Brokers Offer Predictions for Hibbett, Inc.’s Q1 2025 Earnings (NASDAQ:HIBB)

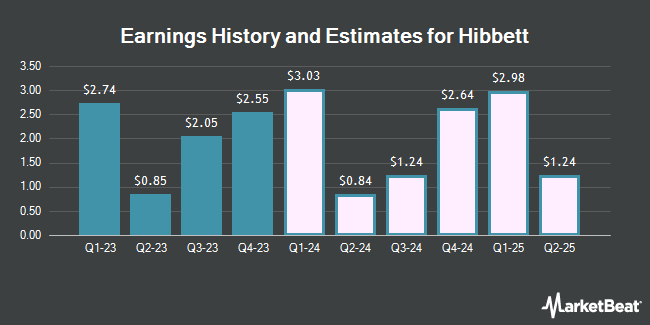

Hibbett, Inc. (NASDAQ:HIBB – Free Report) – Equities researchers at Telsey Advisory Group increased their Q1 2025 EPS estimates for shares of Hibbett in a research report issued on Monday, March 18th. Telsey Advisory Group analyst C. Fernandez now expects that the company will post earnings of $2.71 per share for the quarter, up from their previous forecast of $2.68. Telsey Advisory Group currently has a “Market Perform” rating and a $74.00 target price on the stock. The consensus estimate for Hibbett’s current full-year earnings is $8.35 per share. Telsey Advisory Group also issued estimates for Hibbett’s Q2 2025 earnings at $0.97 EPS, Q3 2025 earnings at $2.09 EPS, Q4 2025 earnings at $2.33 EPS, FY2025 earnings at $8.10 EPS, Q1 2026 earnings at $3.11 EPS, Q4 2026 earnings at $2.62 EPS and FY2026 earnings at $9.25 EPS.

Hibbett (NASDAQ:HIBB – Get Free Report) last announced its earnings results on Friday, March 15th. The company reported $2.55 earnings per share for the quarter, topping analysts’ consensus estimates of $2.54 by $0.01. The firm had revenue of $466.60 million during the quarter, compared to analyst estimates of $477.42 million. Hibbett had a net margin of 5.97% and a return on equity of 25.72%. The company’s revenue for the quarter was up 1.8% compared to the same quarter last year. During the same period in the prior year, the business earned $2.91 EPS.

A number of other equities analysts also recently commented on the stock. Williams Trading restated a “hold” rating and set a $73.00 price objective on shares of Hibbett in a research note on Monday. TheStreet upgraded shares of Hibbett from a “c+” rating to a “b-” rating in a research note on Monday, November 27th. Monness Crespi & Hardt increased their price objective on shares of Hibbett from $72.00 to $82.00 and gave the stock a “buy” rating in a research note on Monday. Finally, B. Riley increased their price objective on shares of Hibbett from $60.00 to $70.00 and gave the stock a “neutral” rating in a research note on Monday. One investment analyst has rated the stock with a sell rating, four have assigned a hold rating and three have given a buy rating to the company. According to data from MarketBeat, Hibbett currently has a consensus rating of “Hold” and an average target price of $67.86.

Get Our Latest Analysis on Hibbett

Hibbett Trading Up 0.7 %

Shares of NASDAQ HIBB opened at $74.00 on Wednesday. The firm has a market cap of $870.98 million, a PE ratio of 9.04, a PEG ratio of 1.09 and a beta of 1.77. Hibbett has a 1-year low of $34.86 and a 1-year high of $83.00. The company has a fifty day moving average price of $71.82 and a 200 day moving average price of $60.79.

Hibbett Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, April 2nd. Shareholders of record on Thursday, March 21st will be issued a $0.25 dividend. The ex-dividend date of this dividend is Wednesday, March 20th. This represents a $1.00 annualized dividend and a yield of 1.35%. Hibbett’s dividend payout ratio is currently 12.21%.

Institutional Inflows and Outflows

Several hedge funds have recently made changes to their positions in HIBB. GAMMA Investing LLC bought a new position in shares of Hibbett during the fourth quarter worth approximately $28,000. Quarry LP increased its holdings in shares of Hibbett by 138.7% during the first quarter. Quarry LP now owns 678 shares of the company’s stock worth $40,000 after purchasing an additional 394 shares during the period. Coppell Advisory Solutions Corp. bought a new position in shares of Hibbett during the fourth quarter worth approximately $47,000. Acadian Asset Management LLC bought a new position in shares of Hibbett during the first quarter worth approximately $50,000. Finally, FMR LLC increased its holdings in shares of Hibbett by 32.0% during the third quarter. FMR LLC now owns 1,258 shares of the company’s stock worth $60,000 after purchasing an additional 305 shares during the period. 94.08% of the stock is owned by institutional investors.

About Hibbett

Hibbett, Inc together with its subsidiaries, engages in the retail of athletic-inspired fashion products in the United States. Its stores offer a range of merchandise, including athletic footwear, athletic and fashion apparel, team sports equipment, and related accessories. The company operates Hibbett stores, City Gear stores, and Sports Additions athletic shoe stores.

Featured Articles

Receive News & Ratings for Hibbett Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Hibbett and related companies with MarketBeat.com’s FREE daily email newsletter.