Brokers Offer Predictions for Nordson Co.’s Q2 2024 Earnings (NASDAQ:NDSN)

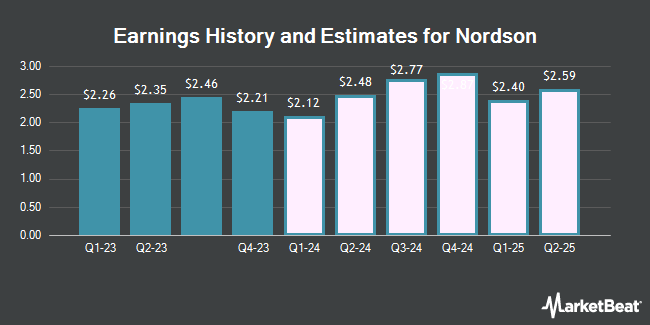

Nordson Co. (NASDAQ:NDSN – Free Report) – Analysts at DA Davidson issued their Q2 2024 EPS estimates for Nordson in a research note issued on Tuesday, February 27th. DA Davidson analyst M. Summerville expects that the industrial products company will post earnings per share of $2.32 for the quarter. DA Davidson has a “Buy” rating and a $315.00 price objective on the stock. The consensus estimate for Nordson’s current full-year earnings is $10.26 per share. DA Davidson also issued estimates for Nordson’s FY2025 earnings at $11.15 EPS.

Several other research firms also recently commented on NDSN. StockNews.com downgraded shares of Nordson from a “buy” rating to a “hold” rating in a research report on Friday, December 22nd. KeyCorp reissued a “sector weight” rating on shares of Nordson in a report on Monday. Finally, Wells Fargo & Company raised their target price on Nordson from $290.00 to $315.00 and gave the company an “overweight” rating in a report on Friday, February 23rd. Four equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of “Moderate Buy” and a consensus target price of $270.43.

Check Out Our Latest Research Report on NDSN

Nordson Stock Performance

NASDAQ NDSN opened at $266.96 on Wednesday. The company has a market cap of $15.27 billion, a P/E ratio of 31.22, a PEG ratio of 2.03 and a beta of 1.00. The company has a fifty day simple moving average of $258.39 and a 200 day simple moving average of $240.31. The company has a current ratio of 2.19, a quick ratio of 1.37 and a debt-to-equity ratio of 0.56. Nordson has a 12-month low of $202.57 and a 12-month high of $275.67.

Nordson (NASDAQ:NDSN – Get Free Report) last issued its earnings results on Wednesday, February 21st. The industrial products company reported $2.21 EPS for the quarter, beating analysts’ consensus estimates of $2.03 by $0.18. Nordson had a return on equity of 20.59% and a net margin of 18.59%. The business had revenue of $633.20 million during the quarter, compared to analyst estimates of $630.77 million. During the same period in the previous year, the company posted $1.95 EPS. The firm’s revenue was up 3.7% compared to the same quarter last year.

Hedge Funds Weigh In On Nordson

A number of institutional investors and hedge funds have recently added to or reduced their stakes in NDSN. Morgan Stanley grew its stake in Nordson by 435.1% in the 4th quarter. Morgan Stanley now owns 1,275,693 shares of the industrial products company’s stock valued at $303,258,000 after buying an additional 1,037,295 shares in the last quarter. Vanguard Group Inc. boosted its holdings in shares of Nordson by 16.5% in the first quarter. Vanguard Group Inc. now owns 5,997,575 shares of the industrial products company’s stock worth $1,361,928,000 after acquiring an additional 850,479 shares during the period. Norges Bank bought a new stake in shares of Nordson during the 4th quarter valued at $176,078,000. Goldman Sachs Group Inc. lifted its holdings in Nordson by 258.7% during the 2nd quarter. Goldman Sachs Group Inc. now owns 878,782 shares of the industrial products company’s stock worth $177,900,000 after purchasing an additional 633,821 shares in the last quarter. Finally, Millennium Management LLC boosted its stake in Nordson by 2,094.6% in the 4th quarter. Millennium Management LLC now owns 469,789 shares of the industrial products company’s stock worth $111,678,000 after purchasing an additional 448,382 shares during the period. Institutional investors own 70.88% of the company’s stock.

Insiders Place Their Bets

In related news, EVP Stephen Lovass sold 2,000 shares of the stock in a transaction dated Tuesday, January 2nd. The shares were sold at an average price of $258.68, for a total transaction of $517,360.00. Following the completion of the transaction, the executive vice president now owns 7,379 shares in the company, valued at $1,908,799.72. The transaction was disclosed in a document filed with the SEC, which is available through this link. In other news, EVP Srinivas Subramanian sold 2,100 shares of the stock in a transaction on Friday, January 12th. The stock was sold at an average price of $250.79, for a total transaction of $526,659.00. Following the completion of the transaction, the executive vice president now owns 4,565 shares in the company, valued at approximately $1,144,856.35. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, EVP Stephen Lovass sold 2,000 shares of the business’s stock in a transaction dated Tuesday, January 2nd. The shares were sold at an average price of $258.68, for a total value of $517,360.00. Following the completion of the sale, the executive vice president now owns 7,379 shares in the company, valued at $1,908,799.72. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 8,113 shares of company stock valued at $2,076,127. Insiders own 0.86% of the company’s stock.

Nordson Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, March 5th. Investors of record on Tuesday, February 20th will be issued a dividend of $0.68 per share. The ex-dividend date of this dividend is Friday, February 16th. This represents a $2.72 dividend on an annualized basis and a yield of 1.02%. Nordson’s dividend payout ratio (DPR) is currently 31.81%.

About Nordson

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids worldwide. It operates through three segments: Industrial Precision Solutions; Medical and Fluid Solutions; and Advanced Technology Solutions.

Featured Stories

Receive News & Ratings for Nordson Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Nordson and related companies with MarketBeat.com’s FREE daily email newsletter.