Brokers Offer Predictions for PROCEPT BioRobotics Co.’s FY2028 Earnings (NASDAQ:PRCT)

PROCEPT BioRobotics Co. (NASDAQ:PRCT – Free Report) – Equities research analysts at Leerink Partnrs issued their FY2028 earnings per share (EPS) estimates for PROCEPT BioRobotics in a research report issued to clients and investors on Tuesday, February 27th. Leerink Partnrs analyst M. Kratky forecasts that the company will earn $0.10 per share for the year. The consensus estimate for PROCEPT BioRobotics’ current full-year earnings is ($1.88) per share.

A number of other analysts have also commented on the company. Truist Financial raised their price target on PROCEPT BioRobotics from $55.00 to $58.00 and gave the stock a “buy” rating in a research note on Wednesday. Wells Fargo & Company raised their price target on PROCEPT BioRobotics from $44.00 to $47.00 and gave the stock an “overweight” rating in a research note on Tuesday, January 9th. Six equities research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the stock has a consensus rating of “Buy” and an average target price of $45.60.

Check Out Our Latest Stock Report on PROCEPT BioRobotics

PROCEPT BioRobotics Stock Performance

NASDAQ:PRCT opened at $49.06 on Friday. The firm has a market cap of $2.48 billion, a PE ratio of -21.90 and a beta of 1.03. PROCEPT BioRobotics has a fifty-two week low of $24.83 and a fifty-two week high of $52.32. The company has a debt-to-equity ratio of 0.18, a quick ratio of 7.89 and a current ratio of 8.91. The business has a 50 day moving average price of $46.74 and a 200-day moving average price of $37.91.

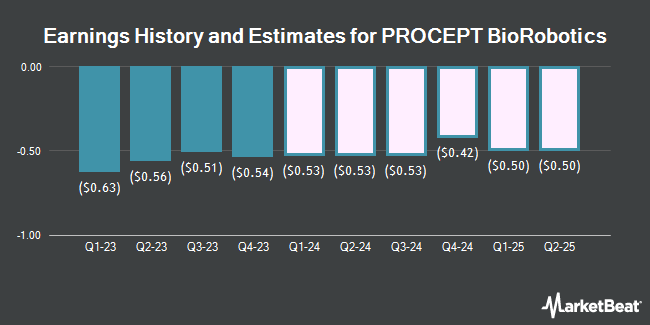

PROCEPT BioRobotics (NASDAQ:PRCT – Get Free Report) last released its quarterly earnings data on Tuesday, February 27th. The company reported ($0.54) earnings per share for the quarter, missing analysts’ consensus estimates of ($0.44) by ($0.10). The company had revenue of $43.58 million for the quarter, compared to analysts’ expectations of $41.79 million. PROCEPT BioRobotics had a negative net margin of 77.75% and a negative return on equity of 50.56%. The business’s revenue for the quarter was up 83.3% compared to the same quarter last year. During the same period last year, the company posted ($0.56) EPS.

Hedge Funds Weigh In On PROCEPT BioRobotics

Several institutional investors and hedge funds have recently modified their holdings of the stock. FMR LLC increased its holdings in shares of PROCEPT BioRobotics by 13.0% during the third quarter. FMR LLC now owns 7,553,460 shares of the company’s stock valued at $247,829,000 after acquiring an additional 870,364 shares in the last quarter. Vanguard Group Inc. increased its holdings in shares of PROCEPT BioRobotics by 2.7% during the fourth quarter. Vanguard Group Inc. now owns 4,184,585 shares of the company’s stock valued at $175,376,000 after acquiring an additional 109,694 shares in the last quarter. Price T Rowe Associates Inc. MD increased its holdings in shares of PROCEPT BioRobotics by 1.5% during the second quarter. Price T Rowe Associates Inc. MD now owns 3,904,003 shares of the company’s stock valued at $127,622,000 after acquiring an additional 58,511 shares in the last quarter. T. Rowe Price Investment Management Inc. increased its holdings in shares of PROCEPT BioRobotics by 4.8% during the fourth quarter. T. Rowe Price Investment Management Inc. now owns 2,697,885 shares of the company’s stock valued at $112,071,000 after acquiring an additional 124,102 shares in the last quarter. Finally, BlackRock Inc. increased its holdings in PROCEPT BioRobotics by 36.1% in the 2nd quarter. BlackRock Inc. now owns 2,580,126 shares of the company’s stock worth $91,207,000 after buying an additional 684,194 shares in the last quarter. 79.46% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other PROCEPT BioRobotics news, EVP Alaleh Nouri sold 6,096 shares of the stock in a transaction on Wednesday, December 6th. The stock was sold at an average price of $39.96, for a total value of $243,596.16. Following the completion of the transaction, the executive vice president now owns 46,933 shares in the company, valued at $1,875,442.68. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. In other PROCEPT BioRobotics news, CFO Kevin Waters sold 22,349 shares of the stock in a transaction on Monday, February 12th. The stock was sold at an average price of $50.16, for a total value of $1,121,025.84. Following the completion of the transaction, the chief financial officer now owns 33,523 shares in the company, valued at $1,681,513.68. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, EVP Alaleh Nouri sold 6,096 shares of the firm’s stock in a transaction on Wednesday, December 6th. The shares were sold at an average price of $39.96, for a total value of $243,596.16. Following the transaction, the executive vice president now owns 46,933 shares of the company’s stock, valued at $1,875,442.68. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 276,253 shares of company stock worth $11,856,409. 19.60% of the stock is owned by corporate insiders.

About PROCEPT BioRobotics

PROCEPT BioRobotics Corporation, a surgical robotics company, develops transformative solutions in urology. It develops, manufactures, and sells AquaBeam Robotic System, an image-guided, surgical robotic system for use in minimally invasive urologic surgery with a focus on treating benign prostatic hyperplasia (BPH).

Recommended Stories

Receive News & Ratings for PROCEPT BioRobotics Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for PROCEPT BioRobotics and related companies with MarketBeat.com’s FREE daily email newsletter.