Brokers Offer Predictions for Newmont Co.’s FY2024 Earnings (NYSE:NEM)

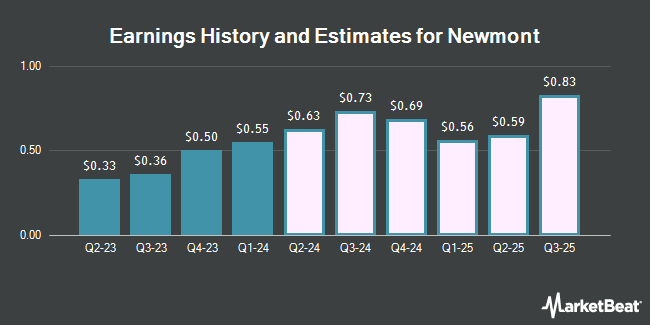

Newmont Co. (NYSE:NEM – Free Report) – Research analysts at National Bank Financial increased their FY2024 earnings per share (EPS) estimates for Newmont in a report issued on Tuesday, April 30th. National Bank Financial analyst M. Parkin now anticipates that the basic materials company will post earnings of $2.42 per share for the year, up from their prior forecast of $1.61. National Bank Financial has a “Sector Perform Overweight” rating on the stock. The consensus estimate for Newmont’s current full-year earnings is $2.16 per share. National Bank Financial also issued estimates for Newmont’s FY2025 earnings at $2.80 EPS and FY2026 earnings at $2.33 EPS.

A number of other equities analysts have also issued reports on NEM. TD Securities increased their price objective on Newmont from $43.00 to $48.00 and gave the stock a “hold” rating in a report on Friday, April 26th. Citigroup reduced their price objective on shares of Newmont from $60.00 to $45.00 and set a “buy” rating for the company in a report on Thursday, April 4th. BMO Capital Markets lowered their target price on shares of Newmont from $56.00 to $54.00 and set an “outperform” rating on the stock in a research note on Thursday. Royal Bank of Canada decreased their price objective on shares of Newmont from $45.00 to $40.00 and set a “sector perform” rating for the company in a report on Thursday, February 8th. Finally, Argus downgraded Newmont from a “buy” rating to a “hold” rating in a research report on Monday, February 26th. Seven investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company’s stock. According to data from MarketBeat.com, Newmont currently has a consensus rating of “Moderate Buy” and an average target price of $48.35.

Get Our Latest Research Report on NEM

Newmont Price Performance

NYSE NEM opened at $40.66 on Friday. The company has a 50-day moving average price of $36.21 and a two-hundred day moving average price of $37.01. Newmont has a 52 week low of $29.42 and a 52 week high of $50.18. The stock has a market cap of $46.88 billion, a price-to-earnings ratio of -15.23, a price-to-earnings-growth ratio of 1.04 and a beta of 0.48. The company has a current ratio of 2.15, a quick ratio of 1.90 and a debt-to-equity ratio of 0.32.

Newmont (NYSE:NEM – Get Free Report) last posted its earnings results on Thursday, April 25th. The basic materials company reported $0.55 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.35 by $0.20. Newmont had a positive return on equity of 6.88% and a negative net margin of 20.19%. The company had revenue of $4.02 billion for the quarter, compared to analysts’ expectations of $3.66 billion. During the same period last year, the business posted $0.40 earnings per share. The firm’s quarterly revenue was up 50.2% compared to the same quarter last year.

Institutional Trading of Newmont

Several hedge funds and other institutional investors have recently modified their holdings of NEM. Mizuho Securities Co. Ltd. acquired a new stake in Newmont during the 3rd quarter worth about $26,000. Life Planning Partners Inc acquired a new stake in shares of Newmont during the fourth quarter worth approximately $26,000. Manchester Capital Management LLC grew its position in Newmont by 171.9% during the fourth quarter. Manchester Capital Management LLC now owns 628 shares of the basic materials company’s stock valued at $26,000 after purchasing an additional 397 shares in the last quarter. OFI Invest Asset Management acquired a new position in Newmont in the 3rd quarter valued at approximately $30,000. Finally, CVA Family Office LLC purchased a new stake in Newmont in the 4th quarter worth approximately $34,000. Institutional investors and hedge funds own 68.85% of the company’s stock.

Newmont Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, June 27th. Stockholders of record on Tuesday, June 4th will be issued a dividend of $0.25 per share. The ex-dividend date of this dividend is Tuesday, June 4th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 2.46%. Newmont’s dividend payout ratio is currently -37.45%.

About Newmont

Newmont Corporation engages in the production and exploration of gold. It also explores for copper, silver, zinc, and lead. The company has operations and/or assets in the United States, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia, Papua New Guinea, Ecuador, Fiji, and Ghana.

Featured Articles

Receive News & Ratings for Newmont Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Newmont and related companies with MarketBeat.com’s FREE daily email newsletter.