Brokers Offer Predictions for Group 1 Automotive, Inc.’s Q1 2024 Earnings (NYSE:GPI)

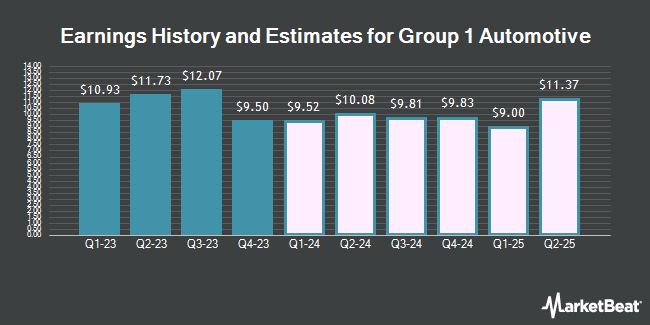

Group 1 Automotive, Inc. (NYSE:GPI – Free Report) – Analysts at Seaport Res Ptn issued their Q1 2024 earnings per share estimates for Group 1 Automotive in a research report issued on Wednesday, March 6th. Seaport Res Ptn analyst G. Chin expects that the company will earn $9.49 per share for the quarter. The consensus estimate for Group 1 Automotive’s current full-year earnings is $38.73 per share. Seaport Res Ptn also issued estimates for Group 1 Automotive’s Q3 2024 earnings at $10.38 EPS, Q4 2024 earnings at $9.64 EPS, FY2024 earnings at $40.12 EPS and FY2025 earnings at $39.22 EPS.

Group 1 Automotive (NYSE:GPI – Get Free Report) last released its quarterly earnings results on Wednesday, January 31st. The company reported $9.50 EPS for the quarter, missing analysts’ consensus estimates of $10.44 by ($0.94). The firm had revenue of $4.50 billion for the quarter, compared to analyst estimates of $4.41 billion. Group 1 Automotive had a return on equity of 24.36% and a net margin of 3.34%. The firm’s revenue for the quarter was up 10.6% on a year-over-year basis. During the same quarter last year, the company earned $10.86 earnings per share.

Other analysts have also recently issued reports about the company. Morgan Stanley upgraded Group 1 Automotive from an “underweight” rating to an “equal weight” rating and raised their price target for the company from $200.00 to $255.00 in a research note on Thursday, February 29th. StockNews.com cut Group 1 Automotive from a “buy” rating to a “hold” rating in a research note on Thursday, February 1st. Finally, Stephens reiterated an “overweight” rating and set a $330.00 target price on shares of Group 1 Automotive in a research report on Tuesday, February 13th.

Check Out Our Latest Stock Report on Group 1 Automotive

Group 1 Automotive Trading Down 1.2 %

NYSE:GPI opened at $262.09 on Friday. The firm has a market cap of $3.59 billion, a PE ratio of 6.14, a price-to-earnings-growth ratio of 1.34 and a beta of 1.42. The stock has a fifty day moving average price of $273.21 and a 200 day moving average price of $271.17. Group 1 Automotive has a 12-month low of $194.33 and a 12-month high of $310.08. The company has a current ratio of 1.11, a quick ratio of 0.33 and a debt-to-equity ratio of 0.74.

Hedge Funds Weigh In On Group 1 Automotive

Institutional investors have recently added to or reduced their stakes in the stock. Hsbc Holdings PLC boosted its holdings in Group 1 Automotive by 47.5% in the 3rd quarter. Hsbc Holdings PLC now owns 15,051 shares of the company’s stock valued at $4,082,000 after purchasing an additional 4,844 shares in the last quarter. Burney Co. boosted its holdings in Group 1 Automotive by 11.0% in the 3rd quarter. Burney Co. now owns 70,085 shares of the company’s stock valued at $18,832,000 after purchasing an additional 6,946 shares in the last quarter. Covalis Capital LLP purchased a new stake in Group 1 Automotive in the 3rd quarter valued at approximately $16,330,000. Boston Partners purchased a new stake in Group 1 Automotive in the 3rd quarter valued at approximately $12,703,000. Finally, Quadrature Capital Ltd purchased a new stake in Group 1 Automotive in the 3rd quarter valued at approximately $2,770,000. Institutional investors and hedge funds own 99.92% of the company’s stock.

Group 1 Automotive Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, March 15th. Investors of record on Friday, March 1st will be given a $0.47 dividend. This represents a $1.88 annualized dividend and a yield of 0.72%. The ex-dividend date is Thursday, February 29th. This is a boost from Group 1 Automotive’s previous quarterly dividend of $0.45. Group 1 Automotive’s payout ratio is 4.41%.

About Group 1 Automotive

Group 1 Automotive, Inc, through its subsidiaries, operates in the automotive retail industry in the United States and the United Kingdom. The company sells new and used cars, light trucks, and vehicle parts, as well as service and insurance contracts; arranges related vehicle financing; and offers automotive maintenance and repair services.

Featured Articles

Receive News & Ratings for Group 1 Automotive Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Group 1 Automotive and related companies with MarketBeat.com’s FREE daily email newsletter.