Brokers Offer Predictions for Juniper Networks, Inc.’s Q2 2024 Earnings (NYSE:JNPR)

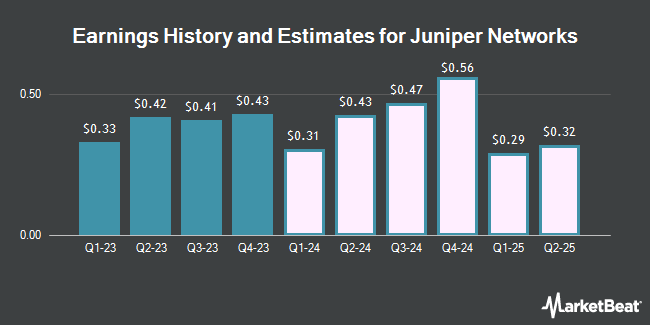

Juniper Networks, Inc. (NYSE:JNPR – Free Report) – Equities researchers at Zacks Research cut their Q2 2024 earnings estimates for Juniper Networks in a research note issued to investors on Tuesday, February 20th. Zacks Research analyst A. Chatterjee now expects that the network equipment provider will post earnings of $0.34 per share for the quarter, down from their prior estimate of $0.36. The consensus estimate for Juniper Networks’ current full-year earnings is $1.41 per share. Zacks Research also issued estimates for Juniper Networks’ FY2026 earnings at $1.64 EPS.

Juniper Networks (NYSE:JNPR – Get Free Report) last released its quarterly earnings data on Tuesday, January 30th. The network equipment provider reported $0.43 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $0.44 by ($0.01). The business had revenue of $1.36 billion during the quarter, compared to analyst estimates of $1.41 billion. Juniper Networks had a net margin of 5.57% and a return on equity of 11.72%.

Several other brokerages have also weighed in on JNPR. Needham & Company LLC reissued a “hold” rating on shares of Juniper Networks in a research report on Wednesday, January 10th. Barclays restated an “equal weight” rating on shares of Juniper Networks in a research report on Wednesday, January 10th. Rosenblatt Securities upped their target price on Juniper Networks from $31.00 to $40.00 and gave the company a “neutral” rating in a research report on Wednesday, January 10th. KeyCorp reissued a “sector weight” rating on shares of Juniper Networks in a report on Thursday, January 11th. Finally, UBS Group decreased their price objective on Juniper Networks from $34.00 to $28.00 and set a “neutral” rating on the stock in a report on Friday, October 27th. Eleven equities research analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat, Juniper Networks has a consensus rating of “Hold” and an average price target of $34.58.

Read Our Latest Analysis on JNPR

Juniper Networks Trading Up 0.2 %

Shares of Juniper Networks stock opened at $36.99 on Thursday. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.80 and a quick ratio of 1.35. The business has a fifty day simple moving average of $34.41 and a two-hundred day simple moving average of $29.96. Juniper Networks has a 1 year low of $24.87 and a 1 year high of $38.04. The company has a market capitalization of $11.91 billion, a price-to-earnings ratio of 38.94, a P/E/G ratio of 7.33 and a beta of 0.99.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the business. Norges Bank acquired a new stake in shares of Juniper Networks in the 4th quarter valued at approximately $136,778,000. Pacer Advisors Inc. boosted its position in Juniper Networks by 11,418.1% in the fourth quarter. Pacer Advisors Inc. now owns 2,829,071 shares of the network equipment provider’s stock valued at $83,401,000 after buying an additional 2,804,509 shares in the last quarter. BlackRock Inc. grew its stake in shares of Juniper Networks by 8.8% during the first quarter. BlackRock Inc. now owns 34,426,578 shares of the network equipment provider’s stock worth $1,184,963,000 after buying an additional 2,776,885 shares during the last quarter. State Street Corp increased its holdings in shares of Juniper Networks by 10.9% during the second quarter. State Street Corp now owns 16,412,994 shares of the network equipment provider’s stock worth $514,219,000 after buying an additional 1,613,651 shares in the last quarter. Finally, Man Group plc lifted its stake in shares of Juniper Networks by 227.6% in the 4th quarter. Man Group plc now owns 1,718,992 shares of the network equipment provider’s stock valued at $54,939,000 after acquiring an additional 1,194,259 shares during the last quarter. Institutional investors own 87.79% of the company’s stock.

Insider Activity at Juniper Networks

In other Juniper Networks news, COO Manoj Leelanivas sold 98,530 shares of the stock in a transaction dated Monday, February 12th. The shares were sold at an average price of $37.00, for a total transaction of $3,645,610.00. Following the sale, the chief operating officer now directly owns 73,684 shares in the company, valued at $2,726,308. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. In other Juniper Networks news, COO Manoj Leelanivas sold 98,530 shares of the business’s stock in a transaction that occurred on Monday, February 12th. The shares were sold at an average price of $37.00, for a total transaction of $3,645,610.00. Following the completion of the transaction, the chief operating officer now directly owns 73,684 shares in the company, valued at $2,726,308. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CEO Rami Rahim sold 5,556 shares of the firm’s stock in a transaction on Wednesday, February 7th. The shares were sold at an average price of $37.10, for a total value of $206,127.60. Following the completion of the sale, the chief executive officer now directly owns 829,406 shares in the company, valued at approximately $30,770,962.60. The disclosure for this sale can be found here. Insiders sold a total of 138,262 shares of company stock valued at $4,931,785 over the last quarter. 1.29% of the stock is owned by corporate insiders.

Juniper Networks Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, March 22nd. Investors of record on Friday, March 1st will be paid a $0.22 dividend. This represents a $0.88 dividend on an annualized basis and a yield of 2.38%. The ex-dividend date is Thursday, February 29th. Juniper Networks’s dividend payout ratio (DPR) is presently 92.63%.

About Juniper Networks

Juniper Networks, Inc designs, develops, and sells network products and services worldwide. The company offers routing products, such as ACX series universal access routers to deploy high-bandwidth services; MX series Ethernet routers that function as a universal edge platform; PTX series packet transport routers; wide-area network SDN controllers; and session smart routers.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Juniper Networks, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Juniper Networks wasn’t on the list.

While Juniper Networks currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You’d need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.