Brokers Offer Predictions for Keysight Technologies, Inc.’s Q2 2024 Earnings (NYSE:KEYS)

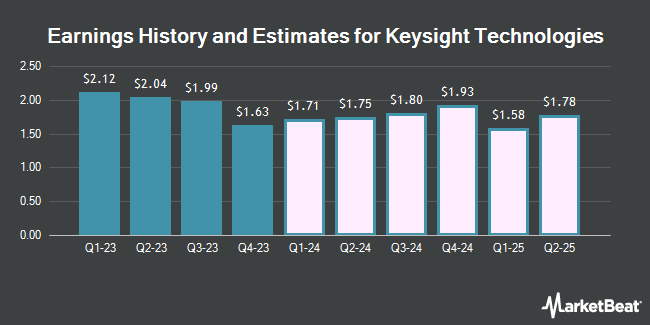

Keysight Technologies, Inc. (NYSE:KEYS – Free Report) – Zacks Research dropped their Q2 2024 EPS estimates for Keysight Technologies in a report released on Tuesday, March 12th. Zacks Research analyst R. Department now forecasts that the scientific and technical instruments company will earn $1.22 per share for the quarter, down from their prior forecast of $1.50. The consensus estimate for Keysight Technologies’ current full-year earnings is $5.76 per share. Zacks Research also issued estimates for Keysight Technologies’ Q3 2024 earnings at $1.38 EPS, Q4 2024 earnings at $1.52 EPS, FY2024 earnings at $5.51 EPS, Q1 2025 earnings at $1.41 EPS, Q2 2025 earnings at $1.51 EPS, Q3 2025 earnings at $1.67 EPS, Q4 2025 earnings at $1.72 EPS, FY2025 earnings at $6.31 EPS, Q1 2026 earnings at $1.73 EPS and FY2026 earnings at $7.85 EPS.

Keysight Technologies (NYSE:KEYS – Get Free Report) last issued its earnings results on Tuesday, February 20th. The scientific and technical instruments company reported $1.63 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.59 by $0.04. Keysight Technologies had a return on equity of 26.84% and a net margin of 18.14%. The company had revenue of $1.26 billion for the quarter, compared to the consensus estimate of $1.25 billion. During the same quarter last year, the company earned $1.72 EPS. The firm’s quarterly revenue was down 8.8% on a year-over-year basis.

A number of other equities research analysts also recently commented on KEYS. JPMorgan Chase & Co. downgraded Keysight Technologies from an “overweight” rating to a “neutral” rating and decreased their target price for the stock from $184.00 to $170.00 in a research report on Thursday, February 15th. Barclays boosted their price target on shares of Keysight Technologies from $134.00 to $141.00 and gave the stock an “equal weight” rating in a research report on Wednesday, February 21st. StockNews.com lowered shares of Keysight Technologies from a “buy” rating to a “hold” rating in a research report on Thursday, November 16th. TheStreet upgraded shares of Keysight Technologies from a “c+” rating to a “b-” rating in a report on Wednesday, December 13th. Finally, Robert W. Baird increased their price target on shares of Keysight Technologies from $155.00 to $160.00 and gave the company an “outperform” rating in a report on Tuesday, November 21st. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and five have assigned a buy rating to the company’s stock. Based on data from MarketBeat, the company currently has an average rating of “Hold” and an average price target of $160.63.

Read Our Latest Research Report on Keysight Technologies

Keysight Technologies Price Performance

NYSE KEYS traded down $0.66 on Thursday, reaching $151.31. The company had a trading volume of 327,313 shares, compared to its average volume of 1,195,282. The firm’s 50 day moving average price is $154.10 and its 200 day moving average price is $142.15. Keysight Technologies has a 12 month low of $118.57 and a 12 month high of $172.72. The stock has a market capitalization of $26.41 billion, a PE ratio of 27.74, a price-to-earnings-growth ratio of 6.53 and a beta of 1.05. The company has a quick ratio of 1.44, a current ratio of 1.93 and a debt-to-equity ratio of 0.25.

Insider Activity at Keysight Technologies

In related news, CFO Neil Dougherty sold 14,686 shares of the stock in a transaction that occurred on Friday, December 15th. The shares were sold at an average price of $159.35, for a total transaction of $2,340,214.10. Following the completion of the sale, the chief financial officer now owns 106,793 shares of the company’s stock, valued at $17,017,464.55. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, Director Ronald S. Nersesian sold 29,672 shares of the stock in a transaction that occurred on Wednesday, December 27th. The shares were sold at an average price of $159.82, for a total value of $4,742,179.04. Following the completion of the transaction, the director now directly owns 296,619 shares of the company’s stock, valued at approximately $47,405,648.58. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CFO Neil Dougherty sold 14,686 shares of Keysight Technologies stock in a transaction that occurred on Friday, December 15th. The stock was sold at an average price of $159.35, for a total transaction of $2,340,214.10. Following the completion of the sale, the chief financial officer now owns 106,793 shares of the company’s stock, valued at $17,017,464.55. The disclosure for this sale can be found here. 0.60% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

A number of hedge funds have recently modified their holdings of the company. Jennison Associates LLC acquired a new stake in Keysight Technologies during the fourth quarter worth about $395,789,000. Norges Bank acquired a new stake in Keysight Technologies during the fourth quarter worth about $303,444,000. Moneta Group Investment Advisors LLC boosted its position in Keysight Technologies by 110,226.3% during the fourth quarter. Moneta Group Investment Advisors LLC now owns 1,500,438 shares of the scientific and technical instruments company’s stock worth $256,680,000 after purchasing an additional 1,499,078 shares in the last quarter. Van ECK Associates Corp boosted its position in Keysight Technologies by 105.5% during the fourth quarter. Van ECK Associates Corp now owns 2,383,143 shares of the scientific and technical instruments company’s stock worth $379,134,000 after purchasing an additional 1,223,694 shares in the last quarter. Finally, Artisan Partners Limited Partnership purchased a new position in Keysight Technologies during the second quarter worth approximately $103,365,000. 81.72% of the stock is owned by institutional investors and hedge funds.

About Keysight Technologies

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Further Reading

Before you consider Keysight Technologies, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Keysight Technologies wasn’t on the list.

While Keysight Technologies currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.