Brokers Offer Predictions for Moderna, Inc.’s Q1 2024 Earnings (NASDAQ:MRNA)

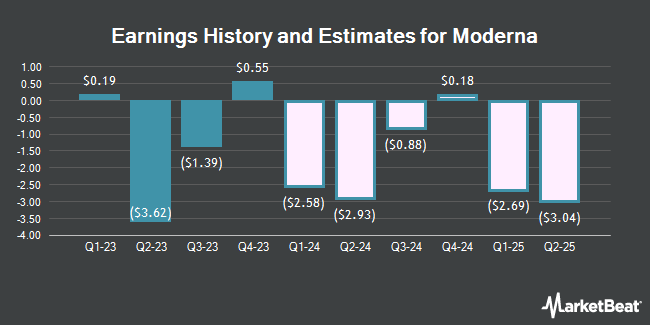

Moderna, Inc. (NASDAQ:MRNA – Free Report) – Analysts at Brookline Capital Management boosted their Q1 2024 earnings estimates for shares of Moderna in a report issued on Thursday, February 22nd. Brookline Capital Management analyst L. Cann now expects that the company will earn ($3.49) per share for the quarter, up from their previous estimate of ($3.55). The consensus estimate for Moderna’s current full-year earnings is ($6.62) per share. Brookline Capital Management also issued estimates for Moderna’s Q3 2024 earnings at ($0.26) EPS, FY2024 earnings at ($5.63) EPS, FY2025 earnings at ($1.01) EPS, FY2026 earnings at $12.50 EPS, FY2027 earnings at $17.10 EPS and FY2028 earnings at $38.20 EPS.

Moderna (NASDAQ:MRNA – Get Free Report) last issued its quarterly earnings results on Thursday, February 22nd. The company reported $0.55 earnings per share for the quarter, topping analysts’ consensus estimates of ($0.78) by $1.33. The firm had revenue of $2.80 billion during the quarter, compared to analysts’ expectations of $2.53 billion. Moderna had a negative net margin of 68.84% and a negative return on equity of 10.23%. Moderna’s quarterly revenue was down 44.9% compared to the same quarter last year. During the same quarter in the prior year, the business earned $3.61 EPS.

Several other equities analysts also recently weighed in on the stock. HSBC upgraded shares of Moderna from a “reduce” rating to a “hold” rating and dropped their target price for the company from $89.00 to $69.00 in a report on Friday, November 3rd. The Goldman Sachs Group reduced their price target on shares of Moderna from $269.00 to $231.00 and set a “buy” rating on the stock in a research report on Friday, November 3rd. Canaccord Genuity Group lifted their price objective on shares of Moderna from $82.00 to $91.00 and gave the company a “hold” rating in a research note on Friday. Canaccord Genuity Group assumed coverage on shares of Moderna in a research note on Wednesday, November 29th. They set a “hold” rating and a $82.00 price objective on the stock. Finally, Deutsche Bank Aktiengesellschaft lowered shares of Moderna from a “hold” rating to a “sell” rating and dropped their price target for the stock from $125.00 to $60.00 in a research note on Thursday, November 2nd. One investment analyst has rated the stock with a sell rating, nine have given a hold rating and five have given a buy rating to the company. According to MarketBeat.com, Moderna currently has a consensus rating of “Hold” and a consensus target price of $128.69.

Check Out Our Latest Research Report on MRNA

Moderna Stock Down 3.0 %

MRNA stock opened at $96.46 on Monday. Moderna has a one year low of $62.55 and a one year high of $163.24. The stock has a market capitalization of $36.78 billion, a PE ratio of -7.77 and a beta of 1.69. The company has a debt-to-equity ratio of 0.04, a quick ratio of 2.35 and a current ratio of 3.42. The company has a fifty day moving average of $98.40 and a 200-day moving average of $94.41.

Institutional Investors Weigh In On Moderna

Several hedge funds and other institutional investors have recently bought and sold shares of the business. Cim Investment Management Inc. increased its holdings in Moderna by 4.2% in the first quarter. Cim Investment Management Inc. now owns 2,139 shares of the company’s stock worth $329,000 after buying an additional 86 shares during the last quarter. Cetera Advisor Networks LLC increased its holdings in Moderna by 0.5% in the fourth quarter. Cetera Advisor Networks LLC now owns 17,195 shares of the company’s stock worth $3,088,000 after buying an additional 87 shares during the last quarter. PFG Investments LLC increased its holdings in Moderna by 2.1% in the second quarter. PFG Investments LLC now owns 4,383 shares of the company’s stock worth $533,000 after buying an additional 91 shares during the last quarter. Ancora Advisors LLC increased its holdings in Moderna by 41.2% in the first quarter. Ancora Advisors LLC now owns 329 shares of the company’s stock worth $51,000 after buying an additional 96 shares during the last quarter. Finally, Sunbelt Securities Inc. increased its holdings in Moderna by 7.5% in the first quarter. Sunbelt Securities Inc. now owns 1,428 shares of the company’s stock worth $211,000 after buying an additional 100 shares during the last quarter. 64.51% of the stock is currently owned by institutional investors.

Insider Activity

In related news, insider Arpa Garay sold 564 shares of the company’s stock in a transaction dated Wednesday, December 6th. The shares were sold at an average price of $78.34, for a total value of $44,183.76. Following the completion of the sale, the insider now owns 3,690 shares of the company’s stock, valued at $289,074.60. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. In related news, insider Arpa Garay sold 564 shares of the company’s stock in a transaction dated Wednesday, December 6th. The shares were sold at an average price of $78.34, for a total value of $44,183.76. Following the completion of the sale, the insider now owns 3,690 shares of the company’s stock, valued at $289,074.60. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CFO James M. Mock sold 772 shares of the business’s stock in a transaction dated Monday, January 8th. The stock was sold at an average price of $109.75, for a total transaction of $84,727.00. Following the completion of the sale, the chief financial officer now owns 3,632 shares in the company, valued at $398,612. The disclosure for this sale can be found here. Over the last quarter, insiders sold 106,899 shares of company stock valued at $10,732,838. 15.70% of the stock is currently owned by company insiders.

Moderna Company Profile

Moderna, Inc, a biotechnology company, discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, autoimmune, and cardiovascular diseases in the United States, Europe, and internationally. Its respiratory vaccines include COVID-19, influenza, respiratory syncytial virus, spikevax, and hMPV/PIV3 vaccines; latent vaccines comprise cytomegalovirus, epstein-barr virus, herpes simplex virus, varicella-zoster virus, and human immunodeficiency virus vaccines; and public health vaccines consists of Zika and Nipah vaccines.

Recommended Stories

Receive News & Ratings for Moderna Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Moderna and related companies with MarketBeat.com’s FREE daily email newsletter.