Brokers Offer Predictions for ICF International, Inc.’s Q1 2024 Earnings (NASDAQ:ICFI)

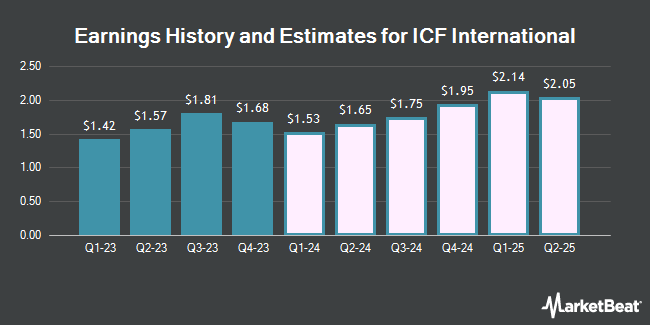

ICF International, Inc. (NASDAQ:ICFI – Free Report) – Investment analysts at William Blair decreased their Q1 2024 earnings per share (EPS) estimates for shares of ICF International in a research report issued on Wednesday, February 28th. William Blair analyst T. Mulrooney now anticipates that the business services provider will post earnings of $1.44 per share for the quarter, down from their prior forecast of $1.46. The consensus estimate for ICF International’s current full-year earnings is $6.72 per share. William Blair also issued estimates for ICF International’s Q2 2024 earnings at $1.50 EPS, Q3 2024 earnings at $1.77 EPS, Q4 2024 earnings at $2.03 EPS and FY2025 earnings at $7.92 EPS.

ICF International (NASDAQ:ICFI – Get Free Report) last posted its quarterly earnings results on Tuesday, February 27th. The business services provider reported $1.68 earnings per share for the quarter, topping the consensus estimate of $1.64 by $0.04. ICF International had a return on equity of 14.12% and a net margin of 4.21%. The firm had revenue of $478.35 million during the quarter, compared to analysts’ expectations of $480.75 million. During the same quarter in the previous year, the business earned $1.56 earnings per share. The company’s revenue was up .6% on a year-over-year basis.

ICFI has been the subject of a number of other research reports. Truist Financial upped their price objective on ICF International from $148.00 to $168.00 and gave the company a “buy” rating in a research report on Wednesday. Canaccord Genuity Group reissued a “buy” rating and set a $170.00 price target on shares of ICF International in a report on Tuesday, February 20th. StockNews.com raised ICF International from a “hold” rating to a “buy” rating in a report on Monday, November 6th. Finally, Sidoti lowered ICF International from a “buy” rating to a “neutral” rating and set a $140.00 price target for the company. in a report on Tuesday, November 14th. One analyst has rated the stock with a hold rating and four have assigned a buy rating to the stock. According to data from MarketBeat.com, ICF International has a consensus rating of “Moderate Buy” and an average target price of $155.75.

Check Out Our Latest Stock Analysis on ICFI

ICF International Stock Up 1.3 %

ICF International stock opened at $154.85 on Thursday. The stock has a market cap of $2.91 billion, a PE ratio of 35.60 and a beta of 0.60. The company has a debt-to-equity ratio of 0.59, a quick ratio of 1.29 and a current ratio of 1.29. ICF International has a one year low of $101.46 and a one year high of $155.93. The stock has a fifty day moving average of $139.96 and a 200 day moving average of $133.41.

Institutional Investors Weigh In On ICF International

Large investors have recently made changes to their positions in the stock. Handelsbanken Fonder AB grew its position in ICF International by 29.8% in the third quarter. Handelsbanken Fonder AB now owns 3,822 shares of the business services provider’s stock worth $462,000 after acquiring an additional 878 shares during the period. Congress Asset Management Co. MA grew its holdings in shares of ICF International by 17.1% during the third quarter. Congress Asset Management Co. MA now owns 258,384 shares of the business services provider’s stock worth $31,215,000 after purchasing an additional 37,728 shares during the last quarter. Strs Ohio grew its holdings in shares of ICF International by 0.4% during the third quarter. Strs Ohio now owns 47,716 shares of the business services provider’s stock worth $5,764,000 after buying an additional 200 shares during the last quarter. Zions Bancorporation N.A. grew its holdings in shares of ICF International by 7.6% during the third quarter. Zions Bancorporation N.A. now owns 15,252 shares of the business services provider’s stock worth $1,843,000 after buying an additional 1,079 shares during the last quarter. Finally, Neumeier Poma Investment Counsel LLC lifted its position in ICF International by 63.9% in the third quarter. Neumeier Poma Investment Counsel LLC now owns 336,005 shares of the business services provider’s stock valued at $40,593,000 after purchasing an additional 130,995 shares during the period. 94.17% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at ICF International

In other news, CEO John Wasson sold 5,000 shares of the stock in a transaction that occurred on Tuesday, December 26th. The stock was sold at an average price of $133.34, for a total value of $666,700.00. Following the sale, the chief executive officer now directly owns 27,483 shares in the company, valued at $3,664,583.22. The sale was disclosed in a document filed with the SEC, which is available at this link. In related news, CEO John Wasson sold 5,000 shares of the business’s stock in a transaction on Tuesday, December 26th. The stock was sold at an average price of $133.34, for a total transaction of $666,700.00. Following the transaction, the chief executive officer now directly owns 27,483 shares in the company, valued at approximately $3,664,583.22. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. Also, COO James C. M. Morgan sold 2,400 shares of the business’s stock in a transaction dated Tuesday, February 27th. The shares were sold at an average price of $155.17, for a total value of $372,408.00. Following the sale, the chief operating officer now owns 39,814 shares in the company, valued at approximately $6,177,938.38. The disclosure for this sale can be found here. Over the last three months, insiders sold 12,400 shares of company stock valued at $1,720,483. Insiders own 1.38% of the company’s stock.

ICF International Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, April 12th. Investors of record on Friday, March 22nd will be paid a dividend of $0.14 per share. This represents a $0.56 dividend on an annualized basis and a yield of 0.36%. The ex-dividend date is Thursday, March 21st. ICF International’s payout ratio is presently 12.87%.

About ICF International

ICF International, Inc provides management, marketing, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally. It researches critical policy, industry, stakeholder issues, trends, and behaviors; measures and evaluates results and their impact; and provides strategic planning and advisory services to its clients on how to navigate societal, business, market, business, communication, and technology challenges.

Featured Articles

Receive News & Ratings for ICF International Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for ICF International and related companies with MarketBeat.com’s FREE daily email newsletter.