 7.5% during the 4th quarter. Morgan Stanley now owns 111,343 shares of the medical research company’s stock worth $173,000 after acquiring an additional 7,791 shares during the last quarter. Finally, Raymond James Financial Services Advisors Inc. lifted its stake in shares of Cytosorbents by 21.3% during the 1st quarter. Raymond James Financial Services Advisors Inc. now owns 57,684 shares of the medical research company’s stock worth $184,000 after acquiring an additional 10,141 shares during the last quarter. 32.87% of the stock is owned by institutional investors.

Cytosorbents Company Profile

Cytosorbents Corporation engages in the research, development, and commercialization of medical devices with its blood purification technology platform incorporating a proprietary adsorbent and porous polymer technology in the United States, Germany, and internationally. Its flagship product is CytoSorb, an extracorporeal cytokine adsorber for adjunctive therapy in the treatment of sepsis, adjunctive therapy in other critical care applications, prevention and treatment of perioperative complications, and maintaining or enhancing the quality of solid organs harvested from donors for organ transplant.

See Also

Receive News & Ratings for Cytosorbents Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Cytosorbents and related companies with MarketBeat.com’s FREE daily email newsletter.